The crypto market recovered quite fast after last week’s crypto crash. We did warn in this previous article about how cryptos might show weakness for a couple of days, but will recover soon afterwards just like what happened during the COVID-19 crash. Today, Ethereum price jumped 15% edging the psychological price of $3,000. Why is Ethereum up? Should you buy Ethereum today? Let’s tackle everything in this Ethereum price prediction article.

Why are Cryptos up?

-----Cryptonews AD----->>>

Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

A few days ago, the US and many EU countries agreed to ban Russian banks from the SWIFT system. This comes as one of the sanctions that were imposed on Russia for breaking into Ukrainian territories. What other alternatives are there to bypass those financial sanctions? Well, cryptocurrencies!

If Russia was to pay anyone without going through regulatory bodies, they can do so via cryptos easily. Iran is another sanctioned country that also used cryptocurrencies back when the US imposed sanctions when Trump was in office. Russia’s economy is more than 10x times bigger than Iran’s. When Russia starts turning to cryptos, it’ll create a significant volume, thus definitely moving crypto markets accordingly.

Ethereum Price Boom 15%, what happened?

Following the SWIFT ban, cryptocurrencies started to move higher. Ethereum, which lost significantly in value with the crypto crash, reached a very strong support area. In a previous article, we clearly highlighted why Ether was on the verge of an explosion from a fundamental perspective. Today, we see the “spot-on” results 😉

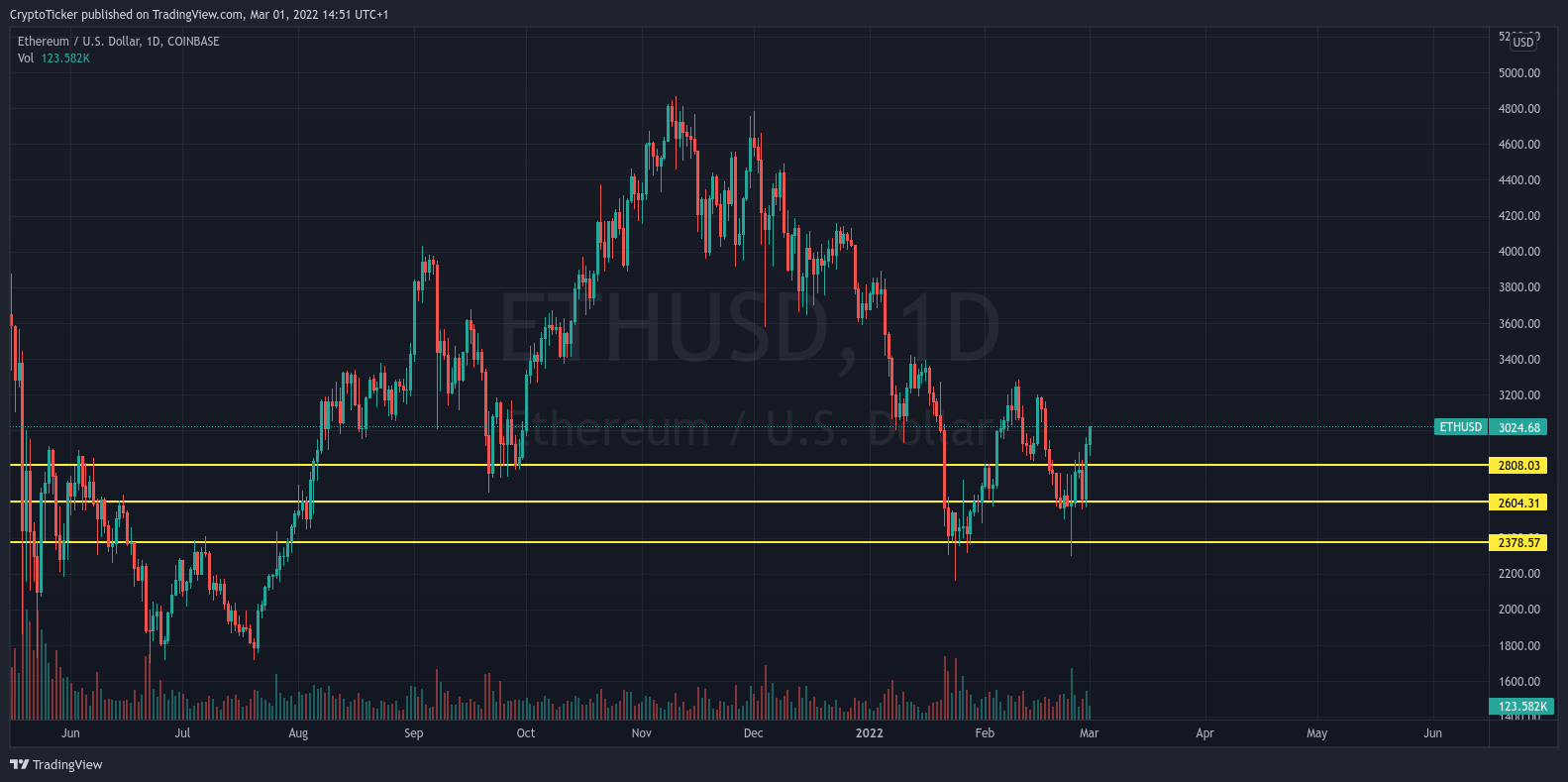

The price action of Ethereum follows the perfect “Day Trader” approach. Ether price was simply testing 3 key areas of support:

- $2,400

- $2,600

- $2,800

Traders who managed to catch those areas knew where to place their buy and sell trades. When prices reached $2,600 and the SWIFT ban happened, traders directly placed orders, speculating that cryptos value will increase. In turn, Ethereum which is the second-largest crypto by market cap followed.

Where will Ethereum price reach next?

Now that Ether price managed to reach $3,000 again, there are many important areas to look into. At a first glance, once might think the next areas are obvious. Not only should prices represent psychological prices, but they should also show a price action history around them. For Ethereum, those next targets are as follows:

- $3,200

- $3,400

- $3,600

If the crypto market continues to go higher, the above-mentioned areas would most probably be reached. That’s why day traders can decide to place take-profits around those areas. The $2,800 represented a good buy price. If prices reach those areas we can say a new uptrend is coming, pushing prices to the long-awaited price of $5,000.

Where to Buy Ethereum?

Ethereum is a popular blockchain and its native token Ether can be found on many exchanges. It is always a good idea to only deal with safe and secure exchanges. That’s why we at CryptoTicker suggest using the following:

Buy bitcoin and other cryptocurrencies on crypto exchanges Binance , Coinbase , Kraken and Bitfinex !

Don’t miss a thing, sign up for our newsletter