The number of people holding a Bitcoin address with holdings above 0 hit an all-time high in February 2022. These addresses have risen sharply since the beginning of the year. Could this insight be another crucial sign of a possible Bitcoin bull market? Well, let’s assess and look closer into what this indicates.

Bitcoin Address Holders Nearing All-Time High!

If we look at the supply side of the bitcoin asset, an important metric is the number of bitcoin addresses that have a bitcoin value greater than 0. It shows how many addresses in the network actually hold bitcoins. It provides information on how much the network is actually expanding by eliminating the addresses that do not hold bitcoins.

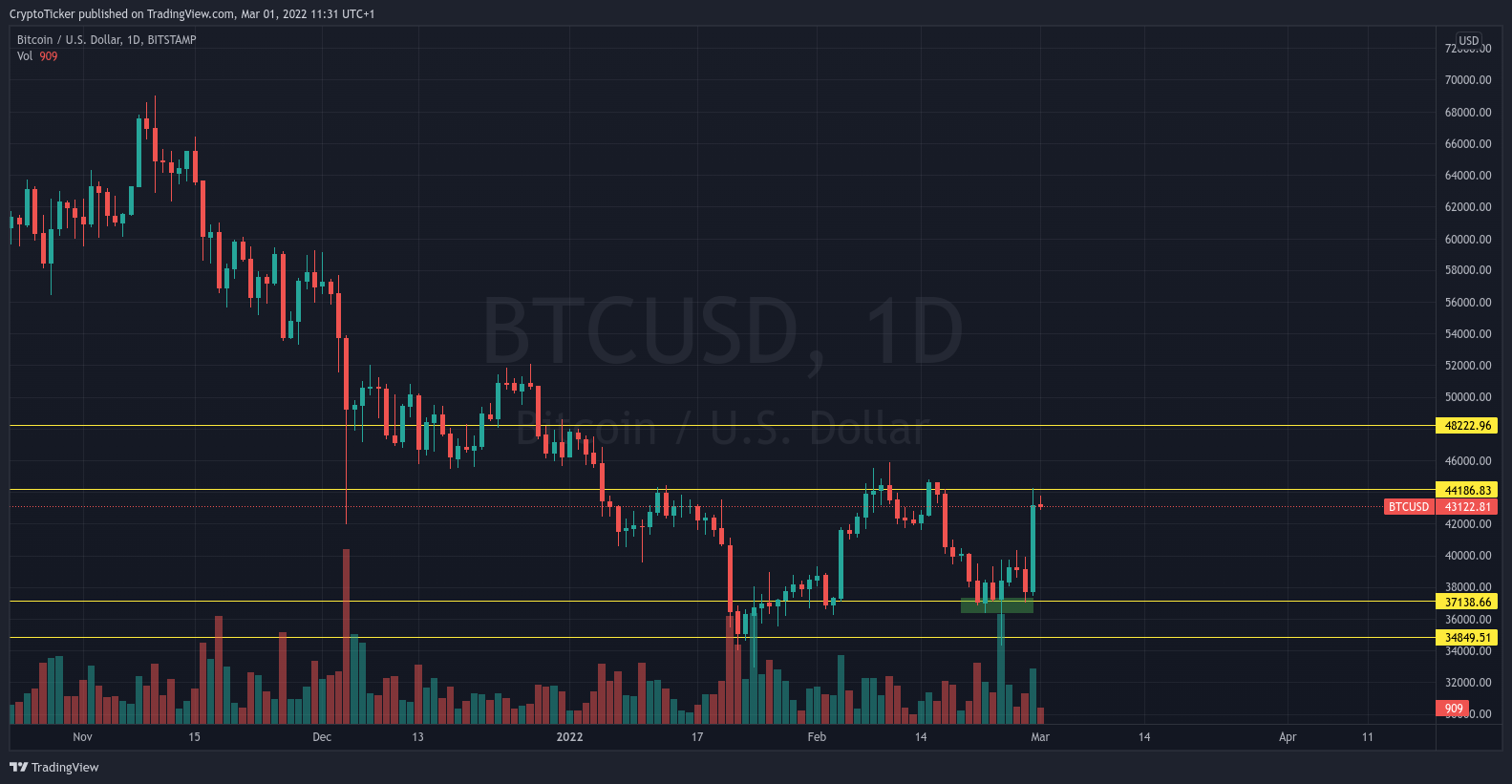

This value rose continuously in 2019 and 2020 but experienced a plateau in mid-2021. After a drop in the summer of 2021, we have seen a stronger increase in the number of Bitcoin addresses holding a value above 0 since the beginning of 2022. This sign hints at a potential return of a crypto bull market. When buyers enter the market, prices start to rise again.

Other Signs of a Bitcoin Bull Market

In addition to the increase in the number of Bitcoin addresses with a value above 0, there are other signs of a possible upcoming Bitcoin bull market:

- The hash rate in the Bitcoin network recently reached a new high again, although the difficulty of Bitcoin mining is constantly increasing.

- Big Bitcoin addresses are accumulating Bitcoin while small investors and speculators make the cryptocurrency so volatile at the moment by constant trading.

Now is a good time to invest cheaply in Bitcoin. Buy Bitcoin on Binance and Bitfinex crypto exchanges !

This good fundamental data for the Bitcoin network gives hope for a bull market. But of course, there are also warning voices. Because some factors could keep the Bitcoin bearish.

Why the Bitcoin Bull Market might Fail?

The fear of an imminent interest rate hike by the US Federal Reserve means that hopes of rising prices continue to decline. Because higher key interest rates mean less willingness to take risks, especially among institutional investors. The war in Ukraine, which could continue to weigh on the markets for some time to come, is also having a negative impact on the equity markets despite some signs of a recovery.

Furthermore, there is a risk of short positions being liquidated in the forex market, which could lead to mass selling and thus drop Bitcoin below $30,000. According to some analysts, the Bitcoin price could drop to $24,000. In this case, the Bitcoin bull market would have to wait a long time.

You can now buy Bitcoin cheaply on the crypto exchanges Coinbase and Kraken .