The hammer candlestick pattern is one of the most commonly used patterns in technical analysis. It is a reversal pattern that can provide valuable insights into market trends and potential price reversals. In this blog post, we will explore the hammer candlestick pattern in detail, including its characteristics, interpretation, and trading strategies.

Characteristics of the Hammer Candlestick Pattern

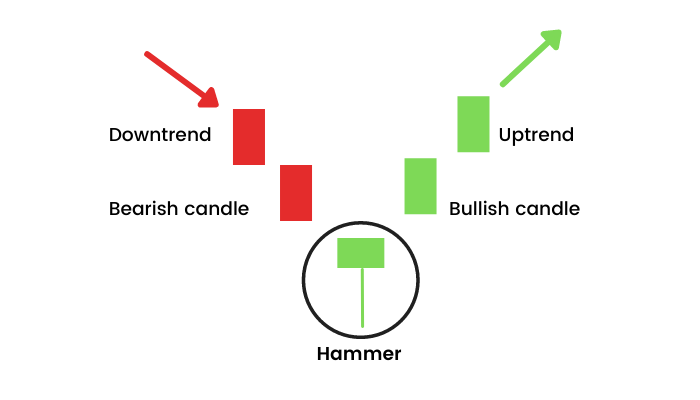

The hammer candlestick pattern is characterized by a small body at the top of the candlestick and a long lower shadow, which is at least twice the length of the body. The upper shadow, if present, is usually very short or nonexistent.

The pattern gets its name from its resemblance to a hammer, with the body representing the handle and the lower shadow representing the head. The hammer candlestick pattern can occur in both uptrends and downtrends, but it is more significant when it appears during a downtrend.

Interpretation of the Hammer Candlestick Pattern

When the hammer candlestick pattern appears during a downtrend, it indicates that selling pressure is weakening and buyers may be entering the market. The long lower shadow suggests that sellers pushed the price down significantly, but buyers were able to regain control and push the price back up.

-----Cryptonews AD----->>> <<<-----Cryptonews AD-----

This pattern is considered a bullish signal, as it suggests that the market is likely to reverse and start an upward trend. However, traders should wait for confirmation before entering a trade based on the hammer candlestick pattern. Confirmation can come in the form of a higher closing price on the following candle or a bullish candlestick pattern.

Trading Strategies Using the Hammer Candlestick Pattern

There are several trading strategies that can be used in conjunction with the hammer candlestick pattern. One common strategy is to enter a long position when the hammer candlestick pattern appears during a downtrend and is followed by a bullish candlestick pattern. Traders can place a stop-loss order below the low of the hammer candlestick to manage risk.

Another strategy is to wait for a confirmation candle to form after the hammer candlestick pattern. This confirmation candle should have a higher closing price and preferably a bullish body. Traders can enter a long position at the start of the following candle and place a stop-loss order below the low of the confirmation candle.

Conclusion

The hammer candlestick pattern is a powerful tool in technical analysis that can help traders identify potential reversals in the market. By understanding its characteristics and interpreting its implications, traders can use this pattern to improve their trading decisions. Remember to always wait for confirmation before entering a trade based on the hammer candlestick pattern and to use proper risk management techniques.

Understanding the Hammer Candlestick Pattern

https://bitcoinik.com/understanding-the-hammer-candlestick-pattern/feed/

https://bitcoinik.com/understanding-the-hammer-candlestick-pattern/feed/