The past few years have marked a period of constant changes for the crypto industry. Whether we’re talking about dramatic falls, crashes, scams, the Bitcoin halving, the Merge, or the approval of BTC and ETH ETFs, so many things have happened, and each one has affected the market one way or another. While the market […]

The post How Did the Crypto Market Perform in Q2 2024? Insights from CoinGecko’s Report appeared first on Coindoo.

The past few years have marked a period of constant changes for the crypto industry. Whether we’re talking about dramatic falls, crashes, scams, the Bitcoin halving, the Merge, or the approval of BTC and ETH ETFs, so many things have happened, and each one has affected the market one way or another.

While the market is still recovering and is going through a period of consolidation after the Bitcoin halving, it still managed to close Q2 of 2024 with a market cap of $2.43 trillion. Indeed, the market cap dropped 14.4% compared to Q1 2024, but it’s trying its best to grow or at least maintain its level.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

Q2 2024 was full of such significant events and changes, and CoinGecko gathered all the data and insights in an extensive report sponsored by BingX.

Bobby Ong, COO and co-founder of CoinGecko, described the 2nd quarter of 2024 pretty well in one of his statements, saying, “The crypto market entered a period of post-Bitcoin halving consolidation amid mixed developments in Q2, with token airdrops, in particular, coming under scrutiny. While the outlook for the second half of 2024 is murkier, we see positive signs, including improving macroeconomic conditions and teams continuing to build regardless of prices.”

Thus, let’s discuss the Q2 2024 crypto industry report by CoinGecko.

Top Insights

- Bitcoin experienced a new halving and a 21.6% fall in trading volume

- The total crypto market cap dropped by 14.4%

- The Bitcoin mining hash rate hit a new ATH

- CEX spot trading volume was down by 12.2%

- DEX spot trading volume increased by 15.7%

- Meme coins were the top crypto narrative

- Ethereum became inflationary, adding 120,000 ETH to the circulating supply

1. Bitcoin, the ATH, and the Halving

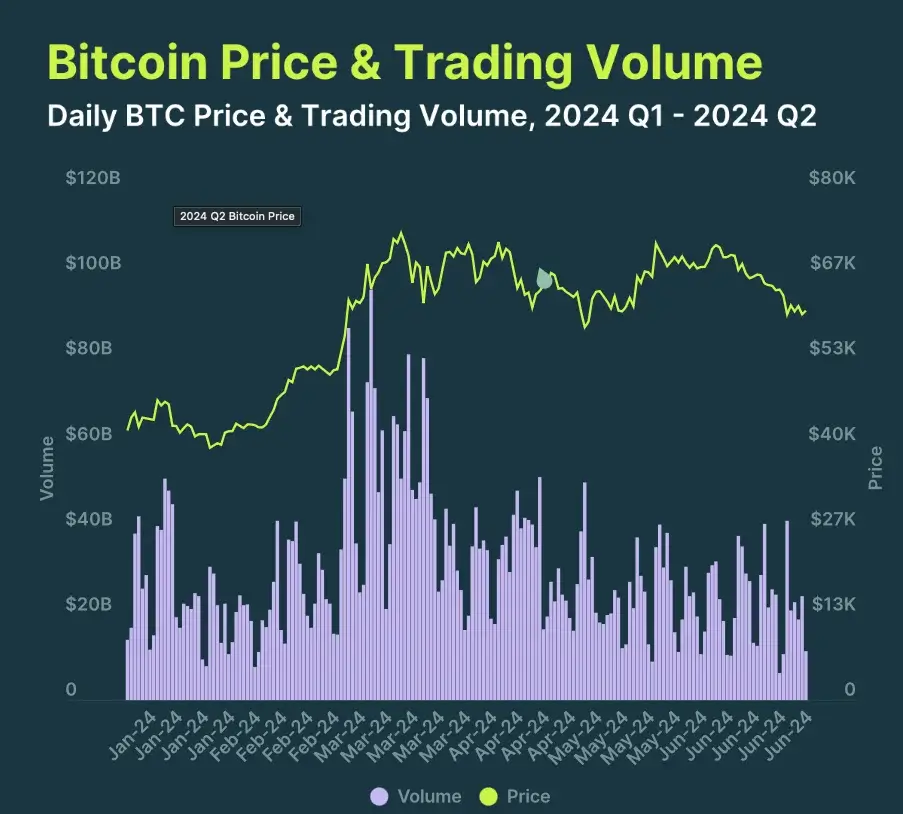

We all know that Bitcoin hit a new all-time high in Q1 2024, reaching $73,098 in mid-March. Since then, it oscillated between approximately $58,000 and $72,000.

