One of the few facts in the financial market is that cryptocurrencies are the surest way to make massive profits. This is due to their rapid increase to provide investors with great profits over a while. However, there have been some limitations that digital assets have had to deal with. One such limitation is that some digital assets cannot be sent from their original blockchain to another blockchain. This meant that some tokens could not enjoy added benefits from blockchains other than the one they were created on. To tackle this, Wrapped tokens were developed and introduced to the market. In this article, we will be looking at what wrapped tokens can offer traders in the market in 2022.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

What are Wrapped tokens?

Wrapped tokens are digital assets tradable on a blockchain but have their values pegged to another digital asset. One good example is the Wrapped Bitcoin. Although the movement of Bitcoin controls its price, traders can trade it on the Ethereum blockchain. One noticeable feature of wrapped tokens is that they work as bridges from one blockchain to another. This means that users can trade their desired tokens out of their natural blockchain and still maintain the same price. They share some similarities with stablecoins, with the only difference being that they are pegged to the price of another crypto.

How Do Wrapped Tokens Work?

Wrapped tokens are minted on a new blockchain after the required amount of tokens to be created is sent into a custodian wallet. For example, if a trader were to convert Bitcoin to Wrapped Bitcoin, he will need to send the exact amount of Bitcoin to be converted into the custodian wallet. After that is done, the custodian locks the Bitcoin in a vault and, in turn, mints WBTC.

Users might ask how wrapped tokens are returned to their original state? It is via the same process that the custodians converted them in the first place. This means that the custodian needs to release the Bitcoin held in the vault for that to happen. This shows that every wrapped Bitcoin has an equivalent value of Bitcoin held in a vault. One thing that traders have argued is the limitation of trust. By this, custodians holding on to funds erases the trust and decentralization in the ecosystem.

Types of Wrapped Tokens

Since the idea’s inception behind wrapped tokens, some high values tokens have taken their place in the top pile. Below are examples of tokens that have been wrapped in the market;

Wrapped Bitcoin

The development of Wrapped Bitcoin was first brought to media attention in 2018 but was subsequently launched in January 2019. Wrapped Bitcoin is a tokenized digital asset available on the Ethereum blockchain. It uses the ERC-20, Ethereum’s unique standard for its token. This means that traders can use the asset across different parts of the blockchain. Ethereum provides users with basic services such as lending and other offerings in the DeFi markets.

Wrapped Bitcoin is also available for use in decentralized exchanges. As mentioned above, Wrapped Bitcoin maintains the same price as Bitcoin. This is monitored by custodians in charge of carrying out liquidity from Bitcoin to Ethereum. The Wrapped Bitcoin is trading on $42,372 on CoinMarketCap, seeing a jump of 0.28% in the last 24 hours. Its 24 hour trading volume is around $141,609,823 and its market cap is around $11,097,996,674.

Wrapped Ethereum

Ox Labs created and launched Wrapped Ethereum in 2017. While wBTC was created to be used on other blockchains, Wrapped Ethereum was made for in-house usage on the Ethereum network. One of the most noticeable features of wETH is that it converts Ethereum to ERC-20. This makes the time usable across most of the DeFi protocols on the network. This allows traders to exchange and use the token for services across all features offered by Ethereum. A trader who wishes to acquire Wrapped Ethereum can only trade Ethereum for the tokens via smart contracts. This is unlike Wrapped Bitcoin that are minted. Wrapped Ethereum is presently trading at $2,923 on CoinMarketCap, seeing a slight decline of 0.28%. In the last 24 hours, the token has had a trading volume of $1,466,547,145.

RenBTC

Like Wrapped Bitcoin, RenBTC is a token that mirrors the price movements of Bitcoin. It conforms with the ERC-20 token standard on Ethereum. This means that for the token to hold on to its value, traders can exchange it for one Bitcoin at any time. RenBTC is openly available for traders who can mint it on the Ren. The main usage of the Ren platform is to allow traders access to different tokens on the Ethereum blockchain. Presently, the platform supports Bitcoin, Zcash, and Bitcoin Cash. Like Wrapped Bitcoin, users send their tokens to RenVM, which locks it in a vault and mints the RenBTC tokens. RenBTC is currently trading at $42,085 on CoinMarketCap, trading up at 0.09% in the last 24 hours. It presently has a circulating supply of 16,276 tokens with a trading volume of $1,943,112 in the last 24 hours.

