The majority of the US-based crypto companies are under the attack of multiple regulatory bodies because supported assets bearing different types of nature under different situations

Crypto & blockchain industry adoption is surging rapidly because of the real world use cases like better & efficient payment systems & secured data processing systems. But in this adoption race, many crypto companies are going through a huge struggle because of the unclear regulatory policies, especially in the United States.

In the present time, there are three types of countries, in the first category there are those countries that are totally against cryptocurrencies like China, and in the second category, there are those countries that adopted crypto as an alternative money market under a precise regulatory framework. For the second category countries, we can take the example of El Salvador, which adopted Bitcoin as a legal tender in September 2021.

But the main problem is associated with those countries where rules are either unclear or partial. In short, in such types of countries, every regulatory body is working in their way to show its power & contribution in the crypto Industry.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

The crypto companies which are based in the United States are facing huge regulatory issues. The US Securities and Exchange Commission (SEC) is taking action against those crypto platforms which are providing crypto assets trading. And the reason of action by the SEC agency is exhibited with the nature of crypto assets, not the nature of crypto services.

On the other hand, the US CFTC agency is taking regulatory actions alongside the SEC agency because few crypto assets are showing Commodity nature.

Here we only talked about SEC & CFTC agencies, which are taking action according to what they see in this industry under their authority. There are also many regulatory bodies in the US & US states which are working separately to regulate the crypto companies, which is not the usual case in other countries.

Here we can take an example of the Coinbase exchange, which is under investigation by the SEC agency for its crypto assets trade offerings. According to the SEC, many assets on the Coinbase exchange are security, while the SEC agency is not taking the same action against other crypto companies which are providing crypto trading of the same assets.

Probably these types of issues can be solved if the US govt may establish a new agency or a small unit that can categorize all the crypto assets under a particular category.

Read also: Successful merge of the Ethereum blockchain on the Beacon chain, may attract spammers

US crypto companies are not able to identify the nature of crypto assets: Report

https://bitcoinik.com/us-crypto-companies-are-not-able-to-identify-the-nature-of-crypto-assets-report/feed/

https://bitcoinik.com/us-crypto-companies-are-not-able-to-identify-the-nature-of-crypto-assets-report/feed/

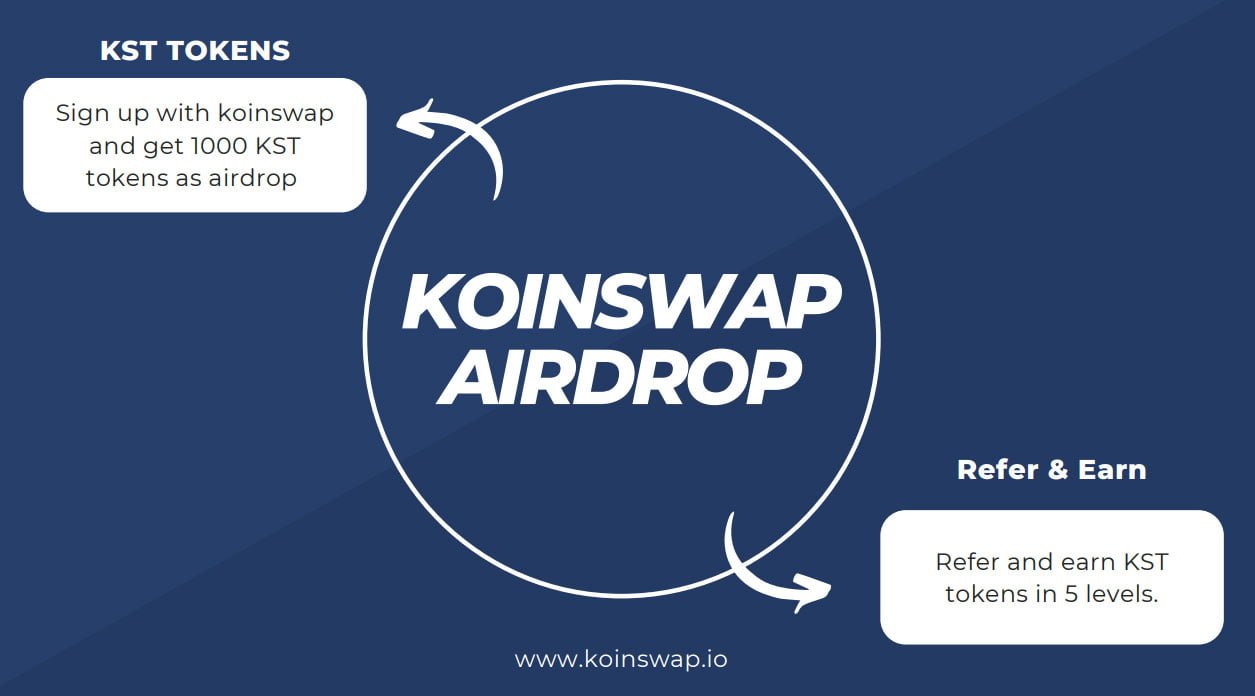

🚀🚀Get ready for the biggest ICO of 2022.

✅ICO Round 1 is Sold Out

✅ICO= Initial Coin Offering. Where you can purchase tokens at base price.

✅ICO has different rounds with different price.

✅Round-1 price: $0.0005 (Sold Out)

✅Round-2 price: $0.001

✅Round-3 price: $0.002

✅Round-4 price: $0.004

✅Round-5 price: $0.008

👉ICO will be finished on September 15, 2022.

👉Trading will start after ICO completion.

🚀🚀EXCHANGE LISTING PRICE: $0.02 per KST. That is 40x than ICO Round-1 (Seed round)🚀🚀

👩🏻💻For more details pls read pdf in marketing tools section in dashboard.

#koinswap #kst #nft #metaverse #blockchain

𝙍𝙀𝙂𝙄𝙎𝙏𝙍𝘼𝙏𝙄𝙊𝙉 𝙇𝙄𝙉𝙆👇🏽

https://koinswap.io/register?referralcode=CFxqfP

▬▬▬▬▬▬▬▬▬▬▬▬▬▬

THIS IS A LIFE CHANGING OPPORTUNITY

*REGISTER N VERIFY UR MAIL N GET 1000 COIN FOR FREE*

TODAY KOINSWAP IS GIVING US 1000 COIN FREE BUT NO ONE CARE TO TAKE IT

👇👇👇👇👇👇

https://koinswap.io/register?referralcode=CFxqfP

JOIN THE GROUP FOR MORE UPDATES

https://chat.whatsapp.com/BGUVkqhI6mg1p9XdJXzBwl

In 2009 you missed# BITCOIN

2014 you missed# DOGE

2015 you missed# XRP

2016 you missed# ETH

2017 you missed# ADA

2018 you missed# BNB

2019 you missed# LINK

2020 you missed# DOT

2021 you missed# SHIBA

https://koinswap.io/register?referralcode=CFxqfP

—————————————————————————————————————————————-

Risk Reminder:

Trading foreign exchange and/or contracts for differences on margin carries a high level of risk and may not be suitable for all investors.

The possibility exists that you could sustain a loss in excess of your deposited funds.

Before deciding to trade the products reviewed by Cryptonews24.eu, you should carefully consider your objectives, financial situation, needs and level of experience.

You should be aware of all the risks associated with trading on margin.

Cryptonews24.eu provides general news and advice that does not consider your objectives, financial situation or needs.

The content of this website must not be construed as personal advice.

Cryptonews24.eu recommends you seek advice from a separate financial advisor.

Nothing on this website should be considered financial advice.

This website is for informational purposes only and you should not rely on anything that is printed or said on this website to make any financial decisions.