The crypto market has continued to suffer massive declines, with Bitcoin leading the market at a slowed pace. Although there have been shouts of a potential bull run in the coming weeks, the market is still stuck in decline. Most top crypto has continued to lead the market decline, with the token posting series of losses across the past few weeks. However, other tokens have performed woefully in the past week. This article will look at the top 5 worst crypto performance in the past week.

Top 5 Worst Performing Crypto For The Week

Over the past week, the crypto market has endured the bears’ activities. Although most of the top tokens were affected, a number of them are gradually returning to the top. For instance, XRP is up by 5.95% in the last seven days while seeing a decline of 0.71% in the last 24 hours. Below are the top 5 worst performing crypto over the last seven days in the market.

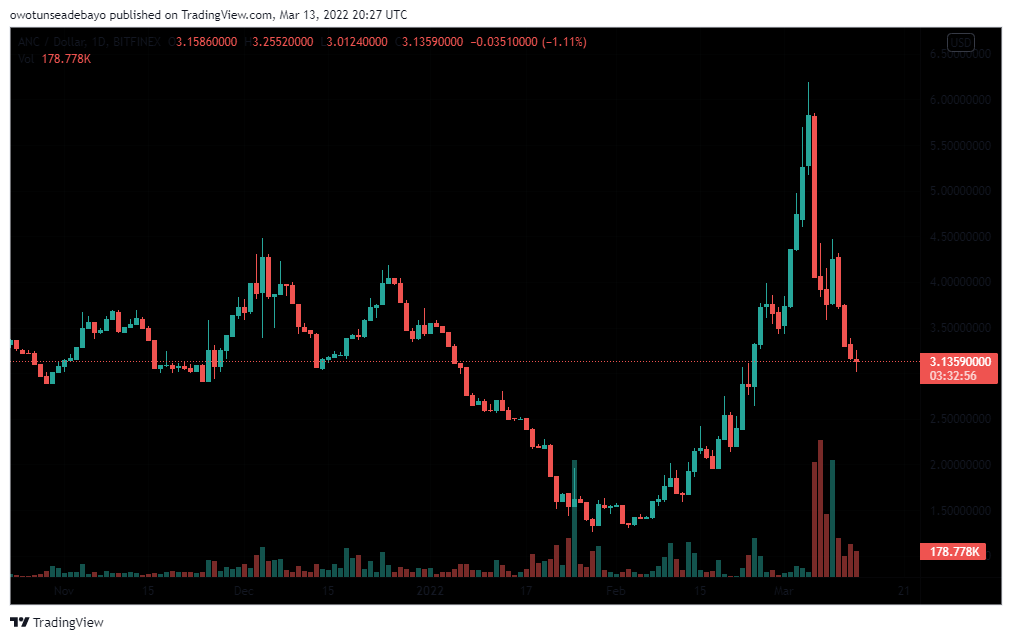

#1 Anchor Protocol (ANC)

Anchor protocol is a platform that offers traders lending and borrowing services across the crypto market. It allows traders to earn rewards of up to 19% on all stablecoin deposits on the platform. Lenders are the major beneficiaries as they can earn rewards on their stablecoins while eliminating high volatility. Traders can enjoy the benefits of holding LUNA tokens while borrowing them out to earn profits on the protocol. Regarding its performance. The native token of the protocol, ANC, is presently trading at $3.22, with a decline of 28.40% in the last seven days. In the last 24 hours, its trading volume has been around $90,723,992. The token’s market cap is $846,378,406, with about 263,056,492 ANC tokens presently in circulation.

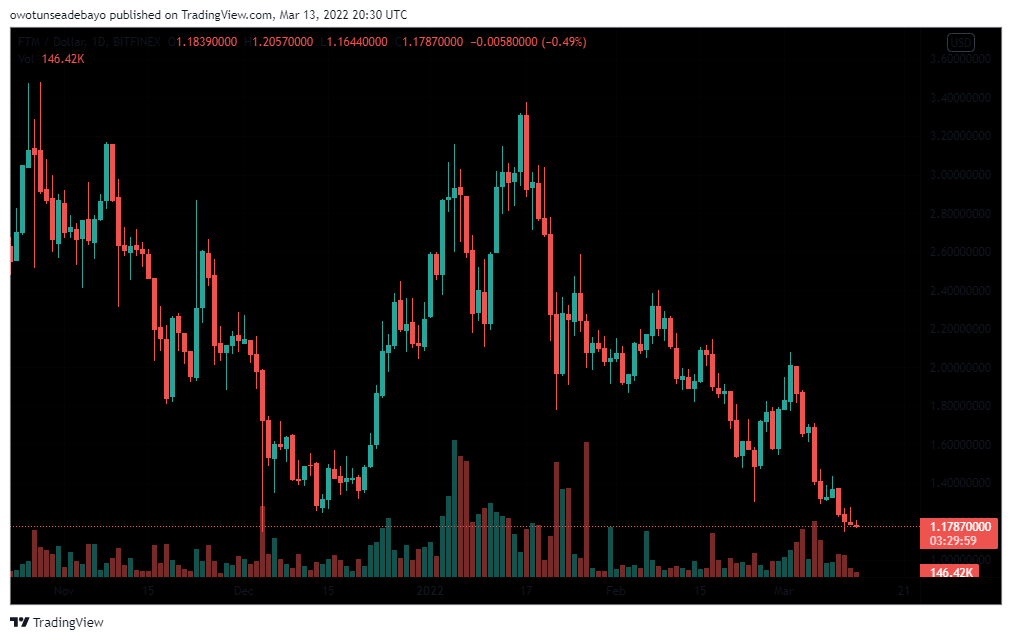

#2 Fantom (FTM)

Fantom is a platform that allows developers to carry out their activities using its special algorithm. Using the FTM native token eliminates basic issues that plague other platforms in this regard. One of the most significant features is the transaction speed which is the fastest across the sector. It acts as an alter ego for Ethereum, providing the basic activities that the network provides for traders and developers alike. Andre Cronje’s exit definitely made an impact on this crypto.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

FTM is presently reading around $1.18 in the last 24 hours, posting a price decline of 17.29% in the last seven days. It is a trading volume of 427,046,373 and a market cap of $3,003,035,348 in the last 24 hours. Presently, there are 3,175,000,000 FTM tokens in circulation.

