Bitcoin analysts claimed that Bitcoin has better potential to cross the $30k range within the next few weeks, on behalf of two main factors.

The year-to-date (YTD) performance of Bitcoin trade price is net positive but still multiple factors are showing that Bitcoin is ready to show more upward momentum.

The current trade price of Bitcoin is $26,481 & this trade price is 2.5% higher over the last 7 days of trade price.

In June & July of this year, the Bitcoin trade price fluctuated between $26,500 to $31,400 and people were expecting that Bitcoin was ready to hit the $42,000 trade price but nothing like that happened, following some negative news in the US.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

In the past 7 days, the trade price of Bitcoin has fluctuated between $26,400 to $26,700.

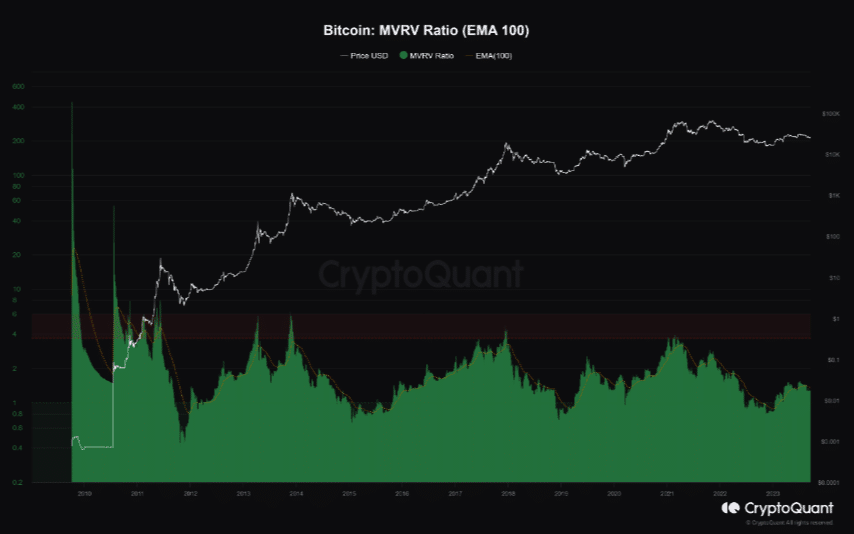

A popular Bitcoin analyst Crazzyblockk, who posts regularly about the market sentiment on CryptoQuant, shared his analysis on the current situation of Bitcoin trade price and dragged attention toward the Market Value to Realized Value (MVRV) ratio, which is above 1.

On behalf of the conclusion, the analyst concluded that “We are still above level 1 of the MVRV Ratio, and based on the Holders’ Cost basis, Realized Cap< Market cap”.

According to Crazzyblockk, this metric does not apply to short-term bitcoin Investors but for mid-term investors, it is showing a good sign, where traders can enjoy the benefits.

This analyst believes that Bitcoin has the potential to hit $30,000 depending on the $27,500 to $29,000 break-even zone.

Furthermore, on behalf of the realised price metric, analyst noted that $29k will be normal for Bitcoin to hit in the short term.

“If we look at the average realized price of these holders or the amount of money they have paid for each bitcoin, the price levels of 27.5k-29k is the break-even area of these holders’ pockets.”

Bitcoin Fear & Greed Index

The current Bitcoin fear & greed index index is 43, which means people are not confident with the current market sentiments. In short, we may consider some more downfall in the trade price of Bitcoin for the short term.

Currently, the majority of the people in the Crypto sector are looking for a better correction in the Bitcoin trade price so that they can buy at a better-discounted trade price, in order to enjoy a better amount of profit in 2024.

In 2024, two main factors, namely the US presidential election & Bitcoin halving, will bring a huge boost in the trade price. After the end of the election, the US will welcome its Bitcoin & crypto-friendly president.

Read also: Jordan Peterson says it’s time to scrap Banks & adopt Bitcoin

Bitcoin may soon hit $30,000 because of this catalytic factor

https://bitcoinik.com/bitcoin-may-soon-hit-30000-because-of-this-catalytic-factor/feed/

https://bitcoinik.com/bitcoin-may-soon-hit-30000-because-of-this-catalytic-factor/feed/