Bitcoin’s price was highly affected by a long-awaited event in the industry – the Bitcoin halving. The 4th Bitcoin halving cut the block reward by 50% again, the reward now standing at 3.125 BTC.

While the cryptocurrency reached its new ATH in March, after the halving, which occurred on April 20, 2024, it dropped in price, reaching approximately $58,000. This was totally expected, as Bitcoin usually experiences a period of consolidation after a new halving, and it’s highly possible that it is still experiencing it.

Bitcoin’s trading volume was not left aside, as it declined throughout Q2 2024 until it reached a daily average of $26.6 billion. This is a 21.6% decrease compared to the previous quarter.

Another significant event that affected was the recent update that Mt Gox, a popular Bitcoin exchange, started moving part of its BTC holdings (approximately 140,000 BTC). The exchange moved the funds to its cold wallet and some unknown addresses, and the total amount of BTC shifted, reaching $9 billion. Furthermore, the German government also started selling its BTC holdings in immense stashes.

2. The Evolution of the Total Crypto Market Cap

The crypto market cap experienced big changes during Q2 2024, too. Part of its evolution came as a result of new launches and approvals for various trading products, such as BTC and ETH exchange-traded funds (ETFs).

On the other hand, the total crypto market cap was also affected by the Bitcoin halving and the consolidation period that followed, as well as various events related to the crypto industry and certain projects.

According to CoinGecko’s report, compared to Q1 2024, the total crypto market cap dropped by 14.4% ($408.8 billion) in Q2 2024, reaching $2.43 trillion by the end of June. During Q2 2024, the market cap oscillated between $2.30 trillion and $2.90 trillion, but it did not reach new all-time highs.

In the meantime, the S&P 500 did not let Q2 2024 go to waste. The investment product ended the quarter up by 3.9%. This way, the correlation between the total crypto market cap and the S&P 500 reached 0.16 in Q2, from 0.84 in Q1 2024.

