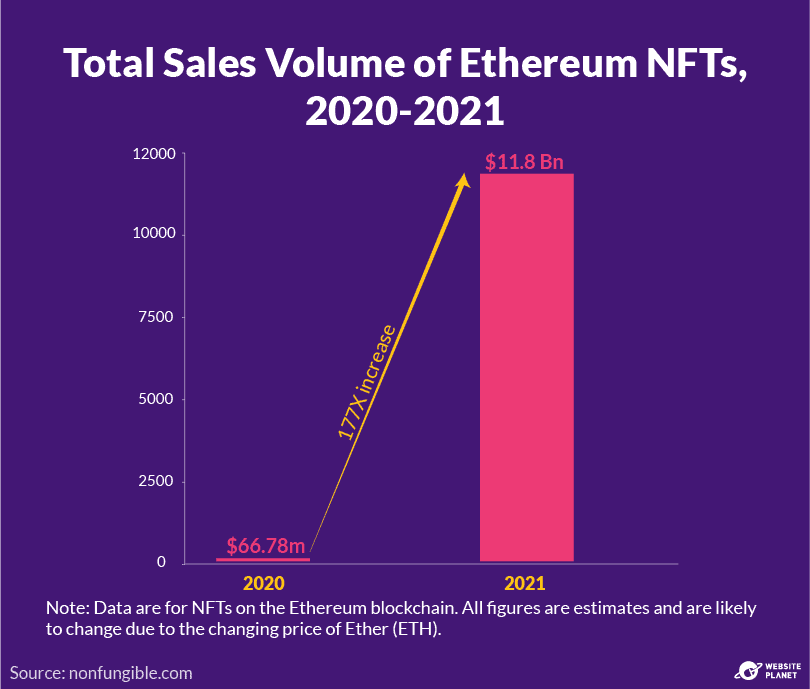

How did global NFT sales rise by 30,000% from 2020 to a total of $13 billion in 2021? And are you missing out (or dodging a bullet) if you don’t invest?

This article is your comprehensive guide to NFTs. We’ll provide an overview of NFTs, how they work, and their real-world applications. We’ll also show you how to successfully create, buy, and sell NFTs.

Quick Summary: What Are NFTs?

Before we can fully define non-fungible tokens, we need to get comfortable with a few key concepts. Let’s start with the difference between fungible and non-fungible assets.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

Fungible Assets

“Fungible” is a word you don’t hear much in conversation, but the general idea is simple: when something is fungible, it means it can be exchanged or traded for an identical item with the same value. If I have an unopened can of soda, for instance, I can exchange it for an identical can of soda. The can of soda is fungible.

Physical currencies and bitcoin are examples of fungible assets. This means they have three broad qualities:

- They can be traded and exchanged. $1 can be traded with another $1, because…

- They have equal value. 1 bitcoin is equal to 1 bitcoin.

- For physical currencies, this system of trade works because everyone agrees to it. With bitcoin, the value is stored on the blockchain (explained below).

There are obviously other factors in determining what makes something a fungible asset, but for the purpose of understanding NFTs, these are the three most important concepts.

Non-Fungible Assets

NFTs are different from physical currencies and bitcoin because they’re non-fungible.

In the most basic terms, this means every NFT has a completely unique value and can’t be easily traded or bartered for another NFT (unless both parties involved decide they share the same value, which probably never happens).

1 NFT does not automatically equal 1 other NFT. They can have vastly different values, which are completely subjective and unique to that specific NFT.

If I ordered a custom birthday cake for my friend, I can’t go back to the bakery and exchange it for a different cake, because the cake I have is unique. Similarly, if I am the owner of an NFT, I have a unique digital item that cannot be replaced with an identical one.

Why does any of this even matter, you ask? Well, it’s what makes each NFT a unique collectible item that actually holds value. How much value, exactly? That varies widely. An NFT can represent the ownership of anything from a GIF file (yes, some of those are actually owned by people), a piece of artwork, a video game element like a character or costume, or even a plot of real estate.

Blockchains

NFTs are stored on blockchains. These public ledgers record the existence and ownership of each token, and cannot be changed later. NFTs signify the ownership of a physical or digital item. Each NFT is a crypto asset with a unique identification code and metadata that makes it unique from other NFTs.

We’ll go into that a bit later, but for now, the important thing to understand is that blockchain records are unchangeable. This means that when someone owns an NFT, whether for a physical or a virtual item, it’s official.

| Blockchain | An anonymous, unchangeable, and publicly accessible log (public ledger) that records transactions in chronological order. Blockchains are decentralized and information about the network’s transactions is stored in batches called “blocks.” |

| Decentralized | Describes an organization in which operations and administrative powers are delegated away from a central authority to several smaller groups or individual parties. |

What’s the Point in NFTs?

When you buy something in the physical world — like a cake — it has unique properties and a limited quantity. A receipt, a deed, or just having the item in your possession can prove that you own it.

The internet doesn’t permit ownership of digital items in the same way you can own something physical. NFTs are supposed to bring some of the structure that applies in the physical world to the digital, allowing digital assets to be scarce in number and distinct from each other.

Advocates of NFTs also say they provide the security of “proof of ownership” needed online.

While this is true in theory, there are limitations. NFTs aren’t regulated, and they don’t create legally binding contracts. As yet, whether or not an NFT can provide the same proof of ownership as a physical receipt hasn’t been tested in a court of law.

NFTs can be sold through different NFT marketplaces, person-to-person, in exchange for cryptocurrency. NFT marketplaces are online platforms that allow you to buy, sell, and create NFTs.

| Cryptocurrency | A decentralized digital currency that is secured and created by cryptography.Right now, NFTs are used to represent: |

- Artwork

- Collectibles such as trading cards

- Virtual items within games including character outfits and in-game currency

- Music

- Virtual land in metaverses*

- Video footage

- Legal documents

- Signatures

- Tokenized real-world assets such as deeds to a car, real estate, or sneakers

Supporters of NFTs hope they become used for more and more things, as the internet becomes increasingly decentralized.

But NFTs have serious issues, including a heavy environmental impact, security concerns, and financial risks.

| *Metaverse | A virtual space where users interact with the environment and each other. Metaverses incorporate features of social media and gaming. They often use virtual reality (VR) and augmented reality (AR), and can be built on a blockchain. |

How NFTs Work

Now that we’ve covered the basics of NFTs, let’s dive a little deeper into how they work.

NFTs are crypto assets. This means that they are secured by cryptography, like cryptocurrencies such as bitcoin and ether. Unlike cryptocurrencies, however, NFTs aren’t used for commercial transactions.

| Cryptography | A way to encode information to secure communications. Cryptography allows only a sender and recipient to view the contents of a message. |

How Do Blockchains Work?

Blockchains, as well as being essential to how NFTs work, are also one of the more confusing parts of this story. But once you string the ideas together, it will all make sense.

They are called blockchains because they are built of strings of computer code – called blocks – that are then chained together. Each block is encrypted (i.e. information is encoded through cryptography) and has a storage capacity.

Once a block is full of data, it’s closed and the data within it is permanently recorded.

New blocks are created to record the next batch of data and each new block links to the previous block, creating the blockchain. This is different from traditional databases that store data in tables.

New blocks are created through a process called mining. Usually, blockchain miners have to solve complex cryptographic algorithms to create new blocks. Mining takes time and uses a lot of computing power, and miners are financially rewarded when their block is added to the chain.

Blockchains are used to publicly record transactions. Each blockchain is stored across multiple computers that are linked in a peer-to-peer network. This means that computers in the network all share files. This decentralized sharing of information is what builds trust into blockchains.

Every computer in the network has a copy of the blockchain. To change the information a blockchain stores, the blockchain would first have to be decrypted, and then the information on each computer in the network would have to be changed at the same time.

Because each blockchain is maintained by its network of users, they can keep a safe record of transactions without a central organization and workforce to log, store, and maintain the data.

People trust the accuracy of blockchains because how this data is stored makes it almost impossible to manipulate.

How Do NFT Marketplaces Work?

NFTs are bought, sold, stored, and displayed on online platforms called NFT marketplaces. NFT marketplaces are similar to ecommerce platforms like eBay; users list their NFTs, which buyers can bid on. These online platforms are separate from the cryptocurrency exchanges where users buy, sell, and trade currencies such as Bitcoin or Ethereum.

NFT marketplaces usually support several blockchains; users can only trade NFTs that are built on supported blockchains and use cryptocurrencies that are compatible with those NFTs.

Most NFTs are stored on Ethereum, which means these NFTs are compatible with Ethereum-based NFT marketplaces. An NFT bought with ether on one platform can be sold on another.

Only a few marketplaces accept traditional currencies like the US dollar. These marketplaces automatically convert the tender into the appropriate cryptocurrency.

How Are NFTs Created?

The process of creating an NFT is called minting. Most NFT marketplaces allow you to mint NFTs, and there are several dedicated NFT minting sites. To mint an NFT, you simply upload a digital file to the NFT marketplace, fill in some details, and click Create. You can turn most digital files into NFTs, including images, videos, and GIFs.

