DeFi emerged in 2020 with a vision to build solutions on top of the existing bottlenecks in the centralized financial system. In the last two years since its inception, by riding on some of the unparalleled use-cases like flash loans, liquidity mining, staking, yield farming, and compounding interest rates, the ecosystem exploded to $87 billion. Dexes emerged as the hotspots for witnessing maximum DeFi activities. Some of the users within the ecosystem who had earlier registered on Cex or Centralized exchanges moved their assets to Dex or decentralized exchanges for interacting with the DeFi protocols via wallets.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

However, one thing which was like an elephant in the room was inconvenience causing trouble for the users. For example, users had to buy cryptocurrencies on one exchange and transfer the same to another DEX for operation. In this way, the process not only killed a lot of time, wasted their resources and caused inconvenience to users; but also deprived them of a good earning opportunity. Hence, to quicken decision making, maximize ROIs and fix the fragmented operational process, crypto aggregators are an amenable choice moving forward in 2022.

What are Crypto Aggregators?

Crypto aggregators establish a system through the use of Dapps, smart-contract, oracles, and APIs, where data from different DEX and CEX are clubbed together on a single platform with price feeds integrated. In this way, the traders need not have to shuffle between exchanges to find out the best prices for an asset. On the contrary, they can simply log in to the crypto aggregator and trade from those platforms. In some rare instances, some of the crypto aggregators allow trading in cryptocurrencies pairs which are not supported even on some of the renowned exchanges operational across the world.

How Do Crypto Aggregators Work?

Crypto aggregators use price oracles that connect to multiple exchanges to provide the latest price feeds. You can take this as an example. Suppose, if you are visiting a holiday destination, there may be multiple hotels available for accommodation. If you have to go and check every hotel to find the best prices, it would take a lot of time and money. However, to ease the process, there’s a website that directly connects with all the hotels present in that holiday destination and tracks all their offers and prices to facilitate quick booking on the go. Using that website, the user can track even the smallest fluctuations in the prices that the hotels provide and grab the opportunity to book their services.

A crypto aggregator works much like the same where it tracks all crypto exchanges through price oracles and APIs to give the latest price for the crypto. Once the user/trader picks up a trade, the protocol runs the trade across all exchanges and swap protocols. Upon finding the best platform for the trade, the protocols execute the trade and the trader ends up making the maximum profit which would have been otherwise impossible without the crypto aggregator’s help.

Top 3 Crypto Aggretaors of 2022

Unizen

Unizen is a CeDeFi crypto aggregator that uses an AI-driven social trade sentiment engine. Along with this, the aggregator has a customized UI that shows a different interface for sophisticated crypto trade when compared to a newbie crypto trader. On Unizen, traders can do multi-asset yield staking and cross-chain trade using BSC or Binance Smart Chain. Unizen has the following trading pairs for traders/investors: ZCX/USDT, ZCX/ BTC, ZCX/ETH.