3. A New All-Time High for Bitcoin Mining Hash Rate

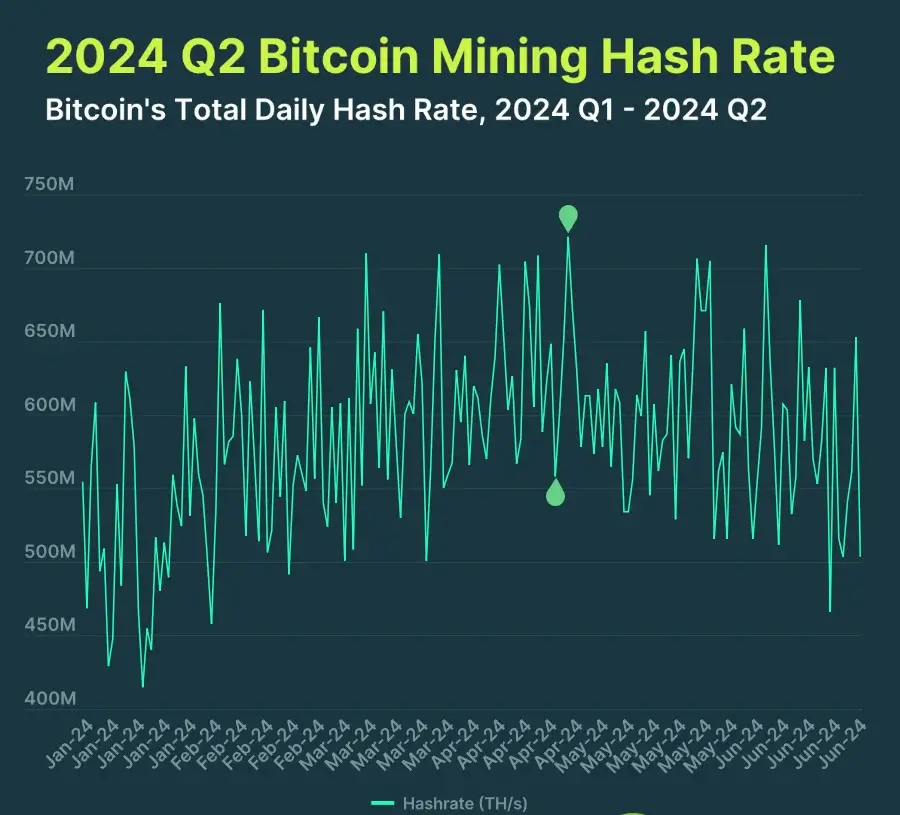

As expected, the Bitcoin mining hash rate experienced an increase, reaching a new ATH (All-Time High) of 721 million TH/s on April 23, 2024. However, the mining hash rate fell by 18.8% overall in Q2 2024, thus becoming the first down quarter for Bitcoin’s hash rate since Q2 2022.

However, the pretty considerable fall of the Bitcoin mining hash rate did not scare big companies such as BitDigital, Terawulf, Core Scientific, Hive, or Hut 8. Such significant industry players started to expand into AI or at least considered it by taking the first step in developing related products or features.

Furthermore, Tether, one of the most popular crypto companies, announced a $500 million investment into the mining sector, while Block finished the development of its 3nm mining chip, thus setting new standards in the industry.

4. Spot Trading Volume on CEXs Was Down by 12.2%

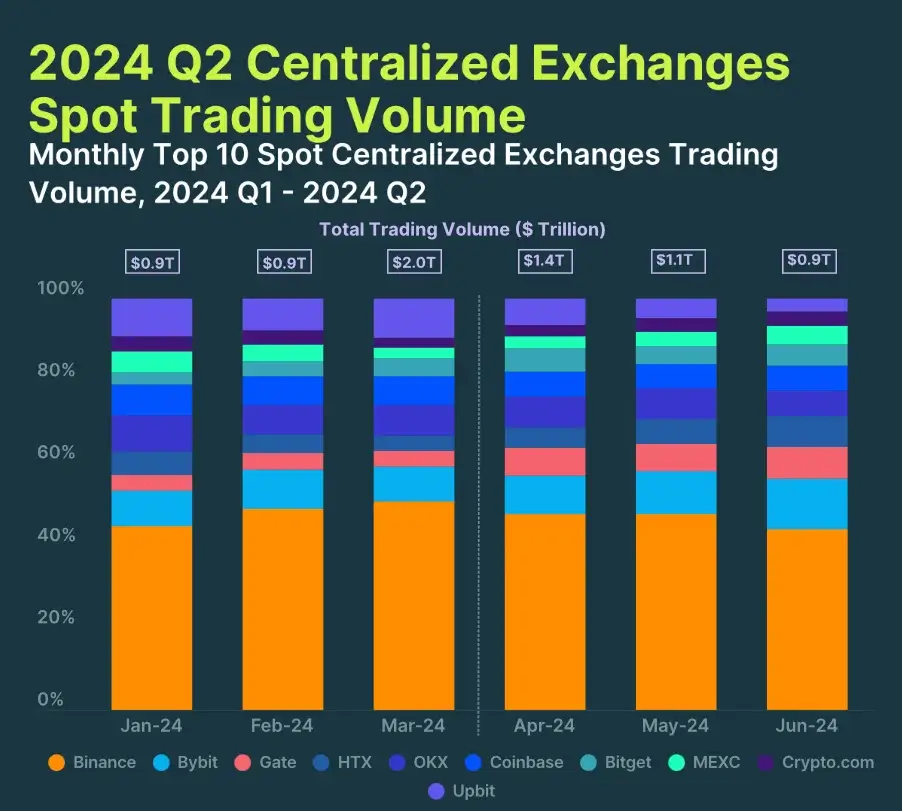

Spot trading and centralized exchanges remain the top choices for most crypto traders, being the most accessible overall. However, as popular as they might be, the centralized exchange spot trading volume reached only $3.40 trillion, dropping 12.2% compared to Q1 2024.

