While the overall growth of the cryptocurrency space has been remarkable, the Decentralized Finance (DeFi) space continues to thrive. The rising global adoption of the cryptocurrency space has also rubbed off on the growing and competitive DeFi space. The increasing number of financial platforms emanating from the space, providing multiple bespoke services, makes it very attractive. These DeFi platforms now offer users value-added services like yield farming, flash loans, etc. However, while it appears that Uniswap is a top dog in the space, other platforms are beginning to compete. One such platform is SushiSwap- a fork of Uniswap, currently attracting users.

What Is SushiSwap Crypto?

SushiSwap (SUSHI) is a fork of UniSwap, and a decentralized exchange (or DEX) built on the Ethereum network. It began operations in September 2020 and instantly became a hit, as its total value locked (TVL) hit $1 billion a few days after. SushiSwap attracted these funds by convincing its early liquidity providers to stake in UniSwap. After staking, they were to receive a high annual percentage yield incentivized in their native token. In two weeks, these stakes made their way back to Sushiswap, increasing the new protocol’s value. Its developers are two anonymous persons; Chef Nomi and OxMaki. SushiSwap allows users to trade cryptocurrencies without a central operator administrator.

It currently adopts the automated market-making (AMM) model for its decentralized exchange (DEX) protocol. This means that there is no order book on the protocol, as it facilitates cryptocurrency trading via smart contracts. Alternatively, the prices for the trading of these assets are determined via an algorithm. Being a fork of UniSwap, the project utilized the code of Uniswap and possessed similarities to that of the DeFi giants. Alternatively, some differences like native token and reward system exist between them. In Uniswap, liquidity providers stop earning rewards after they stop providing the liquidity. However, the case is not the same with SushiSwap, where liquidity providers continue to earn rewards. The native and governance token of the protocol is SUSHI.

How Does Sushiswap Work?

SushiSwap currently runs on Ethereum and incentivizes a network of users who want to trade crypto assets. This trading undergoes processing via smart contracts in the liquidity pool of the protocol. To become a liquidity provider on the platform, users must lock their assets inside the liquidity pool. This pool is open to all, and its reward system is proportionate to how much stake users have in it. This liquidity pool is synonymous with a market, where everyone can come to buy and sell tokens. A minimum requirement of two deposited tokens qualifies users to be a liquidity provider.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

Sushiswap is similar to other DEXs and allows users to swap ERC-20 tokens with compatible likes. Also, to use SushiSwap, users only need a crypto wallet. The process does not require any account opening and identity or KYC verification. Alternatively, SushiSwap users can earn passive income via various bespoke operational schemes on the protocol. A program like BentoBox allows users to earn income by Staking on SushiBars and lending to other users. BentoBox is a vault that allows users to take advantage of all available yield-earning tools on SushiSwap. xSushi is also another protocol initiative that allows users to earn a 0.05% reward fee for all trades from all liquidity pools.

What Is SushiSwap Used For?

As a user of SushiSwap, the protocol provides investors with a lot of access and opportunities to various bespoke services. Most of these services also come with a reward, much to the delight of users. Listed below are a few of the things you can do on SushiSwap as a user;

- Farm: Farming on SushiSwap requires users to deposit multiple cryptocurrencies into a liquidity pool and earn rewards on their stakes. Liquidity providers contribute to its pools by connecting their Ethereum wallet to the farming software. After that, they will also have to lock these assets into a smart contract.

- Borrow: SushiSwap users are eligible to borrow crypto assets. The process is easy, as the requirement is to provide collateral. In most cases, interest is very low and affordable for the borrower.

- Lend: Users keen on making interest can provide their crypto assets for others to borrow while earning passive income on the go.

- Swap: Crypto users also patronize SushiSwap to trade one cryptocurrency for another. Cryptocurrencies that users can swap have to ERC-20 compatible tokens. An example of this is swapping Ethereum for USDC.

- Stake: Enough cannot be said about staking your assets on SushiSwap, as it is one of the rewarding activities on the protocol. Depositing your SUSHI tokens in liquidity pools is a certain means of earning rewards for users.

What is SUSHI Crypto?

SUSHI is the native and governance token of SushiSwap and plays a key role in maintaining and operating the network. It is an ERC-20 token made available for liquidity providers via SushiSwap liquidity mining. The token holders can vote on proposals that might improve their ecosystem, as they have an equal right to governance. These holders are also eligible for a portion of the fees paid to the protocol and can stake them in the xSUSHI pool. It has a circulating supply of 127,244,443 SUSHI coins and a maximum supply of 250,000,000 SUSHI coins. Its supply depends on its block rate, as 100 token produces per block.

Due to the power the token bestows upon its holders, one can easily say the SUSHI community owns the protocol. The governance right also allows holders to submit a SushiSwap Improvement Proposal (SIP). This proposal can bring minor or major changes to the network, as other token holders will have to vote to affect it. One proposal that arose from the community vote is the Minimal Initial SushiSwap Offering (MISO). MISO is a product that allows anyone to launch their project on SushiSwap, even without being a token holder. SUSHI is available for purchase or pairing on many exchanges, including Binance, Kraken, and OKEx.

