The decentralized finance (DeFi) industry has changed how people access financial services. Previously, interested parties went through intermediaries, such as banks, to get loans, borrow money and save. Yet, statistics show that many people don’t have access to traditional financial systems, making it difficult to benefit from all forms of financial aid. Thankfully, DeFi has helped crypto enthusiasts find a medium that provides essential services without time-wasting intermediaries. This is why founders have created projects like Yearn.Finance for the benefit of the community. In this article, we will be looking into the potential of $YFI in the market after the departure of Andre Cronje.

What Is Decentralized Finance (DeFi)?

Decentralized finance is one of the newest industries in the digital world. This concept envisions a world where everyone can access financial services without intermediaries. Traditionally, banks are the most popular medium for accessing loans or even saving money. Yet, this new technology has changed the status quo. Today, crypto enthusiasts can trade, get loans or save through the numerous protocols available in the space. Banks are notorious for their paperwork and protocols, making it challenging for many people to get needed services. While banks can take several weeks to grant you a loan after a series of interviews and paperwork, DeFi protocols may give you the loan immediately. However, it does not pay in fiat. Instead, it pays loan-takers in cryptocurrencies gotten from the pool available.

What Is Yearn.Finance?

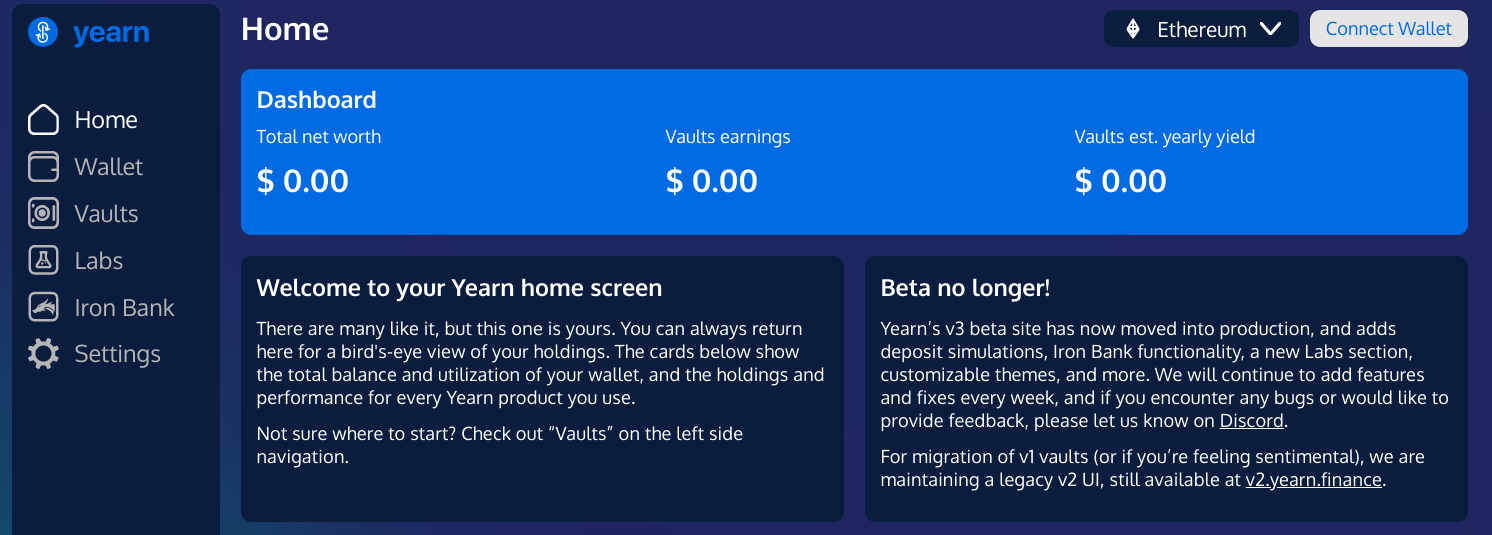

In 2020, Andre Cronje launched Yearn.Finance to provide financial services to users. This protocol helps users optimize their earnings by linking them to the highest yields on their digital assets. While DeFi created an avenue for enthusiasts to gain wealth, experts found many inconsistencies with the technology. This led to Andre Cronje’s drive to create a more suitable platform. Yield Finance made yield farming accessible to the public. It has two products helping users earn, namely, Earn and Vaults. Simply put, Yield Finance allows people access the most-attractive yields. This works by assisting them in lending their assets to profitable platforms like Compound. The product “Earn” helps users find the highest interest rate while lending. On the other hand, “vaults” expose the users to the best strategies to get the most profit.

Products Available On Yearn.Finance

Yearn Finance does all the heavy lifting for users. They don’t need to worry about intermediaries or find peers to complete the trade. Because Yearn.Finance is a DeFi protocol, users can access financial services. Here are some popular products available on the platform.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

Trading

You can choose to trade with this platform. Since trading involves buying or selling, you can find the lowest asset prices and sell them at a higher rate. With this, you have made some profits.

