If you’re new to the crypto space, you have encountered the term market cap or market capitalization, right? And you most probably heard that in November 2021, the total cryptocurrency market capitalization reached over $3 trillion—but what does it mean, and how does it impact investors and traders? There’s no need to panic, as market […]

The post What is Market Cap in Crypto? appeared first on Coindoo.

If you’re new to the crypto space, you have encountered the term market cap or market capitalization, right? And you most probably heard that in November 2021, the total cryptocurrency market capitalization reached over $3 trillion—but what does it mean, and how does it impact investors and traders?

There’s no need to panic, as market cap is a simple concept that discusses how big digital currencies are or one particular crypto. Therefore, we will discuss anything you need to know about market capitalization, how it is calculated, the top 10 biggest cryptos by market cap, and other additional details.

Let’s jump in!

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

Table of contents

What is Crypto Market Cap?

By definition, crypto market cap or capitalization is an important metric used in crypto markets to determine the total dollar value of a particular cryptocurrency or all digital currencies.

To calculate market cap, you must multiply the current price of a cryptocurrency by its total circulating supply, also known as the amount of the asset currently held in users’ wallets.

Therefore, analyzing the market cap helps you grasp the size and importance of crypto within the market. It also enables you to make informed decisions and assess other coins’ growth potential.

Cryptocurrency’s Market Cap Categories

Large Cap Cryptocurrencies

Large-cap cryptocurrencies include Bitcoin and Ethereum since they have a market cap of $1.33 trillion and $423.26 billion as of July 2024.

Therefore, many investors consider higher market caps a low-risk profile and investment since they have a proven track record of higher liquidity, stability, and growth potential.

Mid Cap Cryptocurrencies

Mid-cap cryptocurrencies have values between $1 and $10 billion, presenting a growth potential but with higher risks. As such, there’s room for more investors, yet they should research mid-caps before investing mindlessly.

Small Cap Cryptocurrencies

Small-cap cryptocurrencies have a market cap of less than $1 billion, and they are the riskiest currencies since they are still in the shadows. However, small caps could soar if the market sentiment turns in their favor.

For example, in 2021, Fantom had a market cap of $72,000, but as many investors took a leap of faith, Fantom now has a market cap of $1.41 billion.

Top 10 Cryptos by Market Caps

- Bitcoin (BTC): $1,315,133,586,569;

- Ethereum (ETH): $419,830,394,460;

- Tether (USDT): $114,253,038,202;

- BNB (BNB): $85,100,379,517;

- Solana (SOL): $82,009,209,663;

- USD Coin (USDC): $34,082,303,375;

- XRP (XRP): $33,403,631,522;

- Dogecoin (DOGE): $19,521,795,962;

- Toncoin (TON): $17,410,910,879;

- Cardano (ADA): $15,214,396,717;

Why Is Crypto Market Cap Important?

Opinions differ about the importance of the crypto market cap. Some say that the market cap leads to a higher risk profile, fear, greed, and market sentiment, while others advocate for its power within the market dynamics.

However, the middle way could be this: the cryptocurrency market cap offers an objective view of the crypto market’s performance, away from marketing tactics and social media endorsements that lead to market manipulation.

Another aspect that can impact market cap is a currency’s adoption level, as widely accepted currencies are used in different industries and also have higher trust levels.

Therefore, the market cap can help you make informed investment decisions while diversifying your assets within the cryptocurrency space. Still, they don’t reflect the same accuracy as seen in the stock market.

Also, the market cap isn’t the sole determinant of a cryptocurrency’s potential for growth, and negative news and regulatory overviews could significantly impact the market cap. In contrast, positive news can increase investors’ confidence and market cap. S

So, perform thorough research before making any investment decisions, as these factors could artificially inflate or deflate the crypto market cap.

The Crypto Market Cap and Volume Bond

As we know, market cap indicates a currency’s market value, while trading volume shows the activity level, meaning the buying and selling and liquidity within the cryptocurrency market.

