Categorically speaking, when someone says that beware of slippage while using DeFi, the intent is to caution about a sudden change in prices due to a change in liquidity. For a new user, it might be offsetting since imagine, if you have bid for 100 USDT at 100 USD. But less liquidity during trade meant you got USDT at a much higher price.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

That would lead to an estimated $10 loss on your trade. The question to ask as a result is how to overcome this lag? VVS Finance is a protocol that has simplified trading, swapping, staking, and earning yields; hence the name Very Very Simple Finance.

What is VVS Finance?

VVS Finance, as an AMM protocol built on top of the Cronos chain, simplifies trading in DeFi assets with marginal network fees through its native VVS token. Users can bypass high fees while using VVS tokens. At the same time, they can even enter specific liquidity pools.

VVS Finance through its native token allows access to various liquidity pools for staking and exploring the Initial GEM Offering or IGO program. The IGO program is a trading battle event where users can participate and walk away with grand prizes.

How VVS Finance Eliminates Slippage Problems?

Generally, slippage occurs when the market is extremely volatile and liquidity is very low. VVS Finance counters the same through quick swaps where users can swap across multiple liquidity pools by paying a nominal 0.3% in trading fees. On top of this, there are other rewards as well in the form of CRC-20 pool tokens awarded to LP holders.

These tokens can be staked in the yield farms of the VVS DEX. So through the process of quick incentivization after every second for holding the tokens, liquidity providers are always balancing the liquidity across diverse liquidity pools to manage extreme price volatility; hence eliminating the scenario of slippage.

VVS Finance New Road Map for 2022?

2021 was the year filled with excitement where VVS Finance penetrated the market through collaborations, funding, NFT launch, TVLs, community building, and finally the Christmas Event putting the year to a decisive end. 2022 will be even grander than 2021 since the first phase of the 2022 Road Map will introduce Smart LP Removal features.

This would set a condition and ratio based on which the LPs can withdraw funds without incurring any impermanent loss. To do that, the protocol will set removal targets in tune with the original deposit to eliminate any instances of an impermanent loss.

Furthermore, VVS Finance will also introduce xVVS tokens which will allow stakers to get a share of the platform trading fees. As yield-bearing governance tokens, xVVS holders will not only get better interest rates on token usage but also participate in the governance of the VVS ecosystem.

VVS Price Prediction for 2022

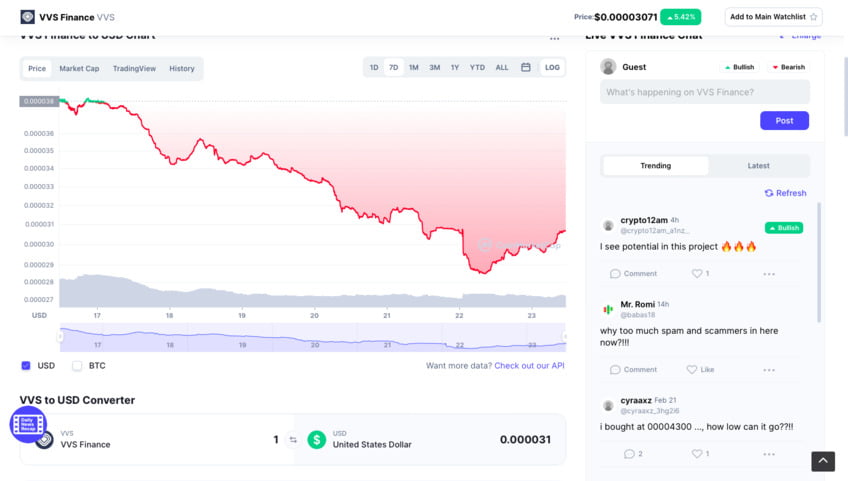

VVS token price has been falling consistently in the last seven days as evident from the chart. The greed index of the token has taken a hit with extreme fear prevailing in the market. All of these concerns make way for far worse days ahead where the token can slide as low as $ 0.000025.

With the current market sentiments showing a bearish signal for the token after recording consistent 20% gains over the past week, VVS could undoubtedly be a good token to buy in the future but current stats do not paint a rosy picture ahead. The crypto market as a whole is on a bearish trend, so it is only natural for VVS to be tanking as well.

How to Buy VVS Token?

You can purchase VVS tokens on 2 main exchanges that have decent volumes traded: Crypto.com and Bitget.

The post Why VVS Finance Is the Ultimate Solution to DeFi Slippage? appeared first on CryptoTicker.

Why VVS Finance Is the Ultimate Solution to DeFi Slippage?