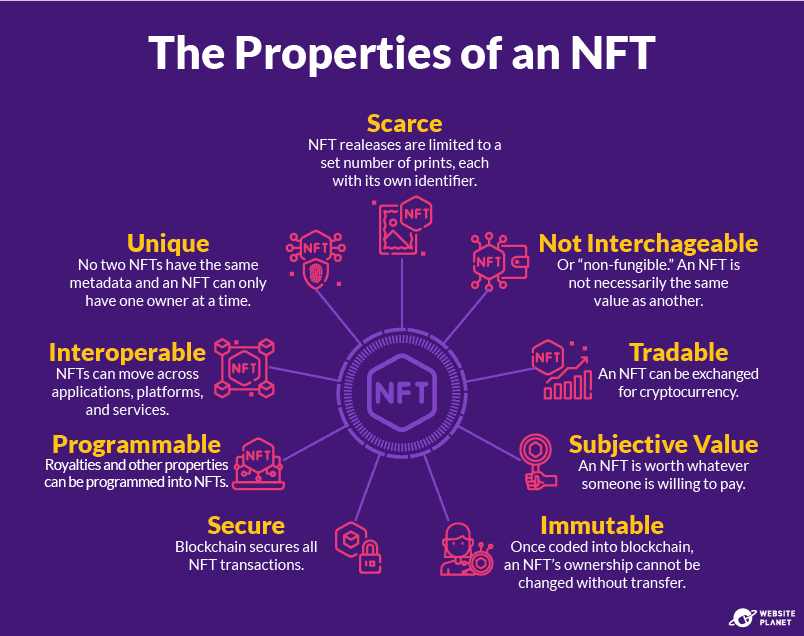

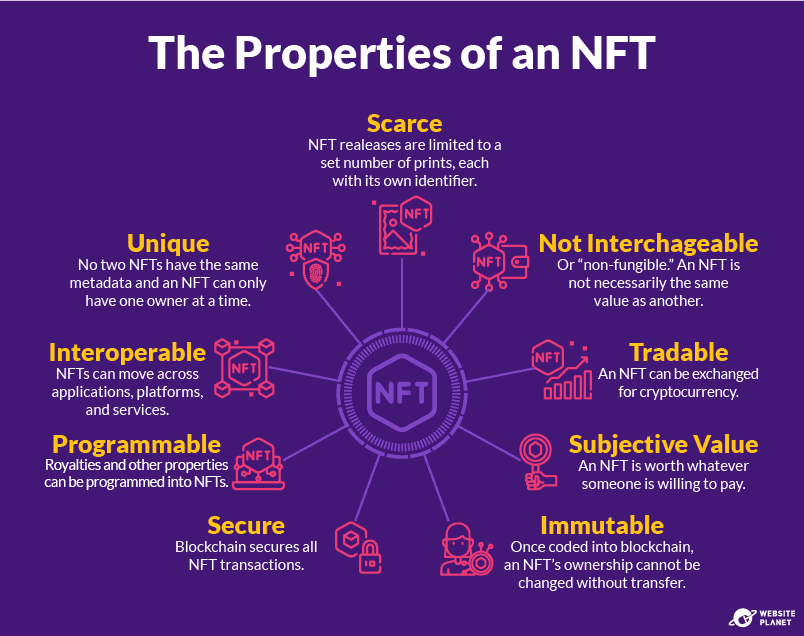

The Properties of NFTs

NFTs have some important properties – such as their uniqueness, scarcity, and tradeability – that make them work.

Unique Asset Ownership

Each NFT represents a single digital or physical asset, and most NFTs only have a single owner at a time. Ownership of an NFT is secured and traceable because it’s recorded on a blockchain (the Ethereum blockchain for most NFTs).

| Ethereum | A decentralized platform that’s powered by a blockchain. Ethereum is known for its smart-contract functionality and its native cryptocurrency, ether (ETH). |

| Smart Contract | A self-executing, trackable, and irreversible contract with terms between parties written into its code and stored on a blockchain.

NFTs are created through smart contracts and can even be contained within smart contracts. |

Because NFT smart contracts are stored on a blockchain – and because blockchains are decentralized, anonymous, and unchangeable public ledgers – no one can change the ownership of an NFT without a legitimate transaction. Proof of ownership is unchangeable.

Your NFT will always be referenced on a blockchain, which is difficult to lose unless you forget your crypto wallet details. This allows NFT ownership to be authenticated.

While an NFT’s ownership record is unchangeable, the underlying assets that NFTs represent, such as digital art pieces, can be copied or lost. Images can be screenshotted and re-sold as fakes, and blockchain technology means no one can prove which NFT is the original. Digital files can also be stored outside of blockchains and vulnerable to hackers, database failure, or link rot.

Each NFT has a public and private key. The NFT’s creator holds the public key, and this never changes – a public key is a certificate of authenticity that proves the origins of the NFT. The corresponding private key acts as proof of ownership. When they sell their NFT on a marketplace, a creator retains the public key while the private key is traded to the new owner.

| Public Key | Used to encrypt communications. They are visible to everyone in a system, and each public key has a corresponding private key. |

| Private Key | Can decrypt (and read) communications that were encrypted by the related public key. Private keys can also encrypt and decrypt messages with the same key. They are stored on a user’s device and have a single owner. |

| Crypto Wallet | Stores the addresses and public/private key pairs for the owner’s cryptocurrency transactions. Can be used to send, receive, and spend cryptocurrencies. |

Fungible vs. Non-fungible

Cryptocurrencies like bitcoin or fiat currencies like the US dollar are fungible. Fungible assets can be traded with one another easily because they are interchangeable and indistinguishable. You can trade one can of soda for another, or a $1 note can be traded for any other $1 note of the same currency.

| Fiat Currency | A currency that is declared by government decree to be legal tender rather than backed by a commodity, such as gold. Examples include USD and EUR. |

Assets are non-fungible if they cannot always be equally exchanged with another asset of the same type. NFTs are non-fungible because each one is unique and represents ownership of a different item with its own characteristics. This doesn’t mean they can’t be traded. It only means that each token may have a different value.

| Non-fungible | A good or asset that is not readily interchangeable with another. For example, a house is non-fungible because you cannot exchange it with any other house. |

Subjective Value

If NFTs are non-fungible, how are their values determined?

An NFT’s value is subjective. It will sell for whatever price a buyer thinks it’s worth. This may be based on the pedigree, popularity, scarcity, and/or collectibility of that NFT. Utility also determines an NFT’s value. For example, an NFT event ticket would likely sell for the same price as a normal event ticket.

An NFT can be surprisingly expensive, especially if prospective buyers think it will become more valuable in the future. Also, NFTs built on the Ethereum blockchain often hold more value than NFTs built on other blockchains. Because more people have ETH tokens, these NFTs can be sold easily across numerous NFT marketplaces, increasing the number of potential buyers.

Scarcity

When a person mints an NFT, they can determine how many of those assets to create and list on the market. It’s similar to an author releasing a limited number of copies of a new book.

A digital artist may decide to create just one original NFT – for instance, a one-of-a-kind digital artwork. The creator could also release one thousand NFT artworks that look the same, each with its own unique certificate of authenticity.

Interoperability

Blockchains are decentralized. This means they aren’t run by a central authority such as a government or business. Instead, blockchains are run by their communities. In theory, this allows NFTs to move across different applications, platforms, and services, as long as each ecosystem supports the blockchain where the NFTs are based.

For example, an NFT of digital artwork could be displayed in several different virtual worlds you inhabit. The same NFT could be the background in your video conferencing app, an accessory in your favorite video game, and your picture profile for your work email.

However, at present, cross-platform NFTs aren’t practical, and are limited. Before NFTs can become interoperable in the way advocates hope, developers must figure out how to port content seamlessly across platforms with different designs.

Tradability

NFTs can be traded on NFT marketplaces and they can be moved from their original platform and into a free market.

One day, NFTs could allow users to trade online content on major platforms. For example, if iTunes songs were coded as NFTs, you could not only buy, but also sell them.

Programmability

Some NFTs never change because their underlying content is static. But NFTs can also be programmed with more complex elements written into their code.An NFT can be programmed to respond to certain triggers or owner actions, or even external factors like the weather.

Complex NFT functions include forging, crafting, redeeming, and randomly generating new NFTs and other forms of content. You can even program NFT smart contracts to change the underlying content when the right conditions are met.

CryptoKitties are a popular example. Created in 2017, they became one of the first popular NFT collections in part because of their programmed features. CryptoKitty avatars can breed with other CryptoKitties – owners can select two CryptoKitties and click a Breed button that mints a new NFT avatar with unique characteristics.

Royalties

A person who mints an NFT can encode royalties into that asset through the NFT’s smart contract. This means the original creator can receive a portion of the fee every time their NFT is sold from one user to the next.

This is potentially industry-changing for creatives, who don’t always receive adequate payment for their work. After the initial sale, creators often don’t benefit if their creation gains value and is resold. For example, an artist who sells a painting for $10 doesn’t profit if that piece later sells for millions of dollars.

Royalties in smart contracts make this compensation accessible to anyone who mints an NFT.

NFTs also create a guarantee that the artist will receive royalties. Musicians, for example, often don’t receive payment from everyone who samples or plays their track for profit. By embedding their address within the NFT’s unchangeable metadata, they both ensure they get paid, and also make it easy for users to pay them.

Security

NFTs have the potential to safekeep digital assets better than current methods. A scan of the deed to a house could easily be lost. Minting a scan of the same deed as an NFT means proof of the document exists on a blockchain. This adds a layer of security.

Blockchain technology is secure because it uses cryptography to encode a token’s ownership. This code requires an incomprehensible amount of computing power to break – essentially, making it impossible to decipher.

Each blockchain ledger is decentralized and anonymous. With no central authority or workforce, tasks are distributed equally between participating computers that form a peer-to-peer network.

| Peer-To-Peer | Networks whereby each connected computer is a server for others in the network. Computers can share information without the need for a dedicated central server. |

| Blockchain Node | An electronic device connected to a blockchain network that forms part of the infrastructure of that network. Multiple nodes communicate with one another and transfer data to verify new batches of transactions (called “blocks”). |

That blockchains use peer-to-peer technology makes them nearly impossible to destroy or corrupt. Every node has an up-to-date copy of the ledger, and someone would have to destroy all of these nodes to wipe out the record of transactions and invalidate the blockchain.

A blockchain’s ledger is also public. Because they are accessible to anyone, ownership is easily verified, which again makes them difficult to steal unless someone tricks you into willingly transferring your NFTs.

Advocates of NFTs believe everyone could use them to represent and authenticate their physical assets. Even personal documents like deeds and drivers’ licenses could be stored as NFTs.

Blockchain technology is very secure, and it’s great for proving that someone owns an item – this proof will always be stored on a blockchain.

However, blockchains don’t store the majority of files that NFTs represent. That content (usually a video or image file) is stored off-chain, and the NFT hyperlinks to that source. This is because storing large files on a blockchain has high transaction fees, and hyperlinks are smaller than the files themselves.

While blockchain technology is secure, this off-chain storage raises concern over the underlying contents. Hyperlinks in NFTs could stop working over time, a common problem called link rot. And storing underlying content on a centralized database leaves it vulnerable to hacks and database failure.

An NFT is pointless if its underlying content disappears. At that point, it will signify ownership of something that no longer exists.

NFT Technology

NFTs are complicated and technical — but at their most basic are just strings of computer code stored on multiple computers. And knowing more about their history and how they developed can make them easier to understand.

For starters, different cryptocurrencies and crypto assets are built on their own blockchains, and there are hundreds, if not thousands, of different blockchains. For example, bitcoins are built on the Bitcoin blockchain, and ERC-20 tokens are based on the Ethereum blockchain.