As such, a high trading volume means an increased interest in a particular asset, while a low trading volume means a lack of interest. Simple, right?

As you can see, market caps must be considered in relation to trading volume. Aiming for a high market cap with a high trading volume is best to ensure long-term success, but it is also essential to consider market volatility.

Calculating Market Cap with Ease

Calculating the market cap is straightforward. You must multiply the current price of a cryptocurrency by its total circulating supply, also known as the amount of the asset currently held in the user’s wallet. So, the formula is:

Market Cap = Coin Price x Circulating Supply

The current price can be found on different exchanges, while the total circulating supply should always be available on the project’s website.

Let’s take a practical example.

For example, if Bitcoin’s market cap is worth $67,498 and its circulating supply is 19.73 million, then its market cap is $1.33 trillion.

However, it is essential to understand that the market cap might vary depending on the data’s source since different exchanges might have different crypto prices. Also, some coins could have a maximum number, meaning the total circulating supply will not increase over time.

In Bitcoin’s case, the maximum supply is 21 million, meaning its market cap is limited, only rising if the price increases.

What Is the Total Market Cap?

The total market cap in crypto represents the total market value of all the cryptocurrencies available through the market data. Therefore, you can have a real-time picture of how the entire crypto assets market performs.

Another important metric of the total market cap is the total supply, as altcoins have a limited supply, like Bitcoin, which has 21 million coins. However, other altcoins could have a much bigger total supply, like the XRP, with 1 billion.

Moreover, coins with a larger total supply are usually less pricey since scarcity is a critical factor in a cryptocurrency’s total value. Therefore, when analyzing your crypto portfolio, it is best to rely on the market cap rather than the price of each digital asset.

Then, there’s the circulating supply, also known as the fully diluted supply, which means all the cryptocurrencies available to the public.

