Experts noted that Grayscale may face significant competition from the BlackRock Bitcoin ETF.

Grayscale Investments is Stamford, Connecticut-based digital currency asset management company. This firm is a subsidiary of Digital Currency Group (DCG) founded in 2013. In the last 8 months, DCG faced a huge downfall in its financial position, because of the exposure of its subsidiaries with weak business model-based crypto firms. Grayscale provides investment in Bitcoin, Ethereum, & few other flagship assets via its trust assets.

Recently Bloomberg Intelligence analyst James Seyffar shared his opinion on the potential launch of the BlackRock Bitcoin ETF and noted that it will create a huge impact on the valuation of the Grayscale investment.

In short, people will shift their Inclination toward BlackRock’s Bitcoin ETF, instead of Grayscale’s Bitcoin Trust.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

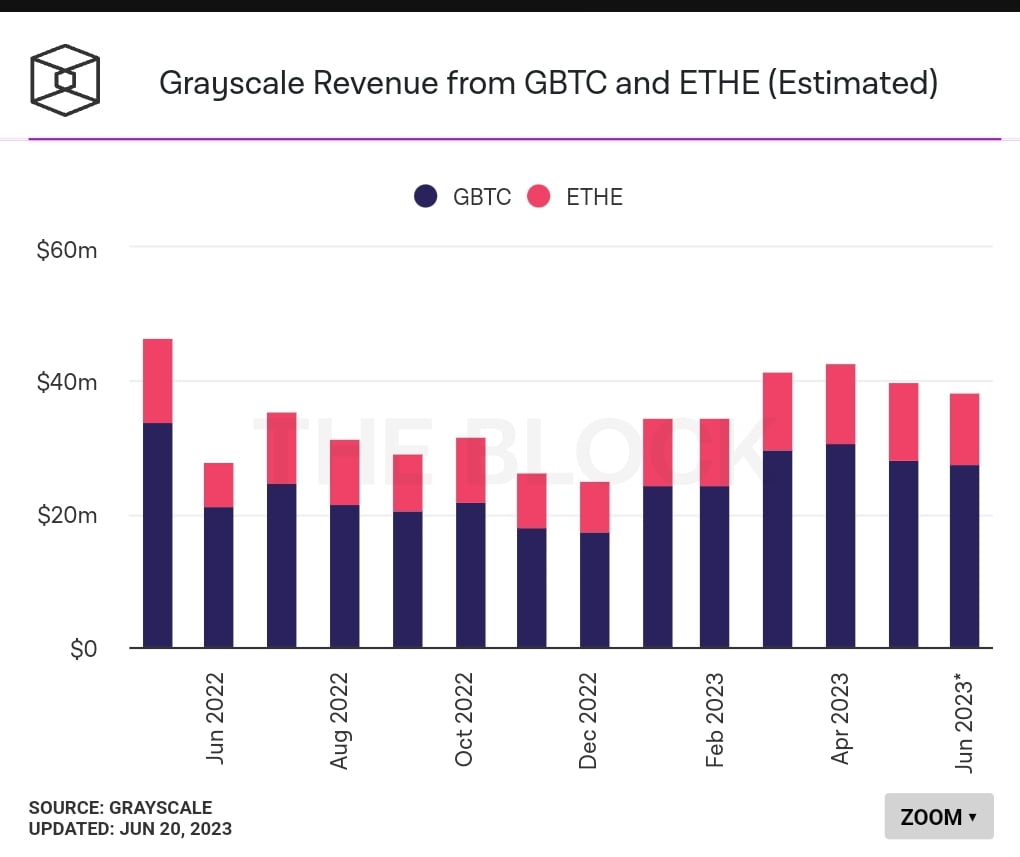

At present, Grayscale Trust manages nearly $16 billion under its crypto assets investment products. And Grayscale’s revenue can be seen in the below graph.

Last week, BlackRock filed for the Bitcoin ETF approval with the United States Securities Exchange Commission (SEC). If the SEC agency will approve BlackRock’s Bitcoin ETF then surely Grayscale will face a big competition & pressure & in that situation, the company will be required to reduce the lower trust charges/fees.

Grayscale Bitcoin ETF vs SEC

Since late 2021, Grayscale has been trying to get approval from the SEC body to swap its Bitcoin trust GBTC to Bitcoin spot ETF but faced rejection.

The Grayscale firm also challenged the SEC’s decision in court & tried to explain that SEC should approve Bitcoin spot ETF applications because the SEC agency already approved risky several Bitcoin futures ETFs, which are more risky over spot ETFs.

In the present time, the majority of the people, including Institutional investors, are looking to invest in Bitcoin, as recently the SEC body sued several crypto exchanges & labelled huge numbers of crypto assets as security crypto tokens, while totally ignored Bitcoin.

Read also: “zkEVM valium” proposal aims to enhance Polygon (Matic) network security

Grayscale’s valuation may face -ve impact after BlackRock ETF launch

https://bitcoinik.com/grayscales-valuation-may-face-ve-impact-after-blackrock-etf-launch/feed/

https://bitcoinik.com/grayscales-valuation-may-face-ve-impact-after-blackrock-etf-launch/feed/