The analysis was made on the top 10 centralized exchanges which, at the moment, include Binance, Bybit, Gate.io, HTX (formerly Huobi Global), OKX, Coinbase, Bitgate, MEXC, Crypto.com, and Upbit.

According to CoinGecko’s findings, Binance remains the largest exchange by trading volume, ending Q2 2024 with a market share of 45%, despite various events involving the company and its executives. Binance was followed by Bybit, which increased its market share to 12.6% in June 2024.

5. Decentralized Exchanges Were Up by 15.7%

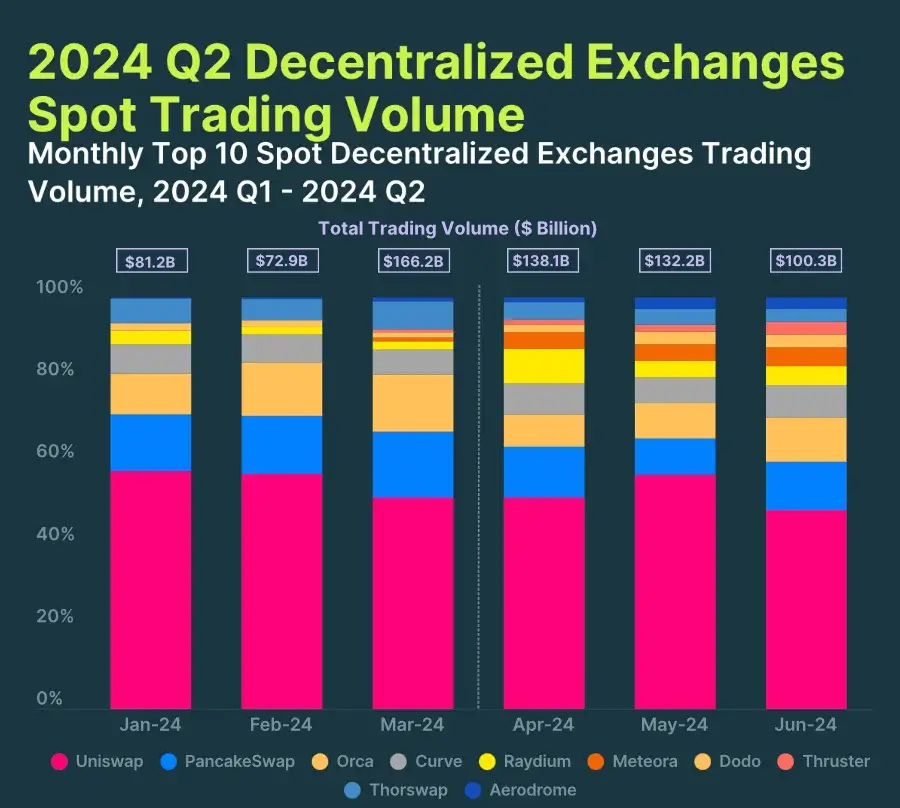

Despite their rather lower spot trading volume, DEXs (Decentralized Exchanges) managed to increase their volume by 15.7% QoQ (Quarter-on-Quarter). The top performers in the sector were Uniswap, PancakeSwap, Orca, Curve, Raydium, Meteora, Dodo, Thruster, Thorswap, and Aerodrome. Together, the 10 DEXs recorded $370.7 billion in spot trading volume.

As expected, Uniswap maintained its place as the top decentralized exchange, having a 48% market share by the end of June 2024. Another surprising evolution in the sector was made by Thruster, which increased its volume by 464.4% ($6 billion) QoQ. This way, Thruster had the largest gain in Q2 2024.

But what factor led to such an increase in DEX spot trading volume?

6. Meme Coins’ Popularity Reached New Heights

If you have been part of the crypto community for at least half a year, you surely have seen the evolution meme coins experienced in the past months. With numerous new meme-themed tokens and an increase in market cap for established ones, meme coins have been a key topic since the beginning of 2024.