Wrapped BNB

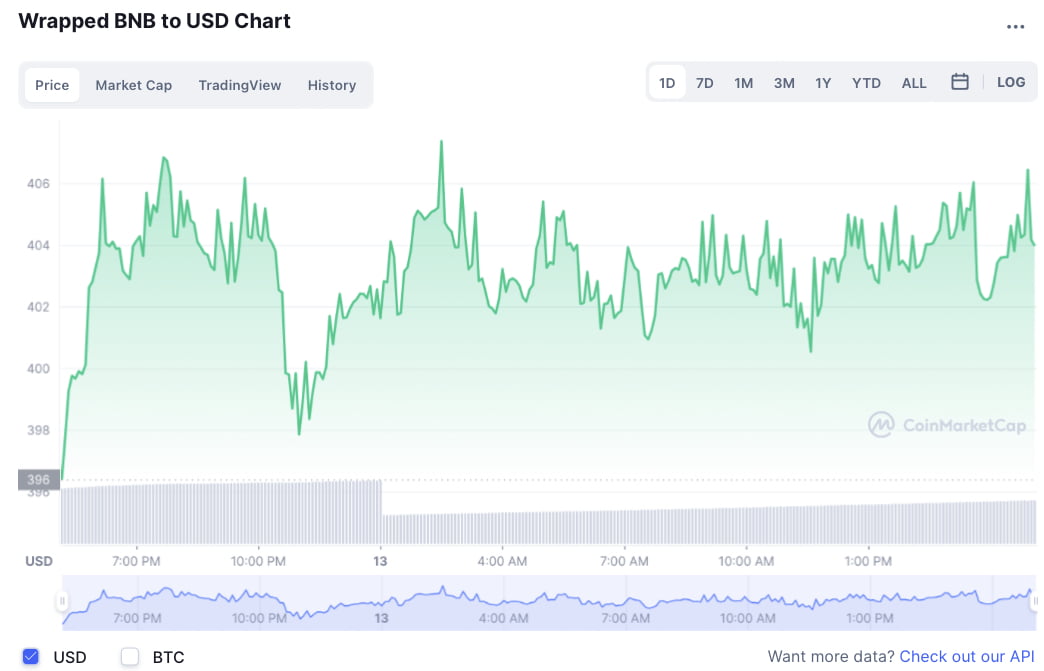

Wrapped BNB is the wrapped token version of Binance’s BNB token. Unlike the BNB, wBNB conforms to the BEP20 token standard. Traders use the token to carry out various services across the Binance Smart Chain. These services include exchange or use in the decentralized exchanges on the network. Although it uses the BEP20, nobody developed and currently owns it. Wrapped BNB currently trades at $404, seeing a gain of 1.01% in the last 24 hours. Its present market cap is around $2,220,456,561 with a trading volume of $461,778,216 in the last 24 hours.

Wrapped NXM

Wrapped NXM is a token that is easily transferable on the blockchain. One distinct aspect is that only members that have passed KYC can wrap and unwrap tokens. Users use the normal NXM tokens to attain membership of the NXM blockchain, a network that provides smart contract cover for purchase. Members of NXM can mutually govern the blockchain and assess risks and claims. While purchasing the cover, the network burns 90% of the funds and gives 10% to the member to use in submitting claims. Wrapped NXM is trading at $33.10 with a 24-hour price loss of 0.82%. It has a market cap of $55,505,848 and a trading volume of $2,369,998 in the last 24 hours.

Advantages of Wrapped Tokens

One unique feature of every blockchain in the crypto market is that they have a standard that their token was designed with. For example, Ethereum uses the ERC-20, and others use their unique standard. But despite this, usage across blockchains is not supported. This is something that traders can enjoy using wrapped tokens. With Ethereum providing a massive offering in the decentralized finance sector, Bitcoin users can tap into this using their wrapped Bitcoin on Ethereum.

Wrapped tokens also help centralized exchanges boost their liquidity, among other things. Users wrapping tokens that can be usable on other blockchains could provide massive liquidity to even decentralized exchanges. Another benefit is speed and transaction fees. Although Bitcoin is one of the most successful digital assets in the market, its fees and speed are sometimes headaches for users. However, traders solve these by wrapping the token with transactions faster and fees lesser.

Disadvantages of Wrapped Token

Holding of funds requires that the traders trust the custodian in charge of locking up the funds before minting. Presently, traders cannot do without using a custodian when wrapping their tokens. These wrapped tokens do not support transfer over different chains yet. However, developers are working to give traders more options while wrapping tokens. To this effect, there would be a trustless method of wrapping and unwrapping tokens in the coming years. Besides that, the cost of minting is another deal-breaker while wrapping tokens.

Are Wrapped tokens A Good Investment?

Major traders and analysts have started pointing to wrapped tokens as the future of the crypto sector. This is because the decentralized finance sector is gradually coming up, and they believe it is the sector’s future. To back this up, there was more than $800 million worth of Bitcoin wrapped in one year. A recent update by Arcane research showed that users locked about 189,000 Bitcoins on Ethereum. Presently, about 202,000 Bitcoin is locked on Ethereum. With the ability to move the assets across blockchains, exchanges in the crypto sector will have massive liquidity. Wrapped tokens are faster in transaction speed and charge lower than heavy tokens like Bitcoin. It also allows users to hold a tiny part of a full asset.

Conclusion

Wrapped tokens are ideally the solution to the issue of moving tokens across different blockchains. Besides the tokens listed above, other tokens can be wrapped using different methods. However, it is good to note that these wrapped tokens mirror the real asset price they are pegged after. This means that one should be careful about the wrapped assets they include in their portfolio. Traders need to carry out research into these tokens before they purchase them. They should also diversify their portfolio in case of times of volatility in the market.

The post What are Wrapped Tokens? Here’s Everything you Need to Know in 2022 appeared first on CryptoTicker.

What are Wrapped Tokens? Here’s Everything you Need to Know in 2022

Don’t miss a thing, sign up for our newsletter