Some blockchains allow users to create non-fungible tokens in addition to fungible cryptocurrencies. The Ethereum blockchain is by far the most widely used blockchain for creating NFTs. However, there are others, including:

- Flow

- Binance Smart Chain

- Solana

- Tron

- Polkadot

- EOS

- Cosmos

- WAX

- Tezos

- Algorand

- Hedera Hashgraph

Some blockchains, including Ethereum, work with other compatible networks and coins, making them interoperable. Users can buy Ethereum-based NFTs with a variety of cryptocurrencies, including ETH, DAI, USDC, BNB, and USDT. Other blockchains, such as Solana, have closed systems and NFTs attached to these systems can only be bought with that blockchain’s token.

Ethereum’s popularity, liquidity, security, and portability across other apps, platforms, and products are part of what makes Ethereum-based NFTs such a popular choice.

Ethereum’s token standards are also widely considered the best for creating NFTs. Token standards tell people how to create, issue, and deploy new tokens that are compatible across a broader ecosystem. Ethereum’s blockchain has several useful standards:

- ERC-721 was the first and is still the most popular standard for creating unique NFTs. It’s an Application Programming Interface (API) within the tokens’ smart contracts. ERC-721 allows developers to create unique tokens and makes transerring the tokens easy and, after approval, automatic..

- ERC-1155 is a standard that gives semi-fungibility to NFTs. With ERC-1155, IDs represent classes of assets rather than single assets. For example, a single ID could contain 100 NFTs. This means that multiple NFTs can be transferred at once, but with less information about each one.

- ERC-998 is a composable token standard. These tokens can represent more than one asset at a time for quicker transactions. ERC-998 tokens can contain both fungible (such as ERC-20) and non-fungible (such as ERC-721) assets.

History of NFTs

NFTs have developed at a frighteningly fast pace, so you’d be forgiven for missing a few key dates.

2012

Colored coins were created on Bitcoin’s blockchain to represent ownership of real-world things like coupons, property, and collectibles. Colored coins are thought by many to represent the beginning of NFTs. These tokens were rudimentary and lacked a lot of the use of today’s NFTs. Nonetheless, they began a conversation about unique blockchain-based assets.

2014

The creation of Counterparty. Counterparty was a peer-to-peer financial platform, based on the Bitcoin blockchain, that allowed users to create and exchange their own currencies. Counterparty was important for the evolution of NFTs because the first NFTs on the platform resembled use cases that we recognize today. Several memes and games were placed on the platform as NFTs following its launch.

2016

The first Rare Pepe NFTs were introduced and quickly gained widespread popularity, effectively kickstarting the Crypto Art movement. Pepe NFTs became tradable with the introduction of Rare Pepe Wallets, and there was even a Rare Pepe auction in the following years.

2016 to 2019

The Crypto Art space continued to grow. NFT collections like CryptoPunks began to showcase the potential of NFT art and collectibles on the increasingly popular Ethereum blockchain. New NFT marketplaces like OpenSea, SuperRare, and KnownOrigin were launched, and NFTs could be created on platforms like Mintable and Mintbase.

2020

NFT marketplaces developed. Existing NFT marketplaces were updated and new platforms like Rarible and Cargo were released. Before 2020, NFT creators had to program smart contracts themselves if they wanted to add features like bulk creation and unlockable content to their NFTs. New platforms meant these features were now readily available during the NFT minting process.

2021

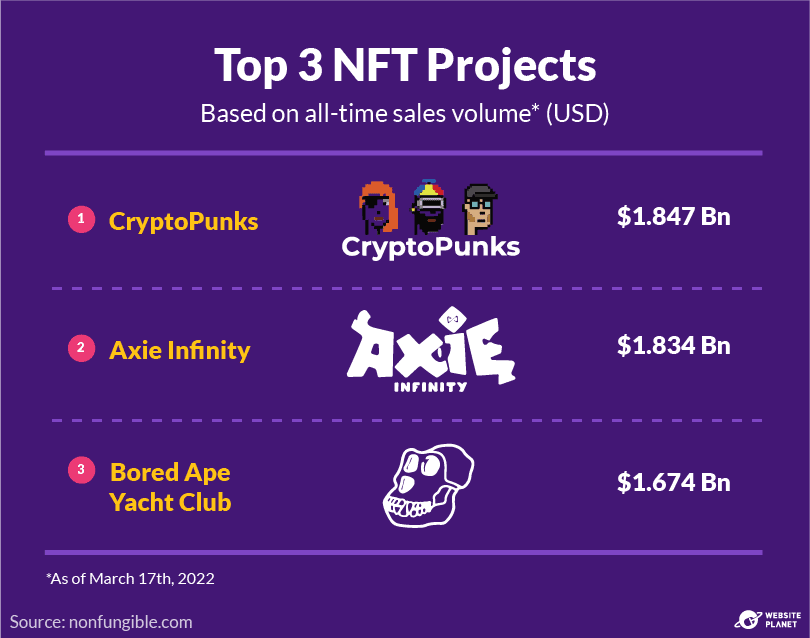

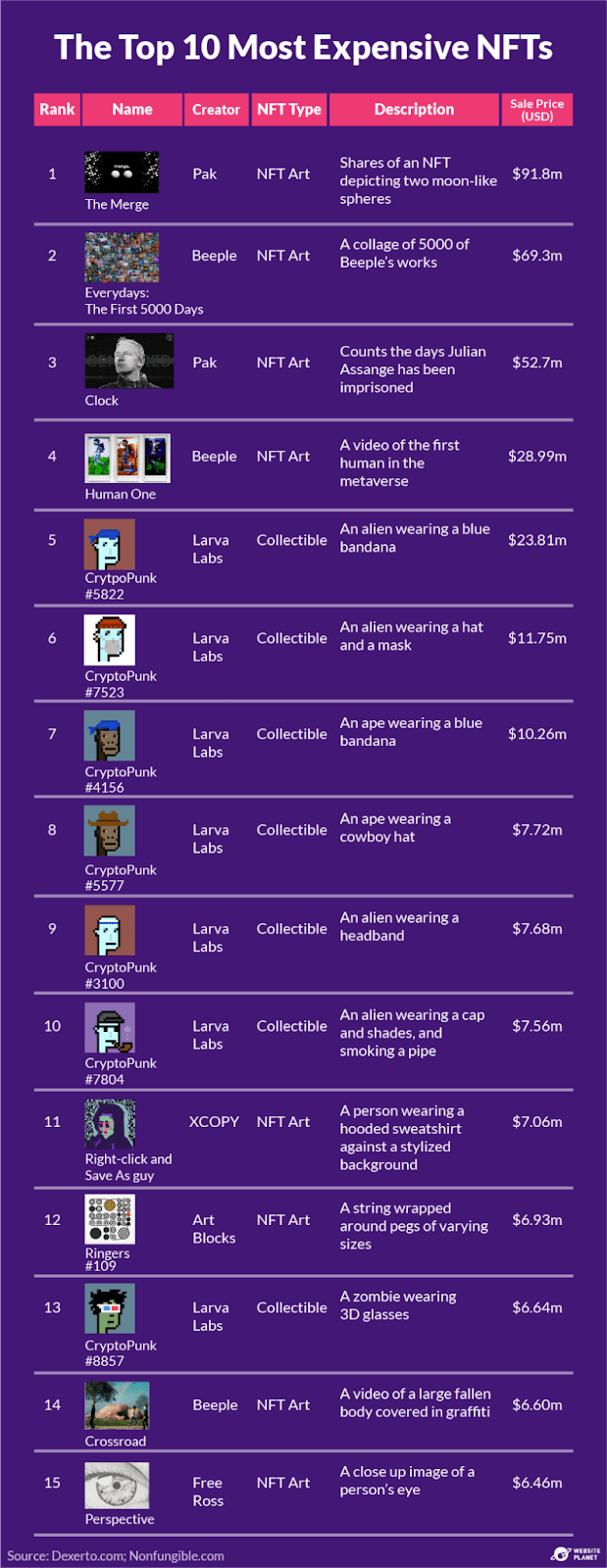

If 2020 was the year the wider public took notice of NFTs, 2021 was the year NFTs exploded. Celebrities and established brands became interested in NFTs and NFT art gained mainstream popularity. Beeple’s “Everydays: the First 5000 Days” sold for $69.3 million at Christie’s art auction, only to be topped by the $91.8 million sale of Pak’s “The Merge” in early December.

Pak’s NFT was sold to more than 28,000 users who bought over 260,000 shares in his artwork – valuable proof of fractional ownership.

The first-ever Twitter post was sold as an NFT for $2.9 million in 2021. Over the year, CryptoPunks and Bored Ape Yacht Club NFTs routinely sold for hundreds of thousands of dollars and yesterday’s memes were re-sold as today’s NFTs. Songs, albums, and books were released as NFTs. Meanwhile, experts continue to develop new uses for NFTs outside of the creative industries.

NFT Risks & Issues

While NFTs are useful in the digital space, a few issues threaten to stifle the technology’s progress. They also hold some risks you should beware of before forming an opinion or investing.

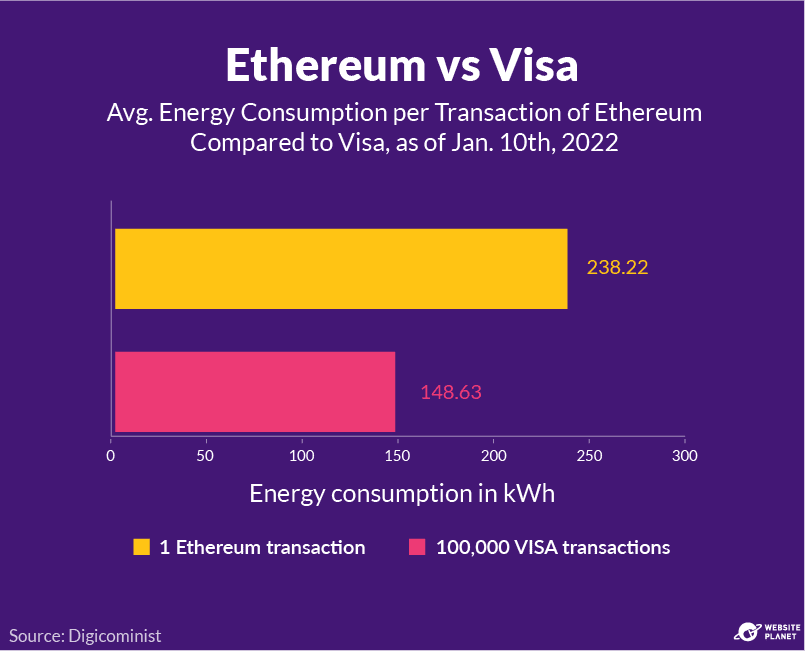

NFTs Are Bad for the Environment

NFTs have a significant carbon footprint due to their reliance on the Ethereum blockchain and its proof-of-work system.

