Another week has passed, the Bitcoin price is slowly recovering, going back to its new ATH from a few months ago, and the crypto industry keeps on offering us so much to talk about. While last week the spotlight was on Solana, Cardano, Goldman Sachs, the not-so-surprising growth of a Trump memecoin, and other topics, […]

The post The Latest Crypto News You Might Have Missed – July 15-21 appeared first on Coindoo.

Another week has passed, the Bitcoin price is slowly recovering, going back to its new ATH from a few months ago, and the crypto industry keeps on offering us so much to talk about.

While last week the spotlight was on Solana, Cardano, Goldman Sachs, the not-so-surprising growth of a Trump memecoin, and other topics, this week comes with yet so many intriguing events that simply need to be analyzed.

So, let’s see what happened last week in crypto.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

Table of contents

Top Crypto News

The latest cryptocurrency news focus on the SEC and BlackRock, with some big announcements and milestones that will surely influence the market’s evolution.

1. BlackRock Reached $10.6 Trillion in AUM

Summary

BlackRock’s success reached new heights, with the company raising $10.65 trillion by the end of Q2 2024.

Details

BlackRock, the largest asset manager in the market, reached a new milestone at the end of Q2 2024, its AUM (Assets Under Management) level surpassing $10 trillion. The company registered a 13% increase from 2023, reaching $10.65 trillion in AUM.

According to a report published by the company, BlackRock’s EPS (Earnings per Share) increased from $9.06 to $9.99. Quarterly total revenue rose to $4.81, an 8% increase, and net income reached $1.50 billion.

Source: CryptoPotato

2. The SEC Approved ETH ETFs for Trading on NYSE Arca

Summary

The United States SEC approved Grayscale’s and ProShares’ ETH ETFs for trading on NYSE’s Arca electronic trading platform.

Details

The US Securities and Exchange Commission (SEC) approved two spot-ETH ETFs (Exchange-Traded Funds) for listing on the New York Stock Exchange’s Arca electronic trading platform. The big announcement was made through a filing and multiple press releases on July 17, 2024.

The approval of the Form 19b-4 filing allows NYSE to facilitate trading of the Grayscale Ethereum Minin Trust and ProShares Ethereum ETF. However, the issuers must still wait for the final comments on the products’ S-1 filings before they are actually listed and made available to investors.

Source: Cointelegraph

Regulation

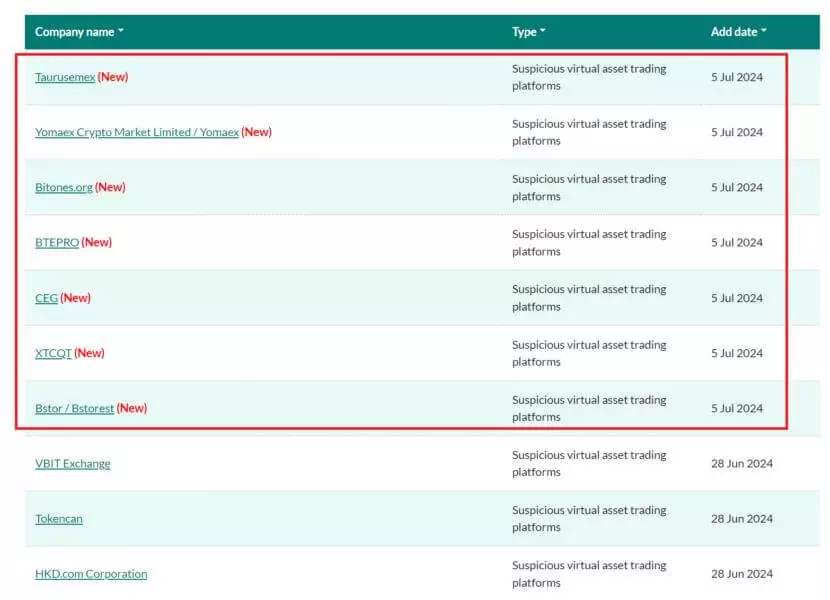

3. Hong Kong Flagged 7 Unregulated Exchanges for Noncompliance

Summary

The Hong Kong Securities and Futures Commission flagged 7 new crypto exchanges that were operating without the required licenses.

Details

The Securities and Futures Commission of Hong Kong (SFC) issued alerts against 7 crypto exchanges after learning that they operate illegally in the region. The platforms do not hold jurisdictional operational licenses.

The Hong Kong SFC introduced the 7 exchanges in the alert list, which has been updated since January 2020. At the moment, the list includes 39 entities, with the newest ones being Taurusemex, Yomaex, Bitones.org, BTEPRO, CEG, XTCQT, and Bstorest. According to the institution, the alerts were issued to keep Hong Kong-based users and not only as safe as possible.

Source: Cointelegraph

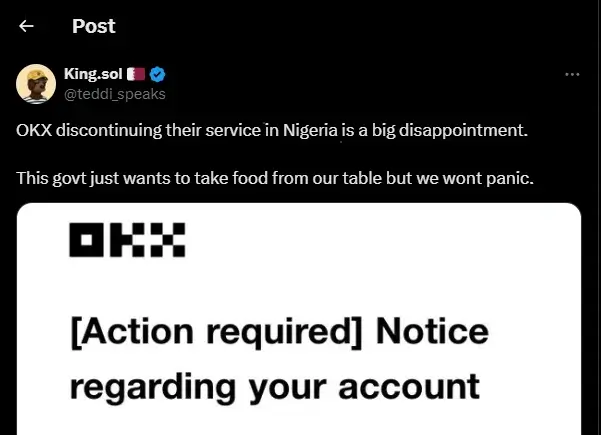

4. OKX Exits Nigeria Due to Regulatory Concerns

Summary

OKX crypto exchange announced it will exit the Nigerian market due to various crackdowns organized by local authorities.