Best Tools to Track Crypto Market Caps

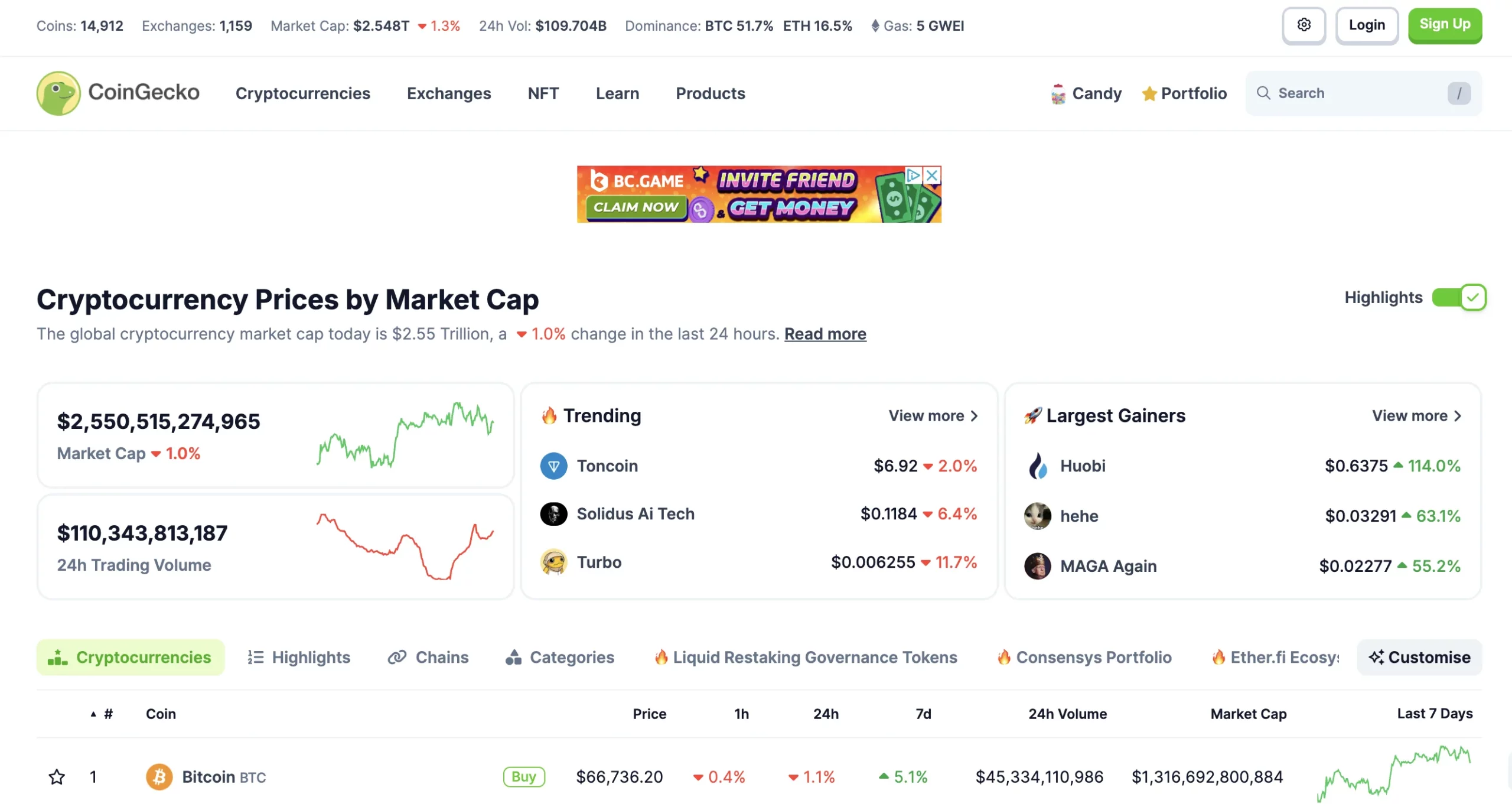

1. CoinGeko

CoinGecko is considered one of the best crypto analysis tools. It offers a detailed overview of digital currencies and is often used to gain a deeper understanding of market dynamics and volatility.

You can use CoinGeko to perform an in-depth search on cryptocurrencies, crypto exchanges, NFTs, while learning more through their insights, news, crypto reports, podcasts and others.