Proof of work helps secure the network’s public record of transactions with complicated cryptography. Mining new blocks on the blockchain requires a large amount of computing power – there are entire warehouses full of computers dedicated to mining blockchains – and those computers consume lots of energy.

That’s not to say alternatives to NFTs are carbon neutral. Physical art, for example, must be manufactured and transported, which also uses a significant amount of energy. But, Ethereum’s carbon emissions are higher than many of the industries NFTs could replace.

There are more than one million Ethereum transactions every day; that includes transactions for each of the different cryptocurrencies and tokens based on the Ethereum blockchain. Transferring cryptocurrency and creating, buying, selling, and bidding on NFTs are actions that are classed as “transactions” on the Ethereum blockchain, and all of them use energy.

Because of all of these many transactions, Ethereum consumes about as much electricity as the nation of Libya (pop. 6.8 million).

According to figures from Cryptoart.WTF, the average NFT has a carbon footprint that’s equivalent to an EU resident’s electricity consumption over an entire month. And thousands of transactions related to NFTs happen every day on Ethereum.

The environmental impact of NFTs is only getting worse. Ethereum’s value rises as NFTs bring their users economic success, encouraging miners to scale their computing power to capitalize on the trend. At least, that’s the view of Susanne Köhler, a sustainable blockchain researcher who spoke to The Verge:

“Many NFT transactions send a stronger economic signal to the miners which may lead to increased emissions.”

It’s worth noting that NFTs account for a relatively small number of Ethereum’s total transactions, and also that the primary environmental issue is Ethereum’s proof-of-work method.

Ethereum is moving to a proof-of-stake system of validation which, in theory, will reduce the network’s carbon emissions to almost nothing. In a proof-of-stake blockchain, miners stake their own cryptocurrency to secure the network rather than using computing power. Ethereum has promised these changes since its launch in 2015, but they have yet to materialize. In the meantime, some NFT artists are offsetting their carbon footprint with green investments, and some miners are switching to renewable energy sources.

There are also ways to make transactions greener. Ethereum Layer 2 solutions can act as a more efficient intermediary between apps and the blockchain by reducing the number of transactions, and NFT marketplaces can become more efficient, as well.

NFTs Are Not Regulated

NFTs are currently unrecognized and unregulated. Several nations – including the UK, Japan, and members of the EU – are working on this problem, but there aren’t yet international laws covering NFTs.

According to the multinational legal firm Osborne Clarke, existing laws could already cover NFTs, at least insofar as they have the same characteristics of other investments. And smart contracts might already provide adequate proof of ownership.

The major holdup here is that these theories haven’t been tested in court. And this lack of regulation creates problems, including the inability to protect platforms (and investors) from scammers, fraudulent copycat sites, and even money laundering – an issue that’s hard to solve due to the the “anonymous” nature of blockchain technology.

Perhaps with better regulation, buyers and sellers could be vetted.

The Legality of Ownership: Copyright and IP Issues

What rights to the underlying work do you acquire, if any, when you purchase an NFT?

Buying and owning an NFT does not mean you possess every right to the underlying asset itself. The transfer of additional rights (other than ownership) have to be clearly stated within the NFT’s smart contract. Otherwise, the creator of an NFT’s content keeps the copyrights and Intellectual Property Rights (IPRs) of their work.

Unless copyrights and IPRs are transferred along with the NFT, buyers do not control the original work. NFT buyers can’t create and sell copies of their purchase, they can’t make the underlying work freely available to the public, and they can’t adapt or reproduce it in any way.

To be clear, this is no different from physical possessions. Buying a Mars Bar doesn’t give you the right to create and sell your own nougat-filled confectionery under the Mars name. But the promise of buying an original asset can be a misleading concept – especially when its so ambiguous about which rights are transferred in a transaction.

Digital content is also inherently shareable and extremely easy to reproduce, which is a temptation for many NFT owners. As a general rule, you’re purchasing ownership of the asset alone, unless otherwise clearly stated in the NFT’s smart contract.

Critics worry this gray area will cause disputes. Buyers of NFTs could falsely claim copyright over the underlying asset, for example, while sellers of NFTs could be sued for misrepresentation if they’re not careful. Worse still, any infringement is largely irreparable because it’s immutably encoded into a blockchain.

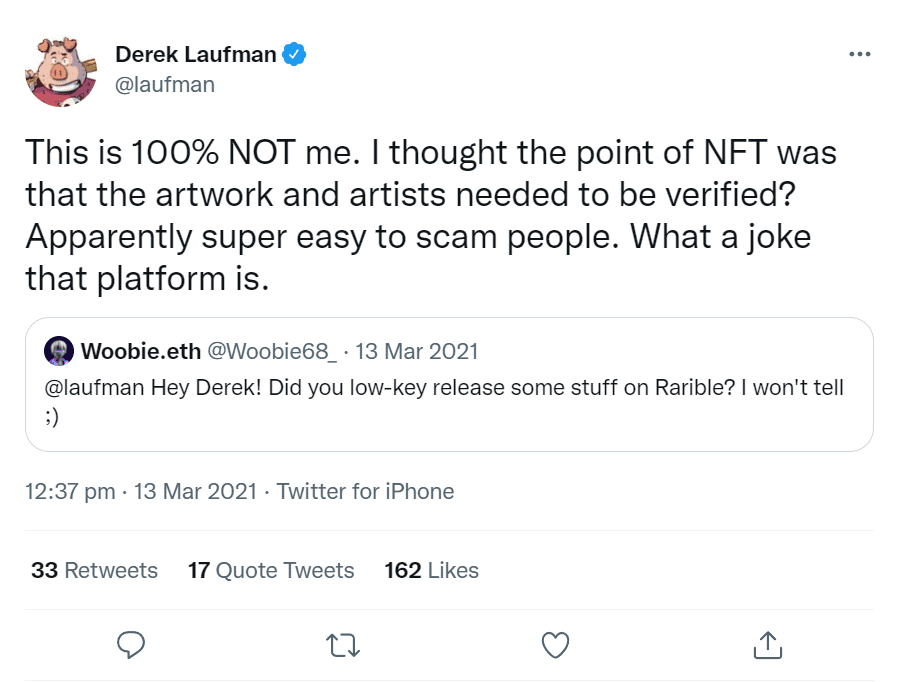

Scams, Fraud, & Security Issues

NFTs can be an uncertain investment in part because so many cybercriminals profit from them.

There are manyways NFT buyers and creators can be scammed, including:

- Fake NFT marketplaces

- Fake sellers posing as NFT creators

- Copies of non-NFT assets minted as NFTs

Since digital assets are files, they can be saved or screenshotted and then minted as an NFT. Of course, this is a clear breach of copyright law. You can’t legally make money from someone else’s work.

But fake sellers do impersonate popular NFT creators to sell copies of their NFTs as the real thing. Since these aren’t the original pieces, they’re worth just a fraction of what they were paid for. Buyers can spend thousands of dollars on an NFT only to realize it’s a worthless fake.

Scammers have also copied and sold the work of creators who aren’t involved in NFTs. In March 2021, the famous illustrator Derek Laufman was impersonated on Rarible.

NFT fraud is perpetuated by tactics like fake NFT giveaways and fake airdrops. People receive these apparently at random, and then sell them thinking they’re legitimate. Cybercriminals have even created fake NFT marketplaces that use the same original logos, design, and content as existing platforms.

| Crypto Airdrop | A method of distributing cryptocurrency or other crypto tokens to specific crypto investors’ wallets, usually to generate interest in a project. |

Buyers can mitigate the risks by purchasing NFTs from reputable and identifiable creators, but that doesn’t mean users won’t continue to face the threat of fraud.

On top of all of this, there’s the risk of losing expensive NFTs in hacks and cyberattacks. Several Nifty Gateway user accounts were compromised in March 2021. Hackers sold and transferred hundreds of thousands of dollars’ worth of NFTs to anonymous accounts.

When we factor in phenomena such as link rot and database failure, which can also lead to the loss of underlying assets, it’s easy to see why you shouldn’t over-invest in NFTs.

NFTs Could Lose Value

Many collectors are sinking millions of dollars into NFTs despite the financial risks associated with the technology. In a worst-case scenario, these collectors could lose enormous sums of money should their NFTs rapidly lose value.

An NFT’s price is based on subjective values, which are difficult to predict. Because they have no fixed standards, their market is prone to sudden drops.

NFTs could also devalue if Ethereum became obsolete. This would be a surprise given Ethereum’s current success, but it’s worth keeping in mind. Most NFTs live and die by the success of the Ethereum blockchain because that’s where they’re based.

NFTs that represent physical items could lose value if that physical asset is lost, stolen, damaged, or destroyed. An NFT may persist even after its physical counterpart has been lost. This points to the fact that an NFT and the underlying asset it represents are separate things.

And finally, what if NFTs don’t follow the trajectory that advocates predict? NFTs haven’t changed the world yet, and unsolved issues remain. They could be rendered worthless if another technology manages to bring the same values of scarcity and proof of ownership to digital assets, but with fewer drawbacks.

If April 2022, the owner of an a NFT representing the first ever tweet on Twitter put the NFT up for auction. While he originally paid $2.9 million for the NFT, when reselling it, he hoped to raise $48 million in the sale. However, the highest bid was equivalent to just $29,000.

Can You Own Digital Content?

Can you really own an NFT in the same way you own physical possessions? When you buy a single edition art piece from a gallery, you’re not only the sole holder of that piece but also the exclusive viewer, if you so please. In the same sense that you don’t have to lend out your favorite book, you don’t have to show others your favorite painting.

Is it futile to endow digital assets with the same rules when they’re different from physical items? On the internet, anyone can save, screenshot, or copy any NFT’s image, artwork, or video and claim they also own that content.

