A new hypothetical stock launched by Standard Chartered is known as “Mag 7B” on March 26, 2025, and the “Magnificent 7” index is well known as a modified version. The main and important change in this version is the “removal of Tesla (TSLA) and addition of Bitcoin (BTC)”, and the bank believes that risk and return are aligned more closely with technology stocks.

The Magnificent 7 is linked with the seven most powerful U.S. tech companies:-

1. Tesla (TSLA)

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

2. Apple (AAPL)

3. Meta (META)

4. Alphabet (GOOGL)

5. Amazon (AMZN)

6. Nvidia (NVDA)

7. Microsoft (MSFT)

However, “Tesla is replaced by Bitcoin” in Standard Chartered’s Mag 7B, it is noticed that Bitcoin is becoming more connected with the tech sector, as it has been acting as a protection against inflation.

“If it [bitcoin] were included, it would mean more institutional buying, as the asset can serve different investor purposes,” Kendrick noted.

Standard Chartered Replaces Tesla With Bitcoin

The main aim of changing “Tesla for Bitcoin” was dependent on the given important financial key and market observations:-

1. Growth of Bitcoin with Tech Stocks:-

According to a report, Nasdaq-listed technology stocks are showing a strong bond with Bitcoin, looking like a fast-growth comparison to a traditional commodity. According to the result, this category fits with the innovators, Magnificent 7 defines that there are high returns on investments.

2. Lower Volatility and Higher Performance:-

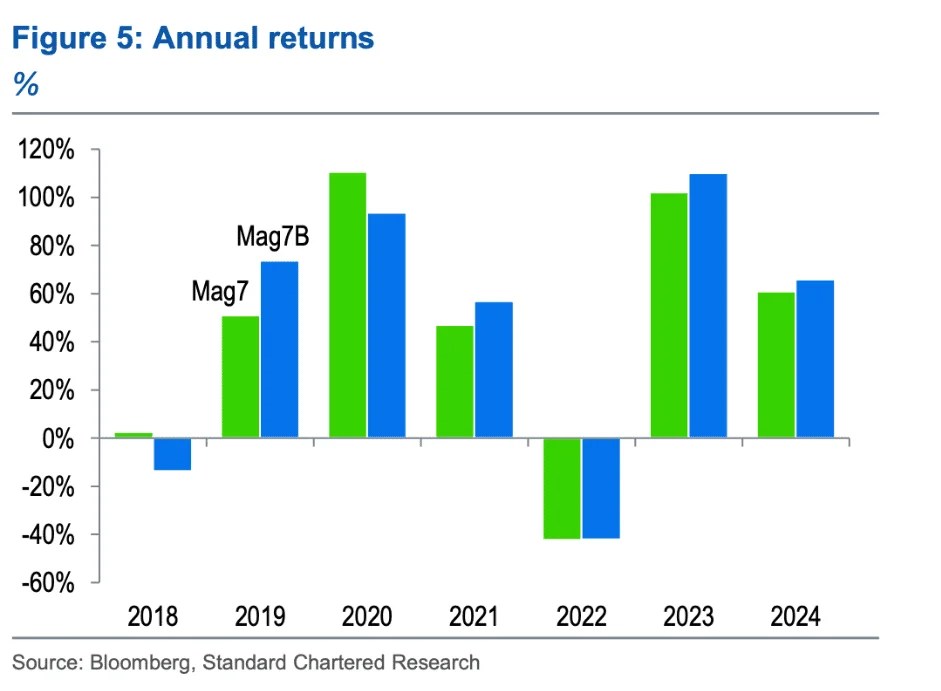

According to Standard Chartered reports, If we compare with the original Magnificent 7 since December 2017, this comparison states that there is a clear result in a 5% increase in returns and 2% lower volatility in replacing Tesla with Bitcoin. This clearly shows that Bitcoin has higher potential compared to Tesla, and Bitcoin has contributed a good, stable,e, higher-yielding portfolio.

3. Tesla Volatility and Slowing Growth:-

According to the reports, Tesla is facing a lot of troubles due to the high competition in the electric Vehicle (EV) sector; the main problems are slowing sales, price cuts and global economic conditions, which are mainly affecting its stocks. It clearly shows that the company’s stock performance has decreased, and for its tech-heavy index, the leading Standard Chartered gives alternative solutions.

Main Impact of This Decision on Tesla’s Stock Price

Tesla’s Stocks are not directly impacted by the removal of Tesla from the hypothetical Mag 7B because they have a Trump or key player in the real-world Magnificent 7 index. The main problem is that it could signal a potential change in investors’ minds or sentiment, providing some negative consequences:-

1. Short-Term Tesla Stock Decline:

– If institutional investors are thinking seriously about this, then there is a high chance that there is a decrease faced by in Tesla’s growth stocks; it is also possible they want to sell off and face a short-term price decrease.

– Some people have large funds, and big traders are thinking that they want to invest in Bitcoin or other tech stocks instead of their Tesla holdings.

2. Long-Term Market Impact on Tesla:-

– Tesla is a strong company in the EV market, but at present, there are more competitive companies like Rivian, BYD, and traditional automakers that are continuously investing in Electric Vehicles.

– According to reports, if the Tesla company failed to continue its marketing in the EV Industry, then most investors would shift their investments to AI, Semiconductors, and other crypto assets linked stocks.

Conclusion: Will Tesla Crash Due to This?

According to reports No Tesla’s Stock will not crash because of this single decision, but Tesla faces a lot of problems due to this temporary volatility.