Tether has announced that it is introducing new peso-based stable coins on Ethereum, Tron, and Polygon as 40% of Mexican companies are considering blockchain adoption.

Currently, the largest stable currency is USDT, with a market cap of $73.28B, coming up from the recent fall of Terra (UST) with some injuries, touched the $ 0.95 mark, and is now ready to receive a Mexican version of it. MXNT, the new stable currency issued by Tether, the company behind USDT, is issued in Mexico, where 2.5% of the population owns cryptocurrency and 40% of companies are interested in blockchain and cryptocurrency.

The MXNT will be pegged with the peso at a price of $0.051. “The introduction of the peso-pegged stable coin will add value to all the emerging markets in the region, especially in Mexico,” said the chief technology officer of Teather Paulo Ardoino.

As per research, the majority of cryptocurrencies in Mexico are used for speculation and trading. Since large-scale inbound payments and difficulties in the money transfer process from the U.S, cryptocurrency and blockchain-based technology have become an attractive proposition for Mexicans.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

“MXNT reduces the volatility of those who want to convert their assets and investments from Fiat to digital currencies.” Tether believes Mexico is a testament to the widespread acceptance of stabilisation in Latin America. “Last year we saw an increase in the use of cryptocurrency in Latin America, which made it clear for us that we need to expand what we are offering,” Ardoino said in a statement. The company already has Euro and Chinese Yuan-pegged stable coins. Unlike Bitcoin, the dollar reserve supports fixed currencies.

All of this was honoured after Tether’s corporate paper stock reserves were transformed into high-quality assets of short-term government debt due to the recent Terra Stablecoin Meltdown which led to $10B worth of USDT withdrawals. According to MHA Cayman, an independent lawyer for the UK-based MHA’s satellite agency MacIntyre. The accounting firm authorities raised the alarm on Tether’s commercial paper stocks which were 31% last July, and have now reduced it to a quarter in March this year. MacIntyre. Before this Tether was imposed a $41M fine by the Commodities and Futures Trading Commission (CFTC).

Reserve helps to prevent ‘bank run’ situations for issuers of stablecoins and further redeem stablecoin for fiat currency. Last week, Ardoino supported and defended Tether’s side, while saying, “Tether has maintained its stability through many Black Swan events and thus has never failed on redemption requests.

Read also: Facebook CEO says Metaverse Will Result in ‘Significant’ Loss in the Short Term

Biggest Stabelcoin firm Launches New Stablecoin: Tether

https://bitcoinik.com/biggest-stabelcoin-firm-launches-new-stablecoin-tether/feed/

https://bitcoinik.com/biggest-stabelcoin-firm-launches-new-stablecoin-tether/feed/

.

Grapefruit Media

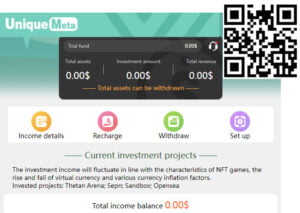

Unique Meta Crypto Investing Platform

DF

GOARBIT – WORLD INVESTMENT COMPANY

Create your free account here…

SUPEREX – The most secure digital asset trading platform of the world!

Create your free account here…

SPIN2MONEY – Investing Platform

Create your free account here…

SMART PART TIME Investing Platform

LIGA FIFA Betting Platform

fifa world cup Qatar 2022

Create your free account here…

Risk Reminder:

Trading foreign exchange and/or contracts for differences on margin carries a high level of risk and may not be suitable for all investors.

The possibility exists that you could sustain a loss in excess of your deposited funds.

Before deciding to trade the products reviewed by Cryptonews24.eu, you should carefully consider your objectives, financial situation, needs and level of experience.

You should be aware of all the risks associated with trading on margin.

Cryptonews24.eu provides general news and advice that does not consider your objectives, financial situation or needs.

The content of this website must not be construed as personal advice.

Cryptonews24.eu recommends you seek advice from a separate financial advisor.

Nothing on this website should be considered financial advice.

This website is for informational purposes only and you should not rely on anything that is printed or said on this website to make any financial decisions.