2. CoinMarketCap

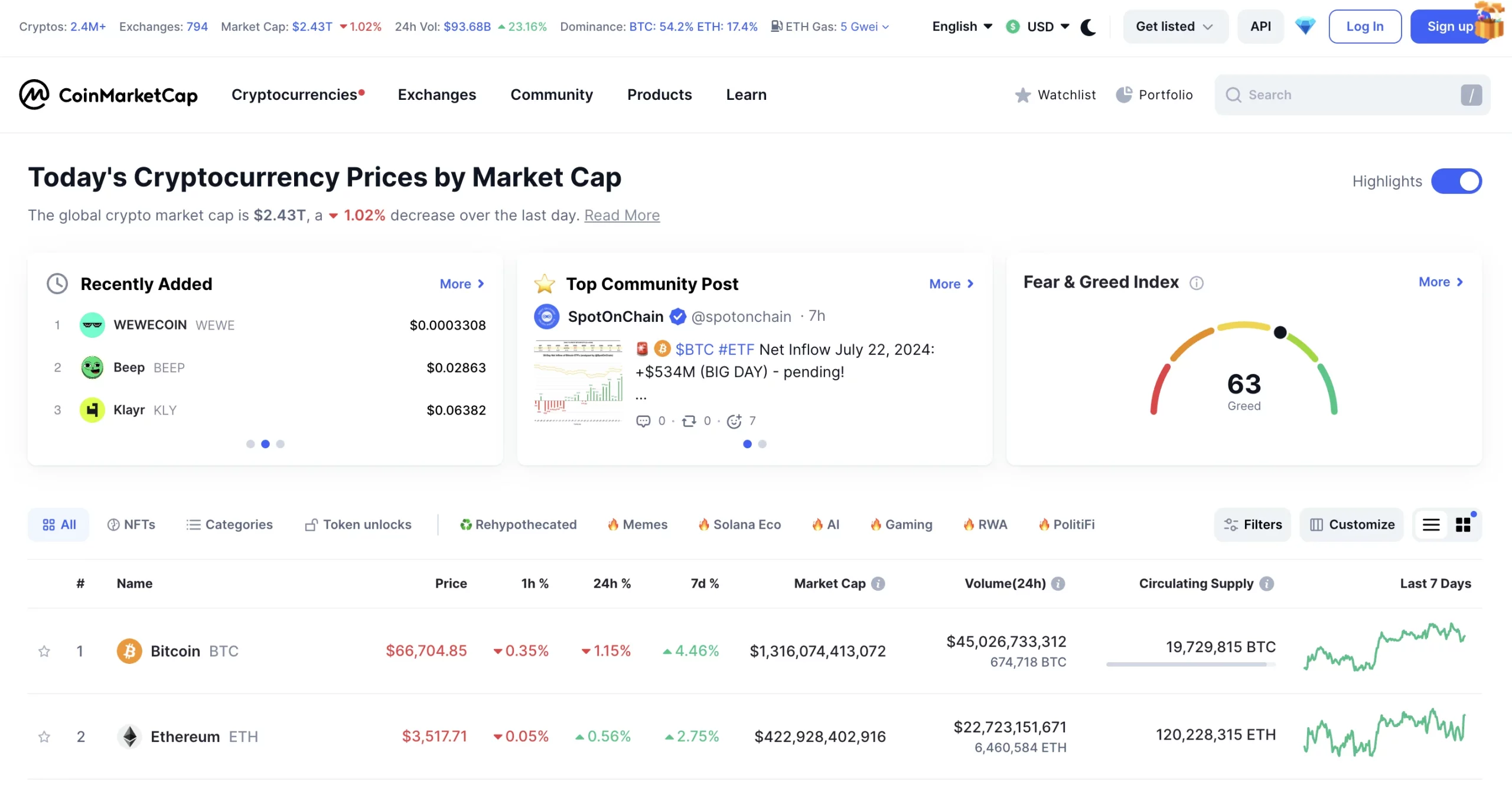

Did you know that CoinMarketCap was the first to popularize using a coin’s market cap to rank crypto assets?

Therefore, CoinMarketCap is the most trusted and accurate source for crypto market capitalization, crypto pricing, and other highly relevant information on a global level.