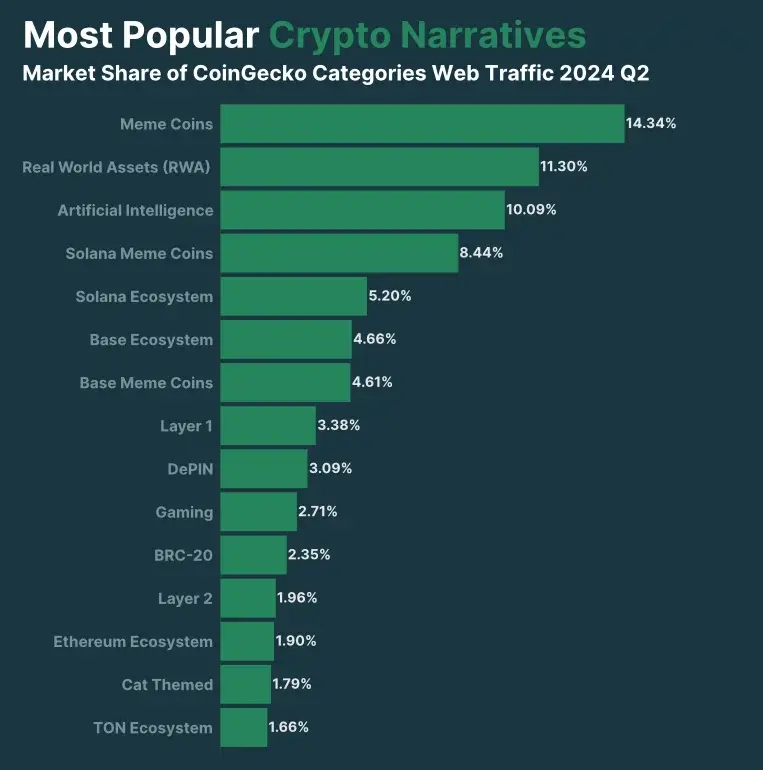

In Q2 2024, meme coins were the most popular narrative, 4 of the 15 most popular crypto narratives being meme coin-related, with a total market share of 29.18%.

Real World Assets (RWA) and Artificial Intelligence (AI) followed meme coins at the top, with market shares of 11.30% and 10.09%, respectively.

7. Ethereum Became Inflationary

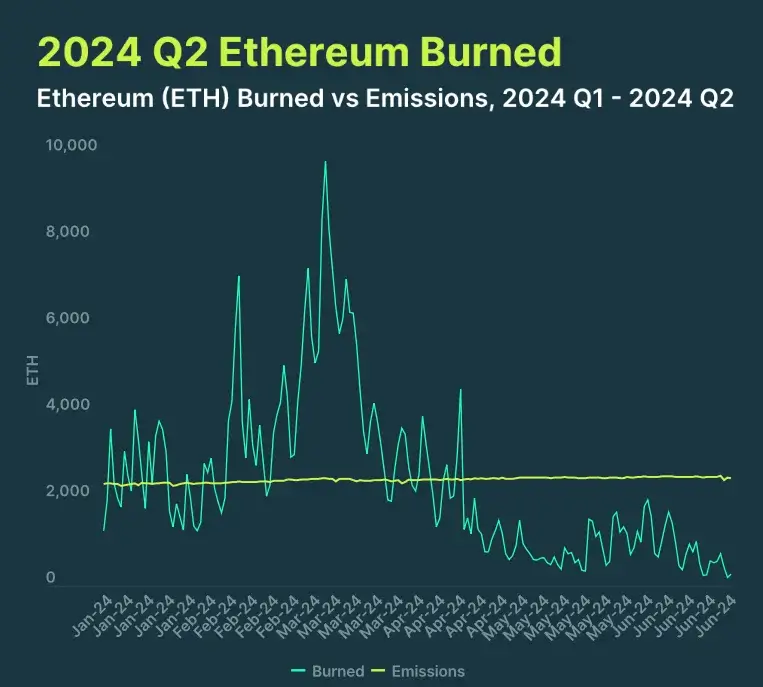

Ethereum (ETH), the 2nd cryptocurrency by market cap, burned 107,725 tokens in Q2 2024. On the other hand, there were 228,543 ETH emitted, thus making the network inflationary. Comparing the burnt and emitted amounts, there were 120,818 ETH added to the circulating supply.

