The US Securities regulator raised questions against BlackRock’s decision to use Prime Execution Agent for IBIT product.

BlackRock is the top fund manager in the world and currently, its team is engaged in the Bitcoin spot ETF product iShares Bitcoin Trust ETF (IBIT). According to ETF experts, the United States Securities and Exchange Commission (SEC) may green signal multiple Bitcoin spot ETF products, including IBIT, before 10 Jan 2024.

As we know, BlackRock mentioned Coinbase as custodian in the June filing with the SEC for its Bitcoin spot ETF product but failed to provide any name for its Prime Execution Agent” ( A third-party broker to handle Bitcoin transactions for its ETF funds).

As per reports, the SEC body raised concerns over the potential plan of third-party brokers use. The SEC agency is not fully in support of this approach. However, the SEC body is not in favour of this approach but BlackRock confirmed in its filing that it will go with this mentioned approach.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

According to some ETF experts, the SEC body tried to force the Bitcoin spot ETF applicants to adopt the “Cash Create” method for ETF share creation over the ‘in-kind’ method.

However, the majority of the top ETF experts are still strong with their prediction that the SEC body will approve these applications in January 2024 but some people noted that the Coinbase exchange is already in a conflict with the SEC body and it may create some road bumps in the path of Bitcoin spot ETF applications approval.

In June of this year, the SEC body charges the Coinbase exchange for offering unregistered securities assets and also running an unregistered national securities exchange.

Now it will be interesting to see how the SEC body will handle this matter. Whether the SEC body will force BlackRock to go with another custodian or something else.

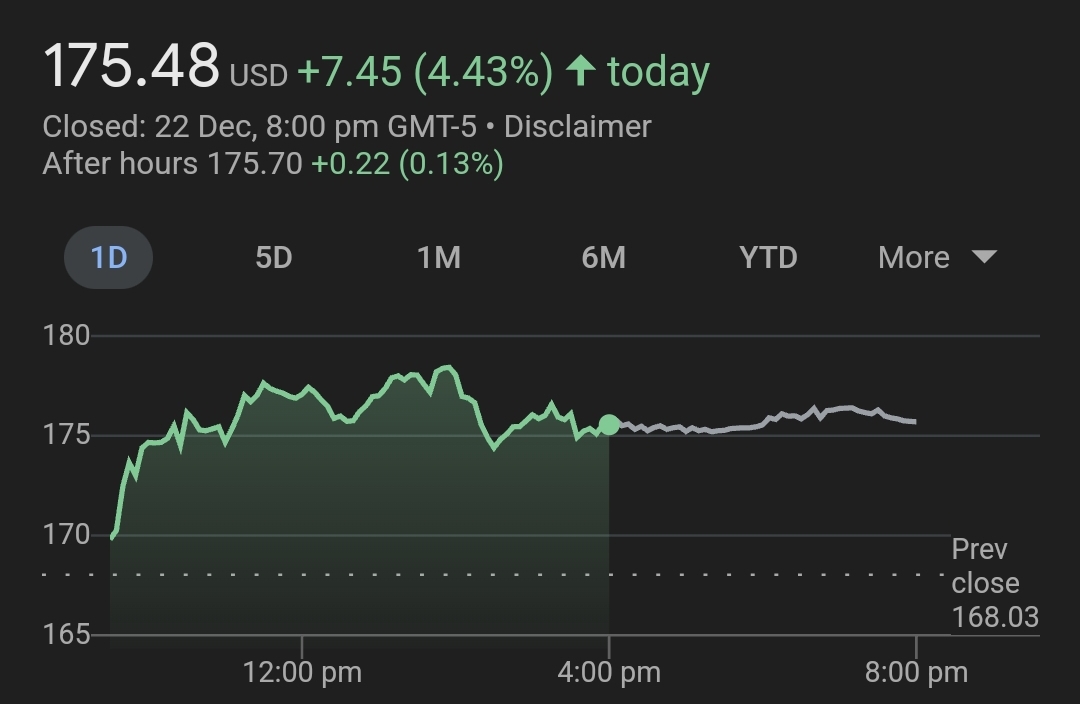

Notably the Coinbase (COIN) stock investors are confident with their investment despite the legal conflict of Coinbase with the SEC body.

The current trade price of COIN stock is 4.5% higher than the last 24 hours’ trade price, thanks to the market conditions & Coinbase’s strong & healthy approach in the legal fight against the SEC body.

Read also: Ethereum co-founder responds to Messari vs Cardano (ADA) controversy

Coinbase vs SEC legal conflict may prohibit Bitcoin spot ETF approval

https://bitcoinik.com/coinbase-vs-sec-legal-conflict-may-prohibit-bitcoin-spot-etf-approval/feed/

https://bitcoinik.com/coinbase-vs-sec-legal-conflict-may-prohibit-bitcoin-spot-etf-approval/feed/