3. CryptoCompare

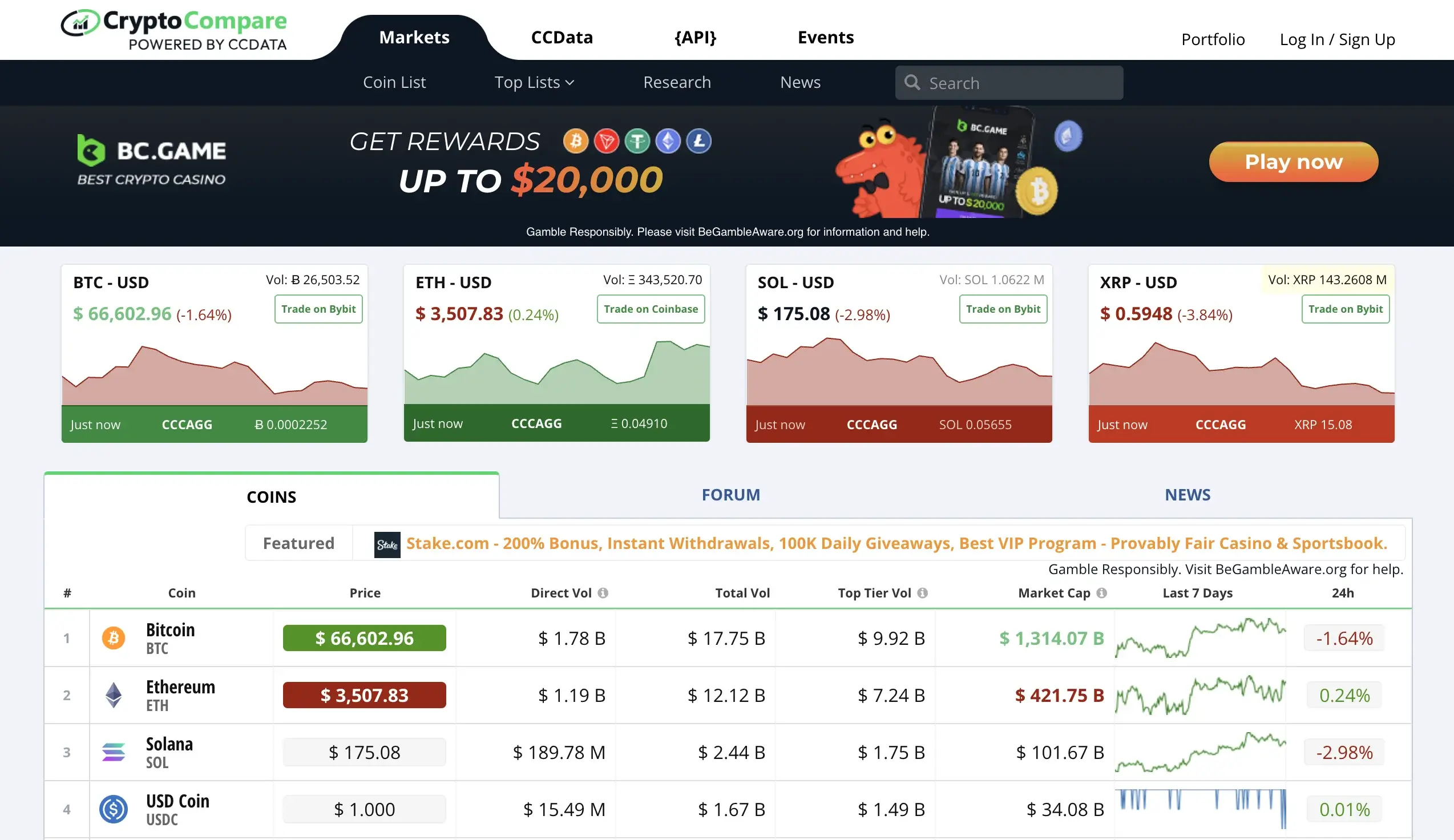

CryptoCompare is one of the top providers of crypto market data, research, and analysis, offering transparent details for all crypto investors and traders.

Moreover, CryptoCompare offer detailed reviews on crypto exchanges, and monitors the market on multiple standpoints such as geographical, and other anomalies.

Market Cap FAQs

What is the current crypto market cap?

The total market capitalization is $2.42T as of July 23, 2024.

Why is crypto market cap important?

The crypto market capitalization offers an objective overview of the crypto market performance, away from marketing tactics and social media endorsement that leads to market manipulation.

What is the highest crypto market cap ever?

The total market cap reached its all-time high of $3 trillion in November 2021.

How is Market Cap calculated?

Market cap is calculated based on the following formula:

Market Cap = Coin Price x Circulating Supply.

Final Thoughts on What is Market Cap in Crypto

In conclusion, understanding market cap is a crucial first step for navigating the often complex world of cryptocurrency investments. By considering market cap alongside other factors like trading volume, you can make informed decisions about your crypto portfolio. Remember, thorough research is essential, and the market cap is just one piece of the puzzle.

The post What is Market Cap in Crypto? appeared first on Coindoo.