The NFT community describes this as a right-clicker mentality.

| Right-Clicker Mentality | A term coined by the crypto community that describes people who save images from NFTs to ridicule NFT owners, claiming that they own the NFT without paying for it. Right-clicker mentality is also used more generally to describe NFT naysayers. |

While these people are a running joke to crypto art collectors, do right-clickers have a point? What’s the difference between an NFT and an identical image if both can provide the same satisfaction?

Some critics have compared NFTs to buying the receipt for a product that anyone can own. Support for NFTs essentially comes down to one’s belief in a piece of code and what it really means for something to be unique. To play the devil’s advocate: Critics don’t think NFTs provide scarcity, nor do they believe this quality can be achieved with digital content.

A Complete Guide to NFT Marketplaces

NFT marketplaces are platforms where you can buy, sell, store, and display NFTs. In some cases, you can even create your own.

When choosing an NFT marketplace, you should be very careful. Each one is compatible only with certain crypto wallets, cryptocurrencies, and types of NFTs. Most NFT marketplaces use Ethereum-based NFTs and accept ETH tokens, which is why Ethereum is so popular.

Other marketplaces may be designed for different blockchains. For example, Solsea is designed for Solana blockchain-based NFTs. There, you would need to link a wallet that’s compatible with the platform and contains SOL cryptocurrency.

Each NFT marketplace may also cater to different types of content. NFT art marketplaces are the most common, but other niche marketplaces include in-game content, music, trading cards, and virtual real estate.

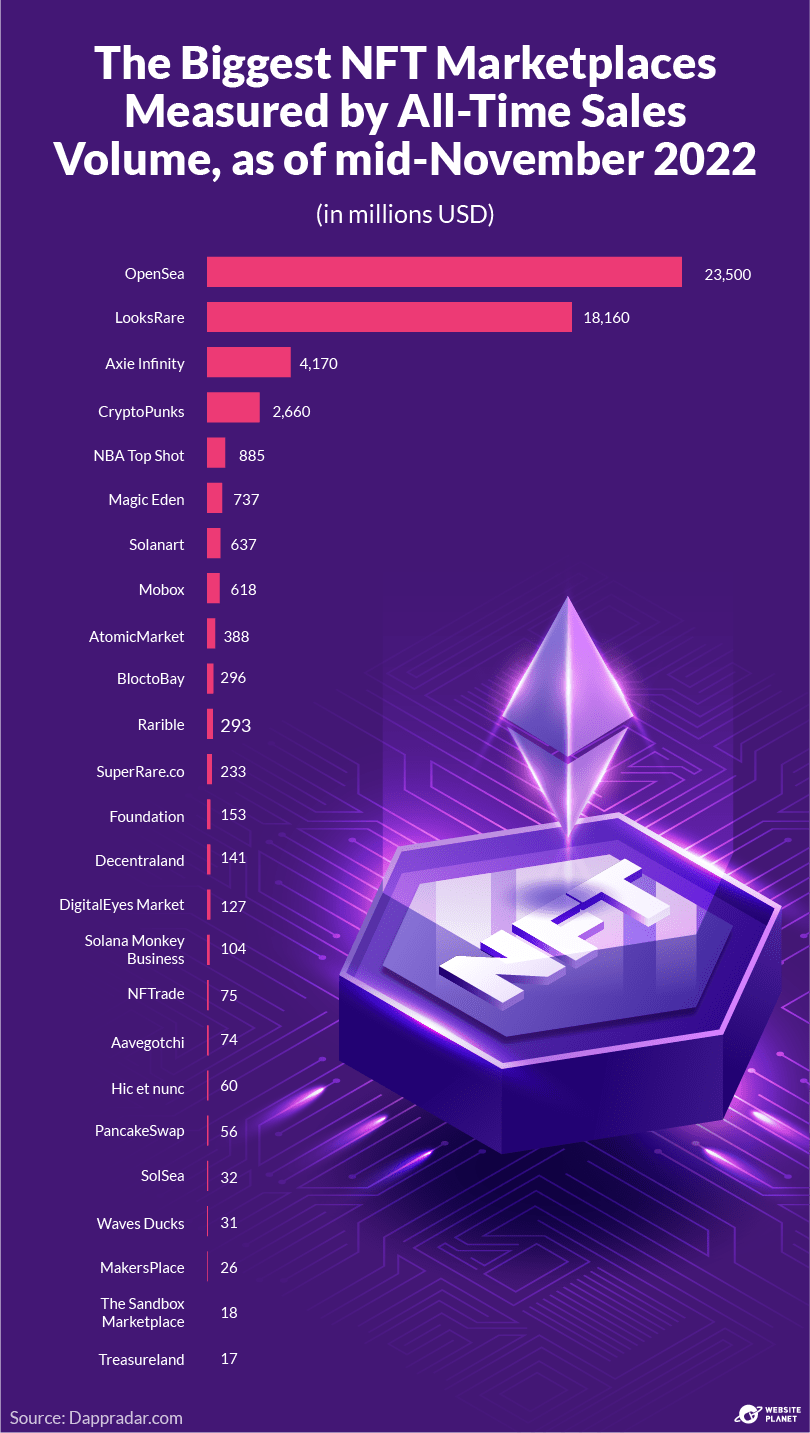

OpenSea, Rarible, and Axie Infinity are among the most popular NFT marketplaces. OpenSea is currently the biggest NFT marketplace, and showed colossal growth in 2021. In August of that year, OpenSea recorded over $75 million of trading volume in a single day. That’s a higher total than the platform saw throughout the whole of 2020.

The marketplaces generally considered the best for buying and selling NFTs are:

- OpenSea is one of the earliest and biggest NFT marketplaces. It’s an all-around user-friendly marketplace that features NFTs of digital artworks, collectibles, domain names, photography, music, utilities, virtual worlds, and sports.

- Rarible is decentralized and run by its community – owners of RARI tokens. In this sense, Rarible is something of a pioneer in the crypto space. Rarible focuses on art NFTs but also contains music, domains, in-game content, metaverse NFTs, and more.

- Nifty Gateway is all about digital art. The site contains NFTs from some of the biggest NFT artists like Beeple and Trevor Jones, not to mention famous NFT collections like Mutant Ape Yacht Club.

- Foundation is another artwork-centric NFT marketplace. Like Nifty Gateway, Foundation features some prominent NFT art and meme collections.

- SuperRare contains single-edition NFTs from top artists, including XCOPY and Coldie. The SuperRare DAO* is governed using $RARE tokens – ERC-20 tokens on Ethereum’s blockchain.

- Mintable is an NFT marketplace solely designed for creating, buying, and selling NFTs. It’s the closest thing to eBay for NFTs. Users can easily create NFTs from artworks, audio files, PDFs, and more.

Some niche NFT marketplaces cater to specific NFTs:

- Axie Infinity is a game with its own huge NFT-fueled economy. The Axie Infinity marketplace contains over 270 million tokens. Players can collect “axies” for use within the game. They can then battle each other with their axies, create new axies (by breeding them), and trade axies with other people.

- NBA Top Shot contains NFT trading cards which feature a short video of an iconic NBA moment. The marketplace is built on the Flow blockchain. Users can buy and sell these trading cards to one another.

- Decentraland is a massively popular NFT game with a market cap of US$6 billion. It’s essentially a metaverse where users can trade virtual land and other in-game items.

| *Decentralized Autonomous Organization (DAO) | A decentralized organization that is governed by a community of its users. DAOs exist online and are organized based on rules encoded on a blockchain. |

How to Get Started on an NFT Marketplace

If you would like to buy, sell, and create NFTs, you need to start on an NFT marketplace.

The process of signing up to an NFT marketplace ordinarily consists of a few straightforward steps.

Choose a marketplace > Sign up > Link a Crypto Wallet

NFT marketplaces require you to input some personal information when you create an account – the same as other online platforms. There are a couple of things you must consider before choosing a marketplace and creating/trading NFTs.

Choosing a Marketplace

This is the most important consideration before creating an account on an NFT marketplace. You’ll want to join the best NFT marketplace for your needs.

You need to choose a compatible marketplace that caters to the type of NFTs you want to buy, sell, and create. OpenSea is a reliable choice as it contains a huge variety of NFTs including art, collectibles, in-game items, and more.

We also recommend you choose an Ethereum-based NFT marketplace. Each blockchain that supports NFTs has its own compatible NFT marketplaces, wallets, and crypto tokens. Ethereum has more NFT marketplaces (and more NFTs) than any other blockchain.

Once you’ve signed up to the marketplace of your choice, you’ll need to link a crypto wallet. Most marketplaces present you with a list of crypto wallets that you can use.

Choose a compatible wallet and sign up there as well. Your account set-up will be complete once you’ve linked your crypto wallet to your account.

Funding Your wallet

You need to have a cryptocurrency balance to trade on NFT marketplaces and pay “gas.” Gas fees are transaction fees on the Ethereum blockchain.

| Gas Fees | Payments made by users of the Ethereum blockchain that cover the computing energy costs of maintaining the network. |

You must purchase the correct cryptocurrency, one that’s compatible with your NFT marketplace. You need to buy ETH tokens to trade NFTs on an Ethereum-based NFT marketplace. You’ll waste money if you buy the wrong cryptocurrency, such as bitcoin. Most wallet providers, including MetaMask, Enjin, and Coinbase, support ERC-721 tokens.

We recommend you buy around $100 of cryptocurrency from an exchange or broker and transfer it to your wallet. This should be enough ETH to cover the cost of creating or buying your first NFT.

What’s a Cryptocurrency Exchange or Broker?

| Cryptocurrency Exchange | A platform that allows customers to buy and trade cryptocurrencies in exchange for other financial assets, such as fiat money or a different cryptocurrency. |

| Cryptocurrency Broker | A company or individual that acts as an intermediary between a cryptocurrency buyer or seller and the market. |

Multiple trades occur simultaneously on cryptocurrency exchanges, with platforms charging a set commission fee on each transaction. Anyone can buy cryptocurrency easily on exchanges using a credit card. Prices are instantly visible to anyone using the platform and largely determined by free-market factors like supply and demand. Coinbase.com and Crypto.com are two popular cryptocurrency exchanges.

Cryptocurrency brokers can offer a more personalized service to buyers and sellers. Brokers set the prices of cryptocurrencies themselves and usually facilitate higher-value trades. A prospective buyer would deposit their capital to the broker and can use that broker’s additional products and services. These could include access to contract for differences (CFDs), derivatives, and market analysis tools. Popular brokers include Caleb & Brown and Bitpanda.