The burn rate for ETH fell 66.7% compared to Q1 2024 as a result of the slowing of network activity and the reduction of gas fees.

In total, Q2 ended with only 7 days in which ETH burns exceeded emissions. As a comparison, Q1 had 66 days when this happened.

8. The DeFi Market Cap Decreased by 20.7%

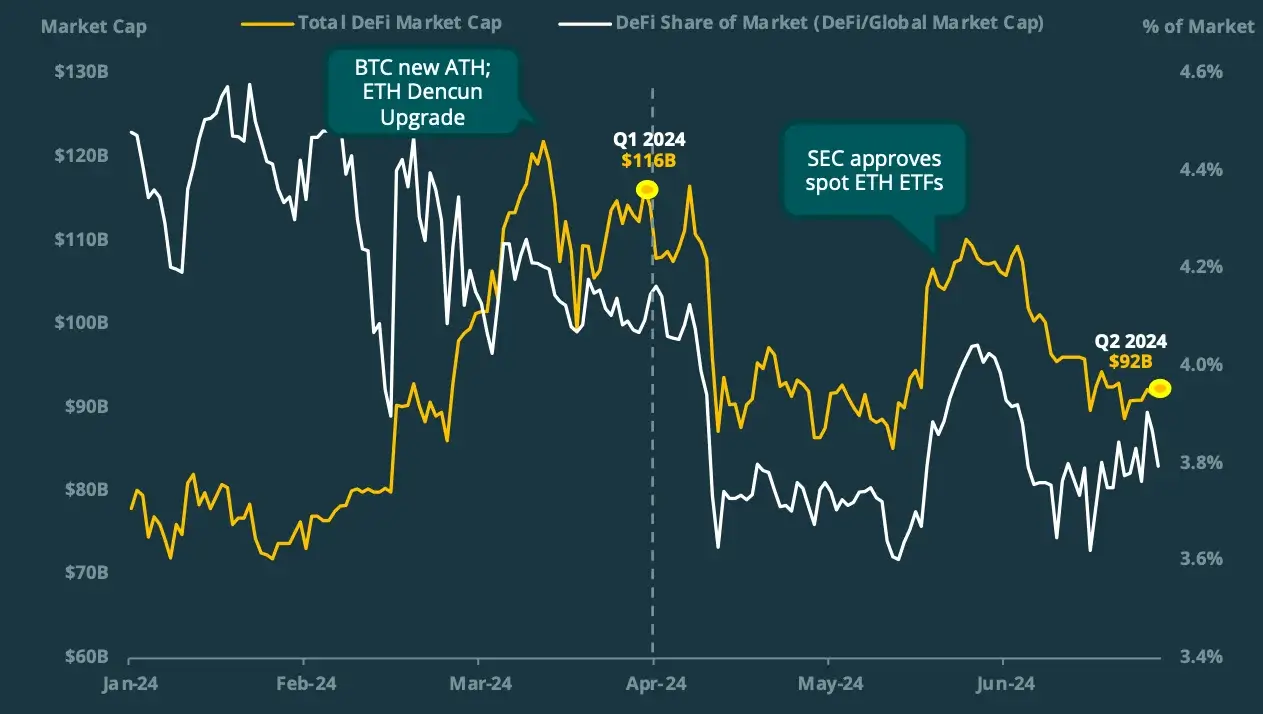

Overall, the DeFi sector was not as affected as others during Q2 2024, but it still experienced some changes resulting from the approval of spot ETH ETFs and other such significant events.

Shortly after the Bitcoin halving, the DeFi market experienced a slight decrease in market cap, but it managed to recover. Still, after BTC fell below $70,000, the DeFi market cap dropped by 25%, from $116 billion to $87 billion.