Why Investors Value SUSHI?

SUSHI is a very attractive token, as traders believe it can provide access to newer and less liquid cryptocurrencies. The majority of these cryptocurrencies are limited or unavailable on major centralized exchanges. Alternatively, investors want to add SUSHI to their wallets because they believe the token will continue to attract more users. Its value will increase as users desire a trading environment without needing to entrust funds to a third party. Investors will also want to keep SUSHI to deposit it into the xSUSHI pool to earn a portion of the network fees. Many investors will also fancy the token because they want to keep hold of Ethereum-based tokens. Last year, SushiSwap introduced an NFT platform to capitalize on the flourishing NFT market. Because of this, Investors will keep hold of SUSHI tokens, as they believe it will further improve its value.

How To Buy SUSHI

Since August 2020, SUSHI has been available for purchase or pairing on many exchanges, including Binance, OKEx, and Kraken. However, listed below are the steps to buying the token on Binance;

Step 1 – Sign Up

Signing up on Binance is the first for new users. This process is usually seamless and complete after supplying a few KYC details. You will also need to verify the information you provided. It is worth noting that only verified accounts will have access to the Binance trading platform. However, existing users will only need to log in to their accounts.

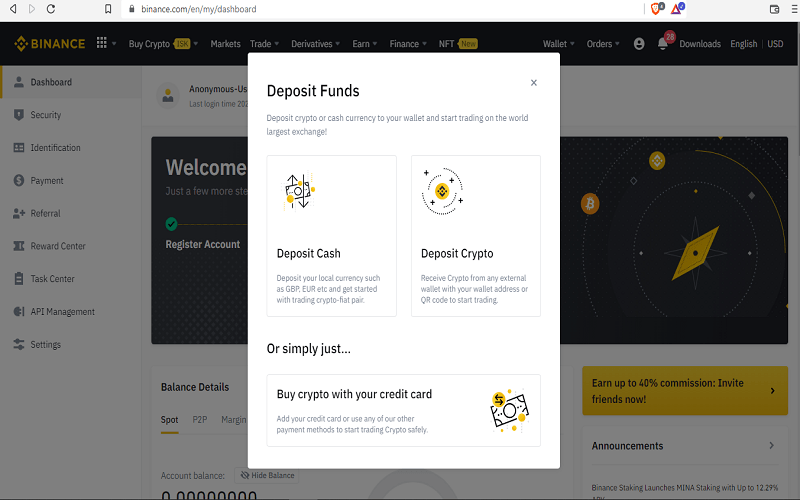

Step 2 – Deposit And Swap Fiat

After creating an account and logging in, you will need to swap either fiat or crypto using the Binance exchange view. Unlike other cryptocurrencies, you cannot use a debit/credit card to purchase SUSHI directly. You will need to pair it with cryptocurrencies like UNI and REP. You will need to purchase these cryptocurrencies to smoothen the process.

Step 3 – Purchase SUSHI

Once you have your crypto, you can use them to purchase SUSHI. Once you buy SUSHI, it will store in your Binance account. You will also gain access to all the powerful products offerings of Binance exchange.

Why Should I Invest In SUSHI?

SUSHI is a powerful token and, despite competition with Uniswap, remains very strong and attractive. The token has also grown in popularity recently, as many crypto investors now fancy it. It has forced itself into the list of top 150 tokens in the market space as it continues to push harder. 24hour trading volumes have also hit $400,936,104.07, as its market cap is now around $1,154,256,553.33. The metrics of the last seven days show a positive trend in its market price and capitalization. Its price is still very far from its all-time high (ATH) of $23.38 achieved last year’s march. However, with a gain of about 30% this week, it’s looking very decent.

Considering that SushiSwap is in a very competitive market, it is fair to say SUSHI’s ROI is fair enough. According to Longforecast.com, SUSHI will close the year around the $5.5 mark but may hit $6.6 early December. They also believe that until April 2024, the token might not hit double figures. The predictions of Coinpriceforecast are similar to Long forcast, as they believe SUSHI will end the year on $5.4. Alternatively, GovCapital sees SUSHI hitting $25.5 in the next 12months, a feat that will be remarkable if it happens. However, investors should remember that SUSHI is like all crypto and very risky to commit to. Investors shouldn’t spend more than they can afford to lose on it.

Conclusion

SushiSwap is a software running on Ethereum that seeks to incentivize users to operate a platform where users can buy and sell crypto assets. This trading executes via smart contracts in the liquidity pool of the protocol. To become a liquidity provider on SushiSwap, users must lock their assets inside the liquidity pool. The native and governance token of the protocol is SUSHI, which empowers users in its ecosystem. According to the worst prediction of SUSHI, the token is capable of generating a minimum of 21% ROI this year. However, while nothing is certain and crypto is risky, investors need to be very careful.