Both exchanges and brokers are reputable methods for trading cryptocurrency, though both methods also present opportunities for scammers and fraudsters. Only use well-known sites and widely recommended firms, and watch out for fake platforms or brokers.

How to Buy and Sell NFTs

Of course, each marketplace is slightly different. But if you’ve completed the sign up and you’ve connected a funded crypto wallet, you should be ready to buy and sell NFTs.

Buying NFTs

Buying an NFT is easy once you’ve funded your crypto wallet. The majority of NFT marketplaces use auctions and fixed-price “Buy Now” sales.

You can either buy NFTs on their initial release directly from the creator, or you can buy them on the secondary market. In-demand NFTs can increase in value over time, so it’s often best to buy NFTs on their initial release. That’s easier said than done; primary NFT auctions can be over in seconds. You’ll need to make sure you have ample funds (and can react quickly) before attempting to bag an NFT on release.

You should look at several different, similar NFTs before committing to a purchase. You want to have a really good idea of the maximum and minimum price of an item before searching for a good value. Many NFT marketplaces show the “lowest ask” and “highest bid” for an NFT.

You should be mindful that scarcity, unique characteristics, and originality are desirable and increase the value of an NFT. Ownership history and the potential of future profitability also affect prices, while certain aesthetics are more fashionable than others. Consider these trends before buying an NFT, to ensure resale value.

Set a budget and stick to it when buying NFTs. Otherwise, with so many options, you may find yourself spending compulsively. Mainly buy from verified sellers to avoid scams, and purchase after considerable due diligence everywhere else.

Finally, remember that you pay gas fees when you buy or even bid on an NFT. So choose your bids carefully and keep some extra ETH in reserve.

Selling NFTs

Selling NFTs that you’ve bought or created may differ slightly depending on the marketplace but, generally, it’s a simple process:

Click Sell on an NFT > Choose Sale Conditions > List the NFT

Whether you’re trading NFTs or releasing your own collection, you must balance getting the best value for your NFTs with some other strategies that can help in the long term.

At the very least, you need to be aware of the value of your NFT. One NFT trader accidentally sold a Bored Ape for just $2,844 in December 2021, a “lapse of concentration” that meant the NFT was listed around $282,000 below its market value. With that in mind, let’s look at some pricing tips so you can avoid making similar mistakes.

How to Price Your NFTs

NFT’s are listed at a range of price points. There are two different ways to value your NFT based on its content.

Supply and demand drive NFT values. If an NFT you’re selling is a utility (i.e. it has an everyday use), you should value it according to its corresponding physical product. For example, an event will sell an NFT ticket for the same price as a physical ticket. In the resale market, that ticket could rise in value if there is high demand.

The value of non-utility NFTs is almost completely driven by supply and demand. Here are some factors that influence the perceived value of NFTs:

- Market demand

- Scarcity

- Originality

- Uniqueness

- Sentimentality

- Ownership history

- Potential return on investment

While you can predict some of these factors, others are solely down to the buyer. An NFT that is owned (or created) by someone famous will likely fetch larger sums of money. An NFT that is unique or original will probably be valued by the community as well.

As a general rule, price your NFT close to similar NFTs on the market. A piece of digital art that contains 3D graphics may sell for around the same price as a similar NFT of the same quality.

You shouldn’t overprice your NFT if you’re the creator and this is its initial drop. The chances of your collection selling out will diminish if it’s overpriced because you’ll deny lower-income collectors from taking part. You want your collection to sell out to generate some hype.

This is also good practice because you want buyers to make a return on their investment. Otherwise, they simply won’t invest. Many top collections maintain affordable drops even when they’re in high demand.

When and Where Should You Sell NFTs?

Timing is crucial when releasing a collection or reselling a popular NFT. Run some marketing in the months before the sale to generate excitement and prime your customers.

Sell your NFTs on more than one online platform. Most top NFT creators and collectors have multiple touchpoints with potential buyers, including social media accounts with links to purchase, a presence on top NFT marketplaces, and a website that integrates with these marketplaces – this way, supporters can go straight to their website to purchase their NFTs.

The NFT marketplace you choose needs to be based on the characteristics of your product. Are you selling a one-of-a-kind digital artwork? SuperRare is the best place to go. Are you selling NFT music? Try platforms like Catalog or OneOf. Unique One Photo is dedicated to NFT photography, while big platforms like OpenSea get exposure for loads of different categories.

You can also list a second-hand NFT on multiple marketplaces at the same time. This is great if you’re reselling an NFT and want to increase its exposure.

How to Market NFTs

NFT creators and collectors use marketing channels to generate interest in their NFTs and build a community of supporters.

Community members are actively engaged in buying and selling NFTs. You want to build this fanbase with marketing communications and the content of your NFTs. Establishing a community is crucial because it helps build credibility and excitement around your project, which ultimately translates into sales.

Successful NFT collectors and creators use multiple marketing channels to promote their NFTs, including:

- Community engagement

- Social media

- Websites

- Outreach to NFT influencers

- Donations of NFTs to influencers

- Adding the drop to the NFTCalendar

- Advertisements

- Content marketing (informative blogs, videos for users)

- Mailing lists

- Airdrops & giveaways

- Pre-sale sign-ups

- Pre-sale NFTs

Community engagement is one of the most important methods of building interest in your NFTs. Think about the content of your NFT – is it an abstract art piece, a sports-themed collectible, a sci-fi avatar? Talk about your NFT drop in social media spaces where your items will be most appreciated.

Discord, Twitter, and Reddit are popular with crypto supporters. You can join NFT groups on Discord and Reddit. On Twitter, you can use popular NFT hashtags to post content to the right audience.

Industry influencers are often used to promote NFT projects and sales. A few NFT marketplaces allow you to promote your NFTs on their homepage for a payment – another great way to find investors.

You could airdrop your first collection of common NFTs to 1000 people for free. This instantly creates an audience for your brand. These people could tell others about your NFTs or even buy in themselves. You could also ask influencers whether they would accept an NFT from your collection for free. Their fans will notice any new NFTs in their collection.

Whatever method you choose to market your NFTs, you certainly want to create a fear of missing out (FOMO) among NFT supporters.

Some collectors and creators go a step further to create FOMO by:

- Posting blurred pictures of NFTs before they’re listed

- Opening the auction to bids before NFTs are revealed

- Drawing out the release into stages: Early access, pre-sale, public sale

Creators can also add unlockable content into their NFTs to create value for community members. This essentially means people join a social club when they buy an NFT from your collection.

Set an On-Chain Identity

Fake NFTs that replicate an original collection are an issue on NFT marketplaces. It’s a good idea to set an on-chain identity if you plan on selling NFTs. You can link your official social media accounts and email address to your anonymous on-chain account. This adds credibility to your NFTs and protects buyers.

How to Trade NFTs for Profit

NFTs can be a valuable investment, if you know the following basic strategies.

Which NFTs Should You Trade?

NFT traders usually focus on a few categories with high profitability:

- Art

- Music

- Gaming

- Photography

The best traders identify desirable characteristics in NFTs that will make them easier to sell. While some categories are preferred over others, money can be made in almost any NFT category – just keep in mind there are risks.

Rarer NFTs are better for trading than collections with loads of units. That’s because there’s less competition from other sellers in rare collections. You’re also less likely to face rapid price crashes and undercutting should interest in an NFT project diminish.

NFTs that feature unlockable content are also preferred – these NFTs build long-term value for their owners outside of the content itself, which can result in user growth and price increases. NFTs that unlock rare content in blockchain games can see large value increases, especially if the game is growing in popularity.

Short-Term Exit Strategy

An exit strategy is the contingency plan a buyer has regarding the sale of an asset. There are short-term exit strategies and long-term exit strategies. You need to decide which exit strategy is right for you and the NFTs you’re buying.

A short-term exit strategy (also called flipping) involves buying an NFT, holding it for hours or weeks, and selling it for a quick profit.

You can manage a short-term exit strategy in a few ways. You could buy an NFT below its average sale price and re-list it for an increased price. You need to unnnderstand the market for your NFT to do this successfully. It also helps to choose an NFT that’s increasing in value every time it’s sold (this information is available on NFT marketplaces).

You could also target NFT releases and new NFT collections with a short-term exit strategy. This means you buy an NFT early and sell it quickly, when interest in that NFT is high. Traders monitor a collection’s trading volume and number of owners to determine its popularity.

Long Term Exit Strategy

Long-term strategies involve buying into an NFT project late and sitting on that investment for months or even years.

Buying in early with this plan is not recommended. That’s because you need to choose NFTs that already have a fanbase. NFTs that are scarce work well here too – collections with lots of new units could depreciate over time, while rare collections tend to gain value.

You should hold your NFT until there is a massive spike in sales volume and valuation, or list your NFT following a prolonged increase in sales prices. Don’t hold onto an NFT for too long after its growth begins to decline. Doing so could result in a decreased profit or even a loss.

If you’re unsure whether to choose a long-term or short-term exit strategy for a particular NFT, look at the trading volume of similar NFTs or NFTs in the same project. If there’s only a handful of trades every week, a long-term strategy may be the best course of action.

Fixed Price or Auction?

In a Dutch auction, the NFT starts at a high price that decreases over time to a minimum sale price. The first buyer to bid on the NFT will win a Dutch auction.

You can use Dutch auctions when you’re unsure about an NFT’s market value. They can also help you recuperate the best possible price when you need to sell an NFT quickly. Setting a price range from below average to low means you have a chance to sell the NFT for more than a low fixed-price auction.

Outside of these two examples, however, it’s best to stick with a fixed-price auction.

Pricing Strategy

The sale price of your NFTs depends on your exit strategy, seller competition, market trends, and your desired profit.

You should monitor the price of NFTs from the same collection on the marketplace. If you want to sell your NFT quickly, price it slightly lower than average. You can price your NFT higher if you’re willing to wait for a better price.

Good NFT traders change the price of their items based on their performance. Increase the sale price of NFTs if the collection is selling better than expected. Decrease the sale price if NFTs are performing worse than expected. This sounds obvious, but many traders lose money by keeping their prices consistent. It’s better to cut your losses and maximize your wins.

The Risks Associated With NFT Trading

NFT traders can make hefty salaries, but they take on some risks. You need to consider these risks carefully before you decide to trade NFTs.

