The recent rise in the fortunes of cryptocurrencies in the last few years has been key to its massive adoption. Investors globally have flocked to digital assets, all in a bid to earn a significant return on investments. This surging demand has also seen the market grow astronomically as competition for space becomes stiffer. However, while one cannot deny that growth, volatility is a big concern for investors. Crypto assets’ lack of price stability at a given time continues to worry investors. Surprisingly, LINK- the native currency of the Chainlink network, appears to be defeating the status quo. The cryptocurrency’s fortune has started to rise. However, the question is, can Chainlink reach $100 mark in 2022?

What Is Chainlink?

Chainlink is a blockchain abstraction that supports the integration of universally connected smart contracts. It is also a decentralized network of nodes that provide data from off-blockchain sources to on-blockchain smart contracts via oracles. The network began operation in 2019 and continues to allow blockchains to interact with events securely, and external data feeds. Examples of such data feeds include stock prices, scores from sports events, etc.

It is a technology-driven network that securely empowers non-blockchain enterprises to connect with blockchain platforms. It functions as both a technology and cryptocurrency and functions. Enterprises that depend on Chainlink also have access to major blockchain networks like Ethereum, Solana, and Terra. The native and governance token of the network is LINK. Like every network token, it is also the fuel that powers the blockchain. It is also used as collateral within the network and to pay its native network operators.

How Does Chainlink Work?

Sergey Nazarov, Steve Elis, and Ari Juels are the network founders and submitted its whitepaper in 2017. Surprisingly, the blockchain didn’t begin operation until 2019. For the uninitiated, oracles are tools that connect blockchain to external systems. Oracles also enable smart contracts to execute solely depending on inputs and outputs from their blockchain. Traditionally, oracles are centralized and possess zero decentralized features. However, with Chainlink, oracles are decentralized, and data move from place to place via a hybrid smart contract.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

Its decentralized oracle network consists of a system of nodes that adhere to given protocols. Also, in the Chainlink network, node operators perform a certain task and have power over activities. They can set fees on the off-chain resources under their control. Alternatively, they must also stake, trade, or sell their LINK tokens for rewards. LINK tokens are also rewards to incentivize network operators to perform tasks pertinent to the chain’s growth. Due to the high functionality of the network, it has many use cases. Such use cases include the distribution of non-fungible tokens (NFTs), gamifying of personal savings, etc.

Features Of Chainlink

Like most networks in the crypto market, Chainlink has some features that help it thrive. Listed below are some of the unique features of Chainlink and why its services are in high demand;

- Decentralized Data Feed: The network is currently one of the few that can gather data from different sources. The data feed input into its system is collated and stored in a decentralized manner. These data are also a part of the blockchain’s hybrid smart contracts.

- Randomness: Software and applications that require randomness can utilize the technology of Chainlink. The blockchain network’s cryptographical secure randomness makes it suitable for applications requiring such services.

- Cross-blockchain interoperability: One of the unique features of Chainlink is its ability to connect blockchains. The connected blockchain platforms can exchange messages, tokens, and data.

- Supports Automation: Enterprises that love and apply automation to their task can utilize Chainlink. The smart contracts on the network can help these enterprises automate key functions and tasks.

Why Is Chainlink Unique?

Starting from aggregating and providing cryptocurrency price data to DeFi protocols, Chainlink has witnessed tremendous growth. The blockchain currently helps in integrating blockchain technology with many industries and business functions. The network remains one of the first to allow the integration of off-chain data into smart contracts. Its astounding growth has attracted numerous trusted data providers, including Brave New Coin, Alpha Vantage, and Huobi. In return for their investment, these data enterprises make money by selling the data access to Chainlink. Chainlink users earn rewards by becoming node operators who contribute immensely to the network’s growth. Chainlink currently utilizes many node operators who run critical data infrastructure. Another unique feature of the network is its decentralized Price Feed oracle networks live in production. Currently, this program helps big Defi names like Compound and Aave generate millions in revenue.

Chainlink Vs. Ethereum

There have been comparisons between Chainlink and Ethereum in the past, as it appears that the two networks have similarities. Chainlink, in its structure, appears to be a complement to Ethereum and other blockchain protocols. The protocol possesses immense abilities to fast-track communication between Ethereum and other blockchains. It is also worth noting that LINK is built on Ethereum and thus complies with its protocols. Also, while Chainlink currently operates on the proof-of-stake consensus mechanism, Ethereum is gradually transitioning into it. However, in terms of differences, one can use Ether to pay miners, facilitate smart contracts, and even for purchases. Unfortunately, one can only use LINK to pay node operators in the Chainlink blockchain.

What is LINK Token?

LINK is the governance and native token of the Chainlink network. It is also currently used to pay Chainlink node operators for their contribution to the network. The token is on Ethereum, following the ERC-20 standard for tokens. In the token’s Initial Coin Offering (ICO), Chainlink announced that its maximum supply wouldn’t exceed one billion tokens. 35% of this supply is for node operators, with almost 50% already in circulation. $LINK is presently trading at $17.86, seeing a small surge of around 3.51% in the last 24 hours. The token is currently available for purchase on Huobi Global, Kraken, Binance, etc.

