With another week passing, here we are again, ready to dive into the top events that shaped the evolution of the crypto industry last week. While last week we talked about a new milestone for BlackRock, the approval of ETH ETFs, new launches in the DeFi sector, and various regulation problems, this week comes with […]

The post The Latest Crypto News You Might Have Missed – July 22-28 appeared first on Coindoo.

With another week passing, here we are again, ready to dive into the top events that shaped the evolution of the crypto industry last week. While last week we talked about a new milestone for BlackRock, the approval of ETH ETFs, new launches in the DeFi sector, and various regulation problems, this week comes with so many new topics that simply need to be discussed.

So, let’s see what happened last week in crypto and discuss the latest cryptocurrency news.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

Table of contents

Top Cryptocurrency News

1. Spot Ethereum ETFs Started Trading on the US Market

Summary

Spot Ethereum ETFs were approved by the SEC and started trading on July 23 in the US.

Details

The first Ethereum exchange-traded funds (ETFs) started trading on Tuesday, July 23, 2024, at 9:30 AM EST. The US Securities and Exchange Commission approved the S-1 filings, thus allowing eight issuers to list their ETH ETFs.

Among the 8 ETFs listed on July 23, users will notice Grayscale Ethereum Mini Trust (NYSE: ETH), Grayscale Ethereum Trust (NYSE: ETHE), Franklin Ethereum ETF (CBOE EZET), VanEck Ethereum ETF (CBOE: ETHV), Bitwise Ethereum ETF (NYSE: ETHW), 21Shares Core Ethereum ETF (CBOE: CETH), Fidelity Ethereum Fund (CBOE: FETH), iShare Ethereum Trust (NASDAQ: ETHA), Invesco Galaxy Ethereum ETF (CBOE: QETH).

Source: The Block

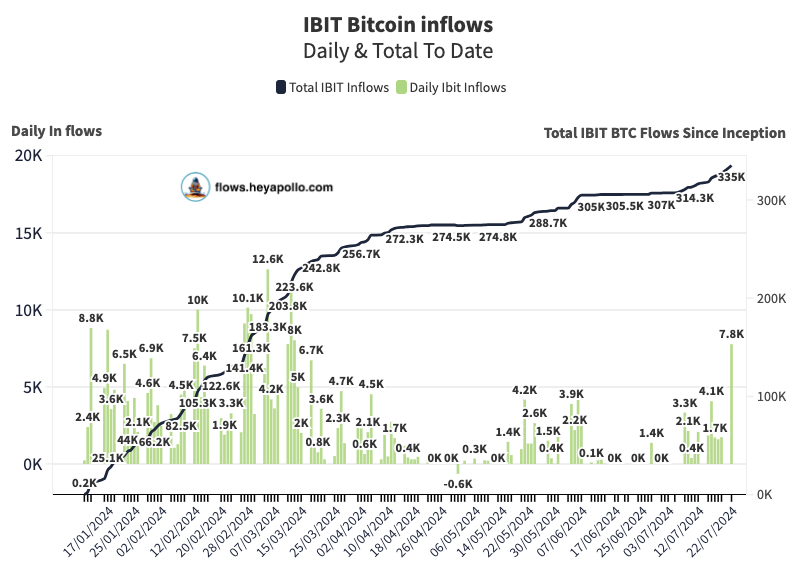

2. The BlackRock Bitcoin ETF Recorded the Biggest Inflow Since March

Summary

BlackRock’s BTC ETF reached a new milestone on July 22, when it had daily inflows of $523 million.

Details

BlackRock’s Bitcoin spot exchange-traded fund (ETF) experienced its biggest number of daily inflows in over four months. The iShares Bitcoin Trust ETF (IBIT) recorded approximately $523 million entering the fund on Monday, July 22, 2024.

After this successful day, the IBIT Bitcoin ETF reached 333,000 assets under management (AUM), reaching approximately $22 billion in total.

Source: Cointelegraph

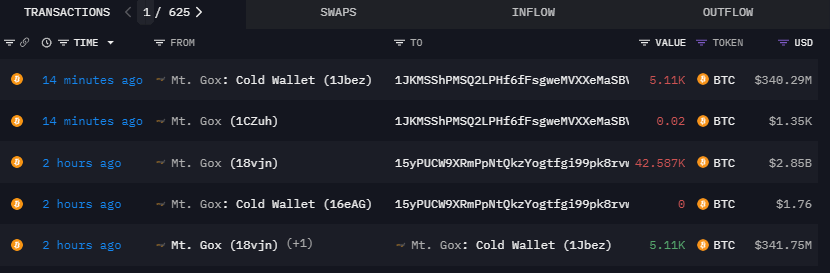

3. Mt. Gox Registered $3.2 Billion in Outflows in Two Hours

Summary

Mt. Gox sent $3.2 billion worth of Bitcoin to two unknown addresses as part of its process of repaying its creditors.