The NFT market is unstable and shouldn’t be seen as a primary source of income, especially if you’re in a precarious financial situation. Committing a large percentage of your savings to NFTs could result in financial ruin. Only invest what you can afford in NFTs.

NFT trading also presents an enormous environmental risk. NFT traders constantly buy, sell, and bid on NFTs. This is a problem because users who make more transactions on the Ethereum blockchain are using more energy. Consider trading other non-crypto assets as an alternative, such as fiat currencies, if this doesn’t sit right with you.

How to Mint Successful NFTs

Creating (or minting) an NFT is fairly straightforward. You don’t need a background in cryptocurrencies or blockchain technologies to do it.

| Minting NFTs | Refers to the process of creating an NFT, which involves turning a digital file into an asset stored on a blockchain. |

First, navigate to an NFT marketplace where you can create NFTs. Not every marketplace allows you to do this, but for most that do, creating an NFT is a similar process.

Upload Content > Choose NFT Properties > Mint Your NFT

While these steps are fairly straightforward, you need to remember that some of the decisions you make here will affect the value of your NFT.

What Things Can You Mint as NFTs?

Most digital file formats can be turned into NFTs. This includes images, videos, audio files, and 3D models. These files could contain anything, including digital art, avatars, memes, GIFs, homemade videos, merchandise, and utilities. As long as you own the full rights to a piece of digital content, you can sell it as an NFT.

NFT avatars are currently popular. So are collectibles like trading cards, digital art pieces, and GIFs. But as popular as these NFTs are, their markets are also saturated.

An emerging trend not yet saturated is generative art, a type of digital art. Real-world utilities are another market gaining traction. You could create NFTs that help people pay bills with cryptocurrency, for example, or gain access to an event – everyday utilities such as these are a likely future of NFTs. Thinking about ways you can apply NFTs to existing industries could take your project to the next level.

You could also leverage NFTs to create something new. What other forms of content haven’t been widely introduced as NFTs? Mini-series, movies, online magazines. Of course, creating professional-quality content isn’t easy. But maybe you have a unique voice, or see problems in these industries that your NFTs could solve.

NFT Aesthetics

You need to choose your NFTs’ aesthetics if they’re in a visual medium. That means choosing the art style, color palette, and themes. You can aim to match current, popular aesthetics used in a lot of NFT collections, or you could get creative with your NFT.

Artnome, FlashArt, and the Museum of Contemporary Digital Art studied the SuperRare marketplace’s huge collection of NFTs. They found these common characteristics:

- The most popular collections often explore futuristic, retro, and sci-fi themes.

- NFTs have a somewhat purple color palette on average, which links to their technostalgia aesthetic.

- 3-D art is viewed more often and sells for higher prices than other NFTs.

- NFTs that are tagged with the word “drawing” underperform.

The NFT community sees NFTs and blockchain technology as the future of the internet, which is reflected in the futuristic, cyberpunk style that many projects adopt. Popular creator Mad Dog Jones’ NFT art is a perfect example of this aesthetic.

On the other hand, you could choose a unique aesthetic for your NFTs.

NFTs are still new, and there are countless characters, themes, topics, and sub-genres they haven’t covered. Think of popular works of fiction in film, TV, literature, and gaming with a style and subject matter that isn’t represented in NFTs. Bringing your own interpretation to these themes might just capture the imagination of buyers.

Tell a Story With Your NFTs

Give your NFT collection a backstory. Great stories can generate hype for NFTs and maintain engagement for several years – an important part of establishing an enthusiastic community. Just look at the continued success of popular movie franchises like Star Wars and James Bond. Fans continue to watch these films for many reasons, one of them being their investment with the characters and storylines.

Use your NFTs’ description box to build a narrative around your project. Your descriptions should tie in with the chosen content and overall theme of your NFTs. They should appeal to your target customer in both details and language.

If you’re creating an NFT collection, you could even give each NFT a unique description. For example, your avatars could have origin stories, personality traits, or special abilities.

Your project’s backstory should ultimately capture the imagination of collectors and make them feel like they’re part of the narrative. Bored Apes are meant to be wealthy Crypto Art collectors who hang out together in a private yacht club. This backstory is designed to make BAYC owners feel like they’re one of these successful apes.

Hire a Creative

Creating the content for your NFT can be fun – if you have the right skills. If you lack the skills to create high-quality content, there are simple solutions.

Quality is essential to the success of NFT collections – no one will want your NFTs if they’re poorly made, no matter how original the idea. Hiring a professional to create the content for your NFTs on a freelance platform like Fiverr gives you instant access to experienced designers, artists, music producers, or videographers to make high-quality content for your NFTs.

Hiring an NFT artist or designer is much the same as hiring any other professional freelancer. Of course, you can’t hire someone to actually mint the NFT on a blockchain. You must connect your own wallet and conduct this final step yourself if you want the transaction to link to your wallet’s address.

You also need to make sure you’re receiving the proper rights should you buy content from a creative. Ownership rights may suffice if you’re selling the artwork as a single, original NFT. However, you need full commercial use of the artwork if you want to make and sell NFT copies as you please. Most freelance creatives hand over commercial rights, but it’s worth checking.

Scarcity Affects the Price of Your NFT

Your NFT’s properties will affect its value, so you need to consider them carefully. Scarcity is one of the biggest factors. You can receive more money per NFT if you mint and sell a single copy. But would you generate more money overall if you created 100 copies of your NFT and sold each one for less? The answer to that question depends, in part, on your NFT and the interest you expect it to generate.

There are some basic guidelines regarding project scarcity to follow when you’re starting out.

Giving people a fair chance to buy your NFT is important – people will lose interest in your project quickly if you only drop a handful of NFTs on your first few releases. You want to create a following, which means you want loads of community members to own your tokens.

You shouldn’t have a situation where loads of people are rushing to get a few available tokens, either. This can lead to scams that capitalize on hype and trick users into buying fake versions of NFTs.

If you want to build a following but you’re still intent on creating exclusive NFTs, there is a happy medium that many creators adopt. Create two or three different NFT designs with a consistent theme to drop at the same time. Then choose a different scarcity for each item. For example, you create 500 copies of Item A, 100 copies of Item B, and 10 copies of Item C. This works particularly well for NFT art collections. It allows many people to own your content while still creating high-value NFTs.

On a side note, it’s a good idea to create scarcity within the characteristics of your NFTs, too, particularly if you’re creating an avatar collection. For example, Alien punks are the rarest CryptoPunks and these generate more interest and value than most other avatars in the collection.

Program Value Into Your NFTs

Programmable features can increase the price of your NFTs by creating a unique selling point (USP) for your project and long-term value for its supporters.

We mentioned CryptoKitties and how their popularity is partly tied to the fact that you can “breed” them to create new NFTs. CryptoKitties was one of the first collections to introduce duplication and this created a unique selling point for the project.

You can program loads of other stuff into NFT smart contracts, such as:

- Unlockable bonus content

- Unlockable NFTs

- Printable physical/digital copies of NFTs

- Unlockable discount codes

- NFT achievements that users can unlock

- Event tickets, raffle tickets, prize draws

Programmable features can differentiate your NFT project from others, while also generating hype for your project by creating value for community members. Bored Ape Yacht Club does an excellent job of this. BAYC regularly drops freebies to Bored Ape owners, including new NFTs and access to BAYC events and parties. Owners can profit by selling free NFTs and they feel part of an exclusive group.

You can program features into your NFTs that incentivize a higher level of engagement with your project. For example, you could program your NFTs to unlock a free rare collectible when the owner purchases a set quantity of your NFTs.

You can even master more creative ways to program your NFTs and generate demand. In the NFT art community, digital artist Pak recently created an NFT collection where the image on each users’ NFT gets larger as they collect more units.

Remember: Gas Fees

You will lose money if your NFTs don’t sell for more ETH than it costs to create them. This means you need to carefully consider the profitability of your idea before you mint NFTs. It costs around $70 to create an NFT on the Ethereum blockchain, depending on the traffic Ethereum is experiencing at that time.

The Most Famous (and Expensive) NFTs

NFTs are just a few years old, and there’s still a lot of controversy surrounding their practicality and environmental impact. But this hasn’t stopped collectors from spending fortunes on them.

Some collections have become extremely desirable to a large portion of the NFT community, while releases from top digital artists routinely spark bidding wars between wealthy collectors. The most popular NFTs are often the most expensive. With that in mind, let’s take a look at prominent NFTs that demonstrate the medium’s earning potential.

Famous NFT Collections

Certain NFT collections have huge fan bases. This may be because they’re part of a popular game or because these NFTs represent an exclusive whose ownership will strike envy in other collectors. Whatever the reason, owners of these NFTs are passionate about each project, and millions of other fans are looking for a chance to buy in.

CryptoPunks

CryptoPunks was an early NFT project. Launched in June 2017 by the Larva Labs Studio, CryptoPunks are uniquely generated 8-bit style avatars, each with its own quirks and characteristics. The avatars portray rebellious punks and are widely regarded as the beginning of the Crypto Art movement.

Originally released for free, CryptoPunks now fetch hefty six-figure sums with a handful of CryptoPunks selling for millions of dollars. Why? CryptoPunks are relatively rare. There are just 10,000 in existence. Coupled with their history and desirability, people are prepared to pay a lot for them, and owning one has become a status symbol in the crypto community.

Bored Ape Yacht Club

Bored Ape Yacht Club is another series of successful NFT avatars. There are 10,000 Bored Apes, each one unique but looking just as disinterested as the next. Like CryptoPunks, each Ape’s attributes were randomly generated.

Again, the desirability and scarcity of Bored Apes mean they are ludicrously expensive. The cheapest apes cost around 52 ether or $210,000.

When you buy an Ape, you gain access to an exclusive club that includes celebrities like Steph Curry and Post Malone. Owners of a Bored Ape Yacht Club NFT are eligible for various perks, such as NFT drops from Mutant Ape Yacht Club and Bored Ape Kennel Club.

Axie Infinity

Axie Infinity is one of the biggest NFT video games available. In the game, players collect little monster characters called axies. Users can battle each other with their axies, breed them to create new axies, and, of course, trade them on the site’s marketplace.

Axie Infinity demonstrates the jaw-dropping earning potential of NFT games. The company reached a trading volume of over $2.5 billion in Q3 2021 and, at the time of this writing, the company is valued at over $6 billion.