How To Buy LINK Crypto

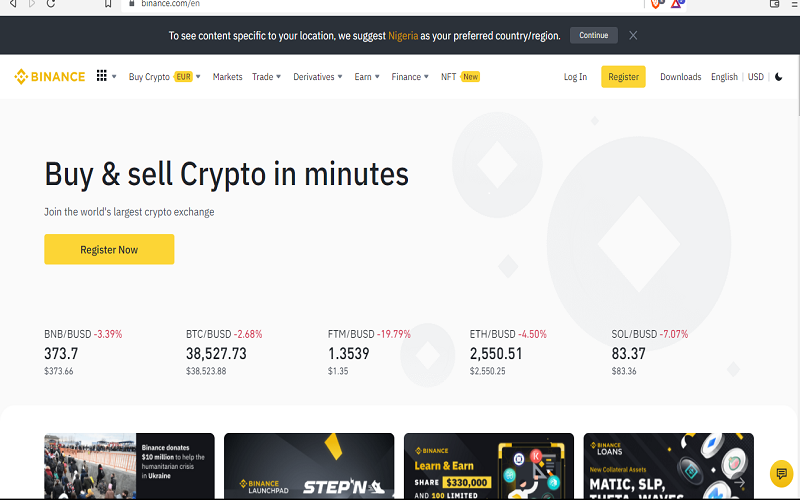

Like every highly-rated token, LINK is available on Binance. To buy the token, you will need to follow the steps below:

Step 1 – Log In/Sign Up

Signing up on Binance is the first for new users. This process is usually seamless and complete after supplying a few KYC details. You will also need to verify the information you provided. It is worth noting that only verified accounts, will have access to use the Binance trading platform. However, existing users will only need to log in to their accounts.

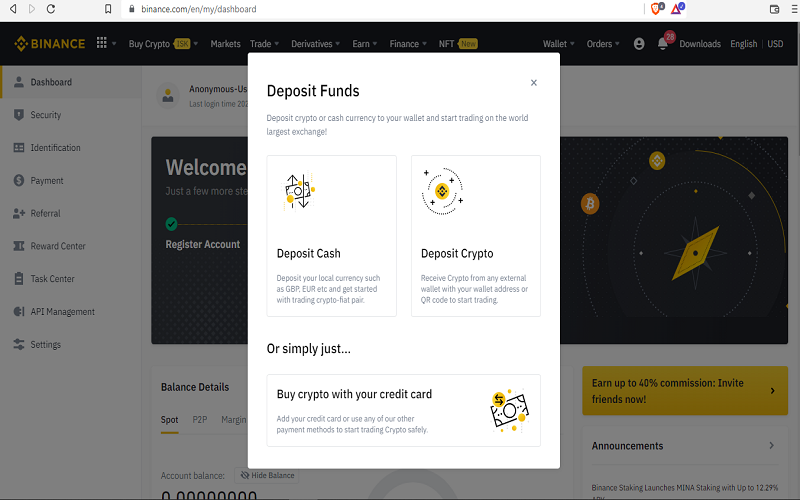

Step 2 – Deposit Funds

After creating an account and logging in, you must have enough funds or digital assets in your account. This will enable you to complete the purchase of LINK smoothly. Funding your Binance account is easy and could be done via a bank transfer or a debit/credit card.

Step 3 – Purchase $LINK

You will now use the funded account to purchase LINK. The quantity you bought will automatically reflect in your account and is immediately available for trading. Binance also allows users to hold, sell or spend LINK.

Can $LINK Reach $100 In 2022?

LINK is one of the highly-rated tokens of 2022, as crypto analysts and investors have set high ambitions for the token. The token is still far from its All-time-high (ATH) price of $52.88, attained in May 2021. However, according to its community, the $17 it currently trades at today’s prices might be the least it will be in the year. According to finance advisors- Business2Community, using Sharpe analysis, LINK is one of the best cryptos to invest in 2022. They do not see the cryptocurrency doing a 10X, but they believe it will make investors smile.

Unfortunately, some analysts do not echo the thoughts of many, as they feel LINK might take a negative turn. They believe that investors should sit on the fence concerning LINK, as the token might be a disaster. Other analysts also don’t see LINK going past $20 by the end of 2022. Lastly, WalletInvestor is unsure about LINK, despite predictions of a bull run looming. WalletInvestor predicts that the token may end well in 2022 but will never reach $100. Alternatively, they keep their options open, as they believe the token could also fall flat in 2022. However, only time will tell the future of LINK in 2022.

Conclusion

Chainlink is a decentralized network of nodes that provide data and information from off-blockchain sources to on-blockchain smart contracts via oracles. The blockchain currently helps in integrating blockchain technology with many industries and business functions. LINK is the governance and native token of the network, currently used to pay node operators for their contribution to the network. While the token is thriving, there are currently no indications that it will do a 10X or hit $100 in 2022.