Fortunately, after the US SEC approved spot ETH ETFs, the DeFi sector was pushed back above $100 billion, as the news acted as a catalyst for repricing Ethereum.

9. NFTs Were the Most Affected Digital Assets

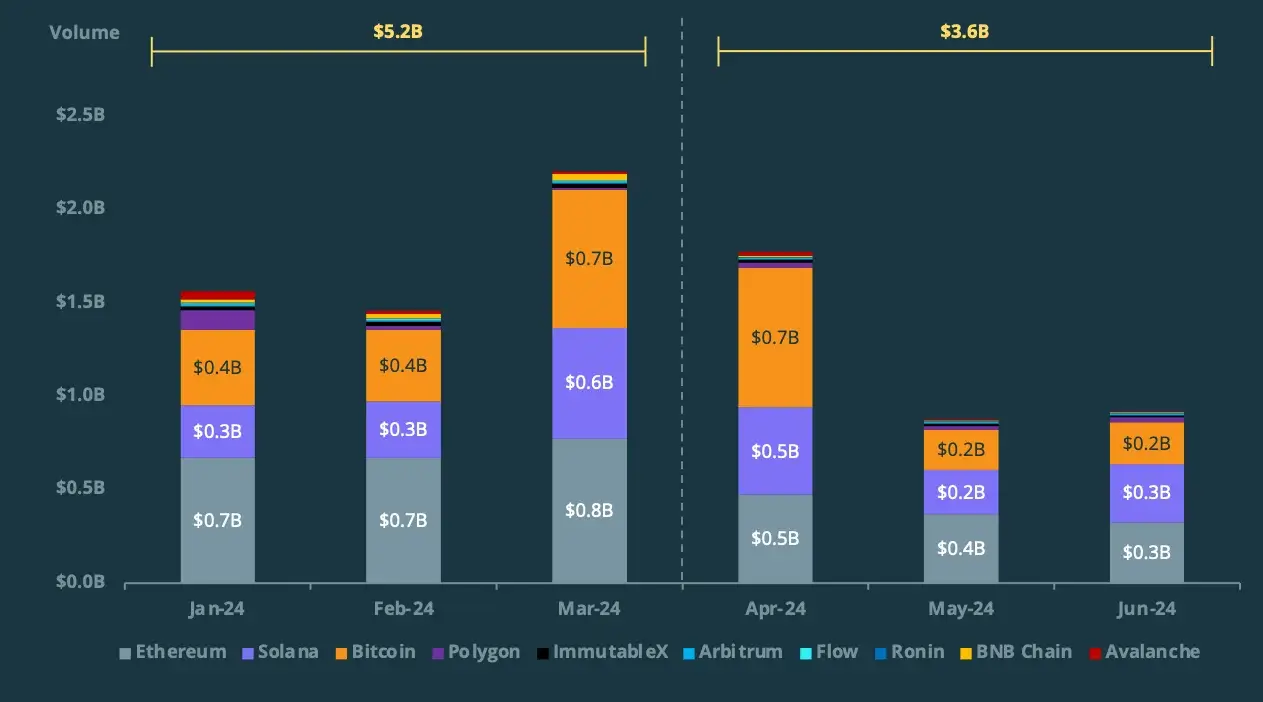

As we all have probably noticed, NFTs’ popularity decreased significantly. According to CoinGecko’s Q2 2024 crypto report, the NFT trading volume decreased by 31.8% QoQ, from $5.2 billion to $3.6 billion. The platform analyzed the top 10 networks: Ethereum, Solana, Bitcoin, Polygon, ImmutableX, Arbitrum, Flow, Ronin, BNB Chain, and Avalanche.

Ethereum still holds the place as the most popular chain for trading non-fungible tokens, having a trading volume of 32.7%. Solana started to grow more and more, especially at the end of Q1 and the beginning of Q2, recording over $1 billion in the past quarter.