Decentraland

Decentraland is an Ethereum-powered metaverse where users can buy virtual real estate, explore the world, and take part in fun games and activities.

Players trade NFTs of virtual land, estates, wearable items, and names on Decentraland. A limited number of virtual plots are available, and all of this trading is done through the game’s website.

The game’s decentralized, user-owned universe is what some consider the future of the internet. NFTs make the metaverse possible (but more on that a little later).

Memers Turned NFT Artists

In February 2021, the original Nyan Cat meme – a GIF showing a cat with a rainbow-colored pop tart for a body – sold for $590,000 on the Foundation marketplace. Speaking after the sale, Christopher Torres (the meme’s creator) told reporters: “I feel like I’ve opened the floodgates.”

Torres’ comment has aged like fine wine. He collaborated with Snoop Dogg two months later to release a Nyan Dog NFT, along with two more NFTs designed especially for the drop, Hazy Nyan Cat and Nyan Blunt. Torres’ second drop raked in a combined $250,000.

For Torres, NFTs are giving meme creators the chance to monetize their content for the first time in their lives. Most members watch hopelessly as their image rights and copyrights are desecrated by millions of internet users. Torres even sued Warner Bros for improper use of his meme in 2013 (which was amicably resolved).

“I didn’t know how to handle things. I had to sit back and watch as people stole my art and used it without asking,” said Torres, speaking to the Guardian.

Torres’ NFT collections have paved the way for similar projects since their release.

Disaster Girl, a meme that featured a little girl looking menacingly into the camera while a building burned behind her, sold as an NFT for a whopping $473,000 (or 180 ether) in April 2021.

The girl pictured is Zoe Roth, who explained she’s felt defined by the Disaster Girl meme while growing up. Roth believes selling the original Disaster Girl was a necessary part of regaining some control over the image: “Maybe agency is the right word,” she commented to Guardian reporters. “I finally had some say in what happened with it.”

These NFT sales are far from isolated incidents. The original Overly Attached Girlfriend meme sold for $411,000 worth of ether in April 2021, and an NFT of the original Charlie Bit My Finger video sold for an eye-watering $760,999 a month later. To top them all, the Doge meme sold as an NFT for $4 million worth of ether in June 2021 to become the most expensive meme NFT yet.

So, NFTs are creating value for meme creators. But why are people buying memes in the first place?

Harry Jones, a 21-year-old investor with a $70,000 collection of NFT memes, explains the extravagant prices:

“It’s about rewarding meme creators,” said Jones, speaking to The Guardian, “these are culturally significant things, for my generation at least … and the people who provided these cool, culturally significant things years ago got no money for it.”

Of course, there’s also an emotional aspect to anything that’s culturally significant. By definition, these items are valuable to entire generations. For an NFT collector, owning a meme’s original file as an NFT is the same as owning a piece of internet history. The cultural value of these items might make them a worthy investment, as long as NFTs stick around.

“I honestly think they are decent investments … as we get older, some of the most collectible assets will be the things that our culture values,” said Jones. “And that is memes.”

Popular NFT Stories

A long list of celebrities have joined the NFT trend, while auction houses have been drumming up some newsworthy stories too. Here are some of the biggest NFT happenings of the last few years.

Celebrities Join the NFT Trend

Some celebrities are unreservedly interested in NFTs, given that NFTs provide plenty of opportunities for artists and popular figures to monetize their fame.

Many celebrities are taking advantage of the excitement surrounding NFTs by releasing collections.

Kings of Leon became the first band to release an album as an NFT, with a $50 version of When You See Yourself in March 2021. Several other artists, including Grimes and Steve Aoki have also released NFTs. NFTs provide artists the chance to cut out the middle-person and retain the rights to their music.

Ashton Kutcher and Mila Kunis are working on a project called “Stoner Cats,” a direct-to-NFT animated TV series about cats that inhale some of their owner’s cannabis. The project is the first of its kind – a digital TV series that you can own. What’s more, the show’s production company says it will commission a decentralized autonomous organization (DAO) to continue the series should its initial 13,420 tokens sell out.

Some celebrities are even launching NFT marketplaces, such as NFL star Tom Brady, who created Autograph. Brady has top executives from the likes of Apple, Spotify, Lionsgate, and DraftKings helping him develop the company.

Other celebrities are avid collectors and collaborators. Snoop Dogg revealed he was @CozomoMedici in late 2021. @CozomoMedici is a previously anonymous NFT whale with a $17 million collection of Ethereum NFTs, including 9 CryptoPunks. Other famous NFT enthusiasts include YouTube personality Jake Paul and NBA star Steph Curry.

Pak’s “The Merge” Displaces Beeple’s $69m NFT

Crypto artist Mike Winkelman, also known as Beeple, sold an NFT artwork at the esteemed Christie’s auction house for a record-breaking $69.3 million in March 2021.

Beeple is the biggest name in NFT art and his artworks command huge prices. Even by Beeple’s standards, $69 million is an absurd amount of money that many thought wouldn’t be topped for a long time.

It took only until early December 2021 for Beeple’s record to be broken. Pak’s “The Merge” sold for $91.8 million on Nifty Gateway to displace Beeple’s “Everydays: the First 5000 Days” as the most expensive NFT. The sale also makes Pak’s NFT the most expensive artwork sold by a living artist.

Interestingly, Pak’s artwork was sold in 266,445 units to nearly 30,000 buyers. These units work like shares. Each collector received an NFT after the sale ended with an image that was sized based on the number of units they purchased. When a collector buys more of The Merge NFTs on the secondary market, they combine with their current units to become a single NFT with a larger image. Conceivably, someone can collect all of these tokens to form one complete NFT.

Pak’s artwork tops the chart as the most expensive NFT of all time. But what other artworks and NFTs have sold for millions of dollars? Check out our list below!

NFT Backlash

There’s also been a fair share of backlash and discontent surrounding NFT projects.

In December 2021, Ubisoft announced it was releasing a handful of in-game cosmetics as NFTs for its latest title in the Ghost Recon franchise. The NFT drop (called Quartz) received a polarized reaction.

Some fans praised the announcement as a significant event – the first NFT project from a major game developer. With in-game content on titles like Decentraland and Axie Infinity costing users hundreds of thousands (if not millions) of dollars, however, many fans of the franchise were reasonably concerned.

Ubisoft’s YouTube announcement received 40,000 dislikes and just 1,600 likes on the platform, and dozens of news headlines bemoaned Ubisoft’s move as detrimental to the future of gaming.

Stalker 2 received an equally visceral reaction when its developers, GSC Game World, announced that users would be able to have their likeness in the game should they purchase an NFT. The studio subsequently canceled its plans to add NFTs following widespread backlash from fans.

For context, numerous blockbuster gaming titles have been monetizing in-game content in recent years, content that was once included in the initial sale price of a game. To a huge portion of gaming fans, NFTs perpetuate an exploitative dynamic rather than create a more immersive gaming experience.

The movie industry has comparable stories. A limited NFT release was planned alongside Legendary Pictures’ sci-fi epic Dune in September 2021. The announcement caused outrage from fans who highlighted the environmental impact of NFTs as a major sticking point. The drop was labeled as hypocritical given the plot of Dune’s original novel, understood by some as an allegory of climate destruction and exploitation.

Real-World Uses of NFT Technology

2021 was a marquee year for non-fungible tokens. Sales by volume of Ethereum-based NFTs increased by over 17,000% in 2021.

We do not know whether NFTs are a sound long-term investment or a bubble waiting to burst. If new uses are found for NFTs and current problems are solved, the medium could have a long life. In the short term, they are a high-risk, high-reward venture.

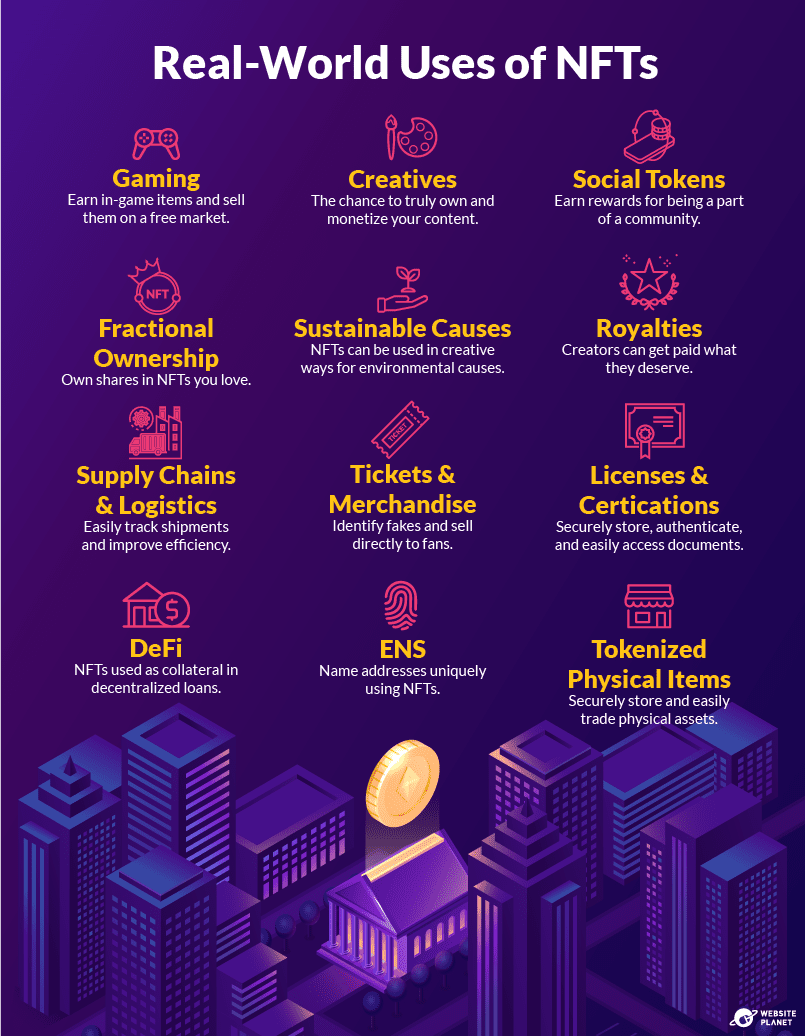

Many crypto experts believe NFTs will move beyond expensive artworks and premium collectibles to encompass everyday applications. So, what real-world uses do we have for NFTs, both now and moving forward?

Smart Contracts