Details

OKX, a prominent crypto exchange, announced that it will exit the Nigerian market after a thorough analysis of the jurisdiction’s regulations. The project has set August 16, 2024, as the date until which users can finish their activity on the platform. After August 16, they will only be able to withdraw their funds and close their positions.

OKX’s decision results from various crackdowns organized by Nigerian authorities. However, the exchange’s decision did not come out of the blue; the platform suspended transactions in Naira at the beginning of 2024 for similar reasons.

Source: The Crypto Times

DeFi

5. BNB Chain Launched L2 Testnet Powered by Optimism

Summary

Binance’s BNB Chain launched the testnet for opBNB, a new layer-2 network developed by leveraging the Optimism OP Stack.

Details

Binance’s layer-1 blockchain, BNB Chain, introduced a new layer-2 chain that aims to address the scalability issue Binance sometimes faces. The layer-2 chain is called opBNB and is currently in its testnet phase.

OpBNB was developed with the help of the Optimism OP Stack, which, according to Binance’s team, will bring a surprising level of security and increased scalability to the main Binance network. The layer-2 network is compatible with EVM (Ethereum Virtual Machine), allowing it to work with smart contracts and ERC-20 tokens.

Source: Cointelegraph

6. Polygon Launched Upgraded ZK Proving System Plonky3

Summary

Polygon Labs, one of the top blockchain development firms in the crypto industry, announced the launch of a new verification system called Plonky3.

Details

Polygon Labs announced the launch of a new open-source technology that aims to improve transaction speed and security for Polygon users. The new zero-knowledge proof system will be called Plonky3 and is considered to be “the next generation of ZK verification systems, super fast and with a modular predisposition.”

Plonky3 will help blockchain developers and crypto enthusiasts in general. It will allow them to launch their own zkVM or zkEVM-type blockchain by leveraging the system’s open-source code.

Source: The Cryptonomist

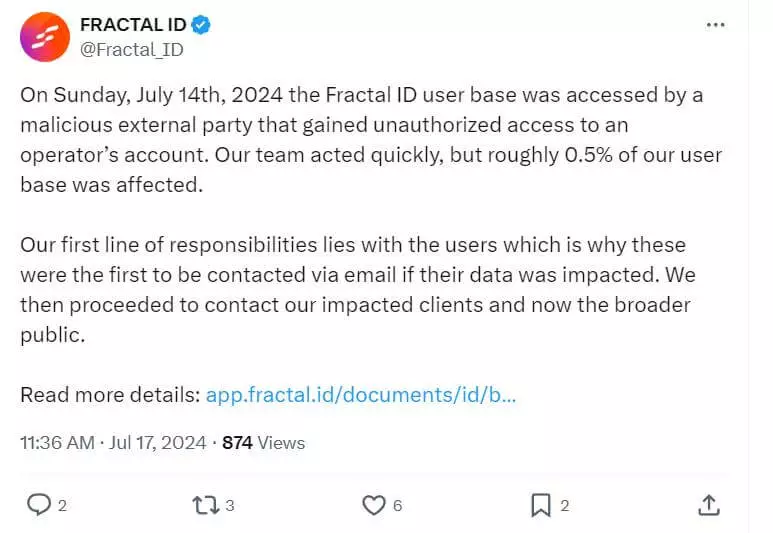

7. Fractal ID Suffered a Data Breach

Summary

Fractal ID was affected by a data breach, which allowed hackers to access the personal data of approximately 50,000 users.

Details

Web 3 KYC provider Fractal ID has reported a data breach that took place on Sunday, July 14, 2024. The data breach affected approximately 50,000 Fractal ID users, 5% of the company’s user base.

According to a notice offered by Fractal ID, one of the company’s engineers detected a potential data breach in one of its systems. An unauthorized entity gained access to an operator’s account and ran an API script that offered them access to users’ data.

The data accessed includes information from Fractal ID users’ profiles, such as names, email addresses, wallet addresses, phone numbers, physical addresses, images, or pictures of uploaded documents.

The Fractal ID data breach raised concerns among Web3, blockchain, and crypto enthusiasts, making them ask themselves whether interacting with this industry is actually as safe as some consider.

Source: Blockonomi

Markets

8. Grayscale Launched a Decentralized AI Fund

Summary

Asset manager Grayscale Investments announced the launch of the Grayscale Decentralized AI Fund, an investment product that will offer investors the opportunity to interact with AI crypto protocols.

Details

Grayscale, one of the largest asset managers, announced the launch of the new Grayscale Decentralized AI Fund, an investment product that aims to offer accredited investors access to protocols that combine blockchain technology and AI (Artificial Intelligence).

The Grayscale Decentralized AI Fund will focus on AI crypto protocols, including, at the moment, Near Protocol (NEAR) at 32.99%, Filecoin (FIL) at 30.59%, Render (RNDR) at 24.86%, Livepeer (LPT) at 8.64%, and Bittensor (TAO) at 2.92%. The fund will be rebalanced quarterly.

Source: Decrypt

The post The Latest Crypto News You Might Have Missed – July 15-21 appeared first on Coindoo.