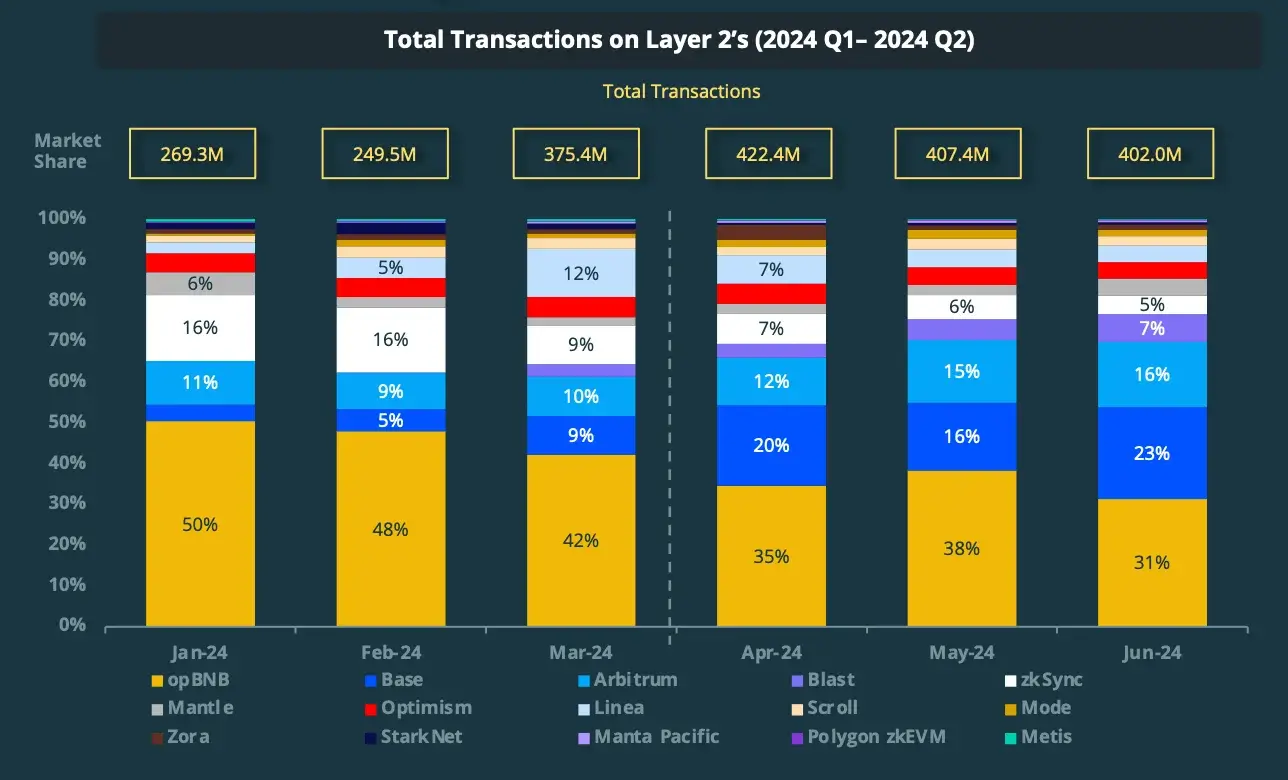

10. Layer 2 Adoption Increased by 37.7% QoQ

Layer 2 (L2) transactions reached 1.23 billion in Q2 2024, according to CoinGecko’s insights. The top L2 networks were opBNB, Base, Arbitrum, Blast, and zkSync, with opBNB being the top player, contributing with 34.8% of all L2 transactions.

Arbitrum was overtook by Base in what concerns onchain activity, but both networks increased significantly when it comes to the number of transactions. Meanwhile, zkSync dropped 37.8% QoQ, shortly after its airdrop was distributed on June 17.

Final Thoughts

The 2nd quarter of 2024 was marked by many significant events in the crypto industry, the most important probably being the Bitcoin halving and the surprise approval of Ethereum exchange-traded funds (ETFs).

With the crypto market passing a period of consolidation after the Bitcoin halving, crypt prices and trading volumes experienced slight decreases, but it seems that the market conditions slowly return to their normal levels, thus increasing the positive sentiment in the industry.

The post How Did the Crypto Market Perform in Q2 2024? Insights from CoinGecko’s Report appeared first on Coindoo.