Dot.Finance

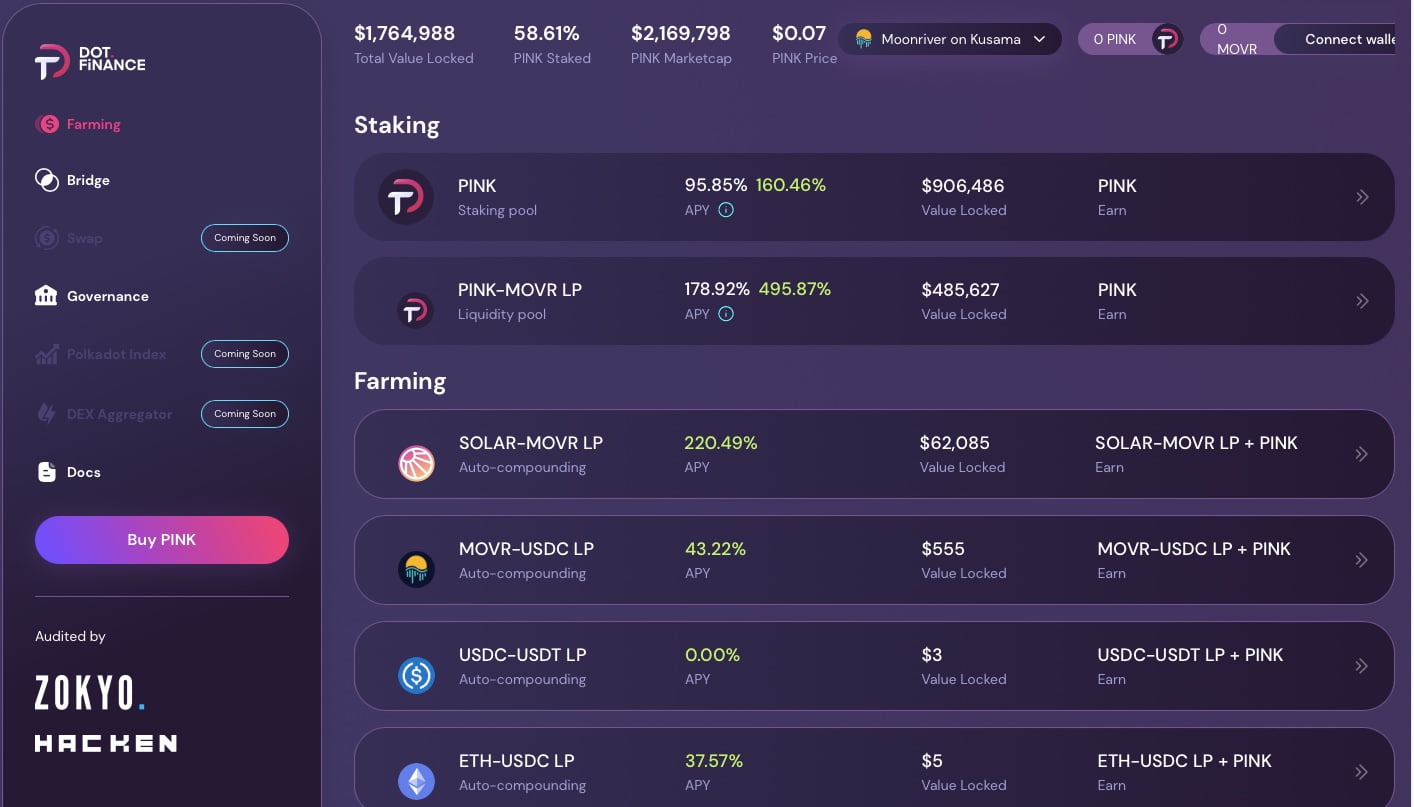

Dot.Finance is an emerging crypto aggregator on the Polkadot ecosystem which helps users to earn high yields on their idle cryptos through staking. To mitigate complexities associated with staking, yield farming and liquidity mining, the crypto aggregator introduces a comprehensive DeFi yield aggregator. All the user needs to do is just lock the tokens in the vault and let the protocol do the best with your asset.

No more fuss and no more banging the head to get the best returns, even a newbie can simply lock the token and let the protocol execute trades on their behalf. Along with this Dot.Finance also introduces auto compounding where traders/investors let the protocol automatically lock the staking rewards to convert the same to LP tokens. While doing the auto-compounding, the investors get entitled to the Pink tokens which give them the leverage of governance over the Dot.Finance ecosystem. The UI is very simple for the crypto users. All you need is just access Dot.finance by clicking the link.