Earn

Earn is slightly more complicated, but users don’t have to worry about the process. The protocol goes ahead to look for the best protocol with the highest interest rate. Here, lenders can maximize their earning potential by benefitting from a high-interest rate.

APY

This is also called annual percentage yield. Before lending out your asset, it’s essential to know the estimated interest rate. This way, you know what to expect when lending. With this tool, users can plan and anticipate the proposed yield. However, many protocols warn that interest rates fluctuate. This is primarily due to cryptocurrency’s volatility.

Vaults

Vaults are an essential feature of Yearn Finance. It enables people to deposit their assets and enjoy interest from such deposits. This line of code helps users maximize their profit while reducing the risks associated with lending. Additionally, it helps reduce the high gas fee on Ethereum. The Ethereum blockchain is one of the most popular networks in the industry. Yet, this blockchain has scalability issues resulting from numerous projects on the network. However, thanks to the Vaults, only one person pays for gas.

What Is $YFI?

YFI is the project’s governance token. Yearn Finance is a unique project for many reasons. For one, the founder did not receive funding for it. Another reason for its uniqueness is that he did not keep some governance tokens for himself. This makes the project highly decentralized and community-driven. He gave out the tokens, allowing early liquidity providers to own a huge portion of the token. It’s important to mention that there are only 30,000 YFI in existence, and traders already own all these tokens. Before participating in decisions, holders need to stake the governance token. This promotes inclusivity and decentralization.

The protocol has a governance forum to build a community and promote governance. These forums are relatively popular in the DeFi world to enable holders to access information from the source. The Yearn Finance forum is one of the most active ones in the space. And through the platform, community members propose new projects and products for the protocol’s growth. A forum is also a place where the community makes crucial decisions. Similarly, members can share ideas and knowledge to help the DeFi platform grow. Before Andre Cronje announced the token’s launch, many people were skeptical about the protocol. When the community’s developers released the ERC-20 token, many people bought the asset to participate in governance. And because of the asset’s low supply, it became valuable within some months.

Andre Cronje Announces Departure From DeFi

Andre Cronje is one of the biggest DeFi influencers in the space. Many people even see him as the Satoshi Nakamoto for the decentralized finance industry. Yet, he might be leaving the growing industry and Yearn Finance for good. YFI also became one of the most popular tokens in the industry. The digital asset went from a dollar to over $40,000 within some months. It’s safe to mention that this is not the first time Andre Cronje would be announcing his departure from DeFi. He had departed from the industry twice in 2020 before returning to help with Yearn Finance.

The news certainly caused havoc in society, and many assets associated with the founder plummeted. Even YFI wasn’t left out as holders panicked, bringing the asset below the $20,000 range. Banteg, one of the platform’s developers, helped calm the panic selling. He assured that Yearn Finance had hundreds of contributors managing the project. The DeFi space may continue to experience price falls. Since everyone is panicking, people may sell their assets to prevent financial losses. While the decentralized finance industry faces some difficulties, the crypto market is also unstable. Since Bitcoin’s fall some weeks ago, many cryptocurrencies have not returned to their all-time highs. Some assets have lost 50%-70% of their value, causing uncertainty for long-term holders.

Will Andre Cronje’s Departure Affect $YFI?

Andre Cronje’s departure has already affected the project and every other DeFi project the founder has worked on. YFI’s value dropped when he announced his departure, as traders predicted. It’s safe to mention that the founder had left some months ago before returning to work on Yearn Finance and other projects. His departure may affect the token’s price for some months, but holders should expect normalcy after the news die down. Many projects have lost their founders, but they kept existing because of the community. Yearn.Finance’s community is powerful because of the governance token. The token gives every holder a voice to help the project’s growth. Additionally, Yearn Finance has a lot of investors and contributors. These people make up the community, helping the project thrive even after everything. YFI has gained some value since the announcement. This means that people may be returning to the community.

$YFI Price Prediction

It’s difficult to predict the asset’s price, especially since the market is very emotional at this point. Nobody wants to lose the money invested in the protocol. Yet, the coin remains unshaken at $18,440 at the time of writing. This may mean bullishness, and it may continue to grow, despite the founder’s absence. The DeFi industry is a new space with a lot of growth potential. And since the Yearn Finance community has a couple of incoming projects, this may help the sector gain some needed recognition.

If this happens, YFI should be around $30,000 before the end of 2022. On the flip side, if the industry fails to thrive or bring in new investors, many DeFi protocols may die. YFI should expect some significant price falls if this happens to the sector, taking it below $15,000. Still, the industry would likely become more attractive to investors thanks to the mouth-watering interest rates, and loan-takers will also enjoy loans without intermediaries.

Should You Buy $YFI?

Buying the YFI token now may be a good decision since it’s far from its all-time high. Holders may enjoy notable price movements in the future. However, you should always do your research before buying coins or tokens to determine if they will succeed. Also, the current situation makes it difficult to predict the market situation, but above all, applying great strategies should help you minimize losses while maximizing gains.

Conclusion

Yearn.Finance is one of the most significant projects in the digital asset space. However, investors are unsure of the protocol’s future, leading to YFI’s price drop. Still, the project has potential and would likely continue to be successful even after the founder’s exit.