Details

On July 23, 2024, Mt. Gox moved over 47,500 BTC tokens (worth approximately $3.2 billion according to the Bitcoin price at that time) to two unknown addresses at 5:05 AM and 6:27 AM, respectively. On July 5, the defunct exchange stated that it would start repaying its creditors, and since then, its accounts have experienced many transactions, some of them having as destinations unknown addresses.

With the $3.2 billion in BTC sent to the two recent addresses, the total of funds offloaded to creditors since July 16 reached $12 billion.

Source: FX Street

Top Crypto News – Markets

4. Nansen Launched an Ether ETF Analytics Dashboard

Summary

Blockchain analytics provider Nansen introduced a free ETH ETF analytics dashboard that will help investors deal with the newly launched Ethereum exchange-traded funds.

Details

Nansen, one of the top blockchain analytics providers, recently launched the first-ever ETH ETF analytics dashboard. Investors and crypto enthusiasts will be able to monitor the new ETH ETFs through a free dashboard that gives traders a real-time summary of important data regarding the Ethereum exchange-traded funds.

Alex Svanevik, the CEO of Nansen, mentioned that the new dashboard will help investors by offering them the tools and analysis needed to navigate the newly approved Ether ETFs effectively.

Source: The Crypto Times

Top Crypto News – DeFi

5. Gate.io Will Wind Down Services for Japan-based Customers

Summary

Gate.io announced it will shut down its operations in Japan due to “compliance requests” from the jurisdiction.

Details

Gate.io, one of the most popular exchanges in the market, announced that it will shut down services for Japanese customers. The crypto exchange’s July 22 announcement mentioned some “compliance requests” from the country’s financial regulator. According to the project, the affected customers will be assisted in migrating their assets.

As of July 22, Gate.io suspended the opening of new accounts for customers based in Japan and will continue to shut down other features.

Source: Cointelegraph

6. Vitalik Buterin Introduced Circle STARKs for Blockchain Efficiency

Summary

Vitalik Buterin announced the launch of a new protocol that aims to increase security and efficiency.

Details

Vitalik Buterin, the co-founder of Ethereum, introduced a new cryptographic protocol called Circle STARKs, aiming to increase blockchain security and efficiency. Circle STARKs will leverage smaller fields in cryptography, increasing speed and reducing computational costs without compromising the network’s security.

Source: CryptoNews

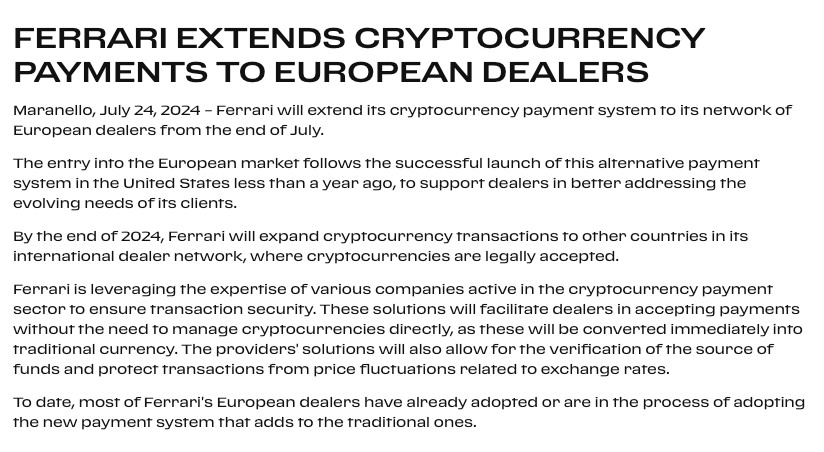

7. Ferrari Will Launch Crypto Payments in Europe

Summary

Ferrari announced that it would extend its crypto payment services to Europe after seeing success in the US.

Details

Italian luxury sports car manufacturer Ferrari recently announced that it plans to introduce its cryptocurrency payment system in Europe by the end of July. The company also stated that it aims to add new crypto transaction options to its global dealership by the end of 2024.

According to an official press release shared on July 24, 2024, Ferrari will consult with numerous crypto-payment entities to increase transaction security and enable dealers to accept payments without handling the digital assets themselves.

Source: CryptoPotato

8. BitFlyer Acquired FTX Japan

Summary

BitFlyer acquired FTX Japan and plans on extending its offerings in the area and not only, reaching the launch of spot ETFs, too.

Details

BitFlyer, a prominent Japanese crypto exchange, announced that it acquired FTX Japan, thus making it a subsidiary and part of its plan to extend its services and enter the spot ETF world. Starting on August 26, FTX Japan will be rebranded under BitFlyer Holdings.

According to a statement made by BitFlyer, the crypto exchange aims to expand in Japan and focus on offering Japanese crypto enthusiasts advanced services and platforms to help them in their crypto-related activities.

Source: Cryptopolitan

The post The Latest Crypto News You Might Have Missed – July 22-28 appeared first on Coindoo.