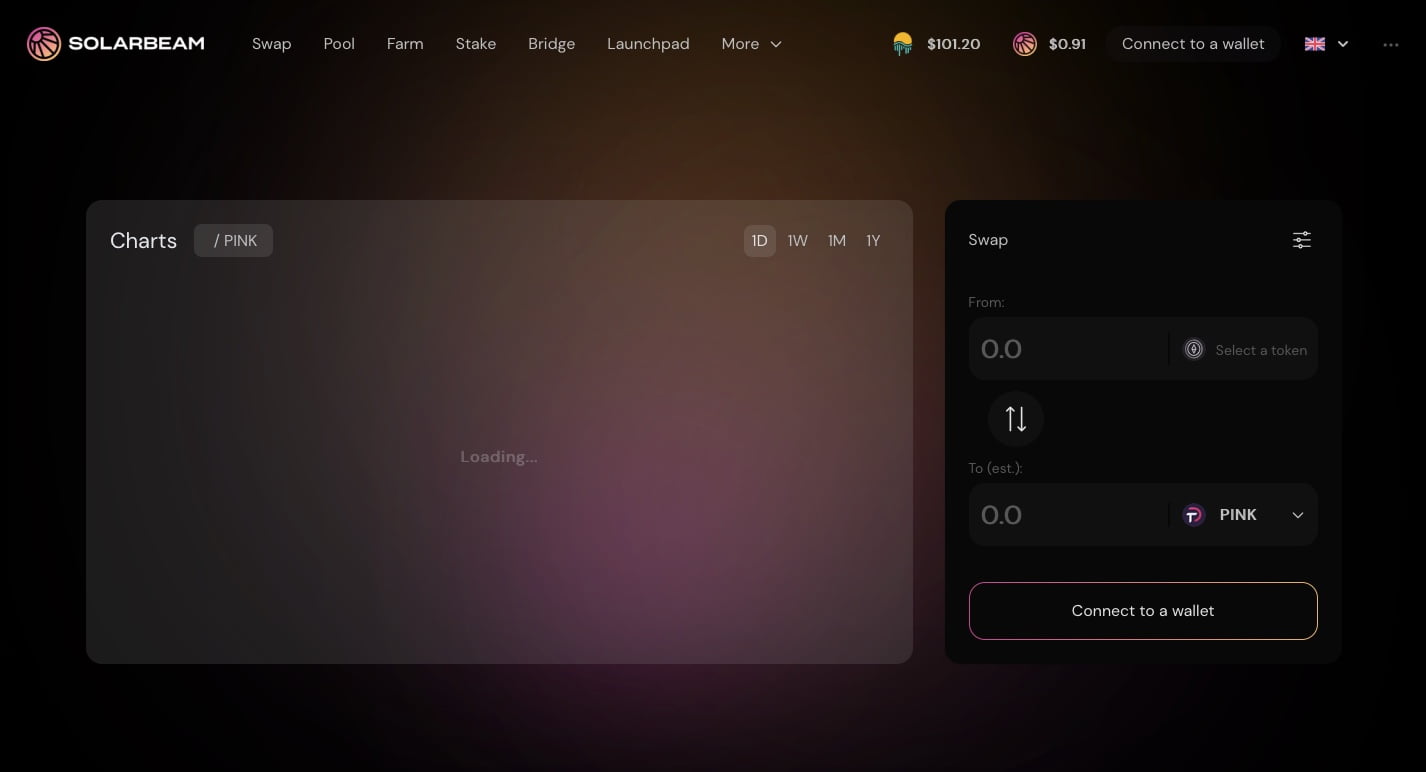

Once you do that, click on enter the app and hit the buy Pink button.

As you can see, there are multiple token pairs available like USDC, SUDT, ETH-USDC, SOLAR-MOVR LP, MOVR and USDC tokens that you can use to earn on the protocol. Moreover, a one click access as shown below allows you to quickly do activities like swap, enter pool, farm, stake and bridge by connecting your wallet.

Rocket Vault

The funding by Polygon Network has allowed a new and advanced crypto aggregator to flourish with the name Rocket Vault. As a non-custodial global liquidity aggregator, Rocket Vault introduces advanced strategies through the use of AI which uses data driven approach instead of sentiments to enter trades. In this way, it helps in maximizing the gains. On top of this, there’s also a provision on Rocket Vault where it identifies some of the key assets and spreads investments in between 500 to 800 assets through its underlying operational algorithm.

Thus helping automatically maximize profits since many cryptocurrencies are thoroughly verified from market volume, sentiments and fundamental standpoint . On Rocket Vault, traders can invest in more than 800 cryptocurrencies. Rocket’s easy to use UI also helps in entering farming and staking tokens in a flash.

For your information, while dealing in cryptocurrencies, one should always use hardware wallets since they give maximum protection and users have full right on their private keys. Make sure you store your cryptos in a hardware wallet.

The post Top 3 Crypto Aggregators To Pick in 2022 appeared first on CryptoTicker.

Top 3 Crypto Aggregators To Pick in 2022

Don’t miss a thing, sign up for our newsletter