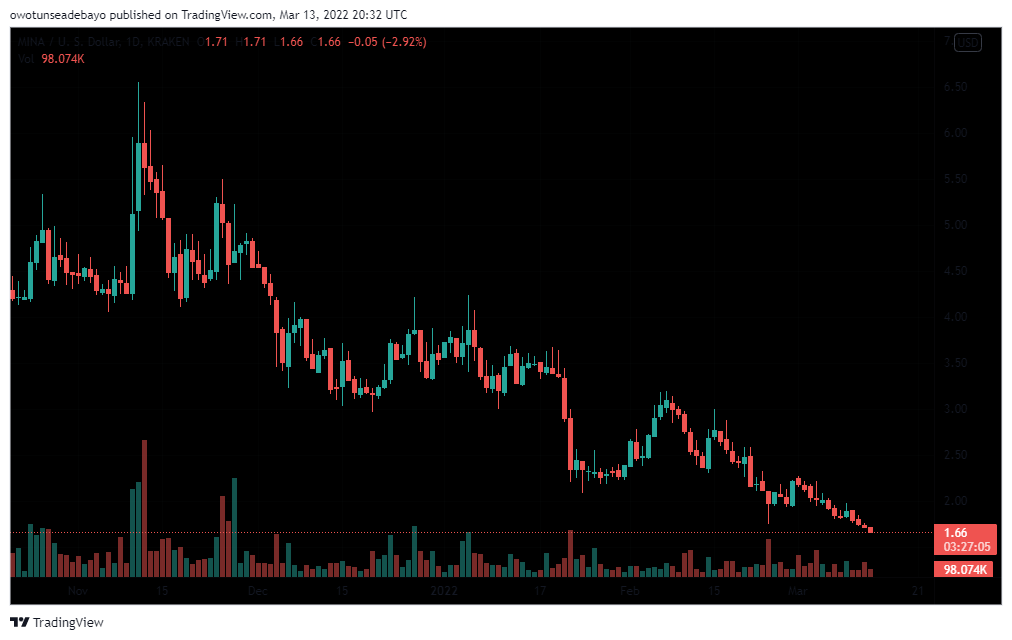

#3 Mina (MINA)

Mina protocol enables users to run dApps efficiently by curtailing the computation needs of the apps. The blockchain is the smallest blockchain in size, despite the growing number of users on the network. Also, it adds a mix of balance when it comes to security and decentralization. Before October 2020, the project was called the Coda protocol. Presently, the native token of the platform, MINA, is trading at $1.68, with a drop of 14.15% over the last seven days. The token boasts a market cap of $697,801,925 with a trading volume of $32,409,305 over the last 24 hours. Presently, there are about 414,440,458 MINA tokens in circulation.

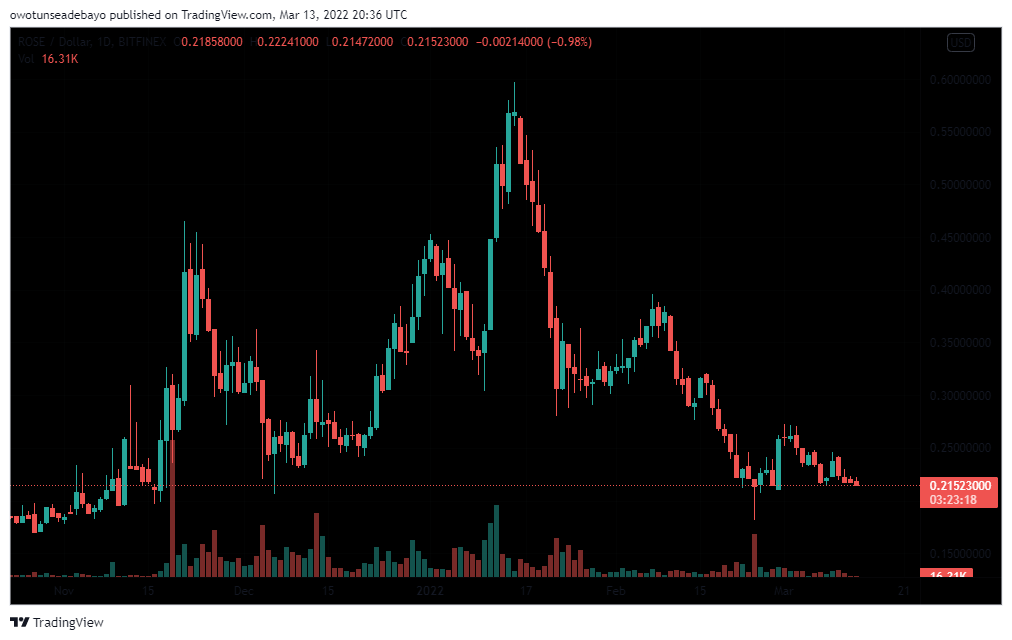

#4 Oasis Network (ROSE)

Oasis network is a scalable layer one blockchain that concentrates on high throughput and low transaction fees. Its secure architecture provides a haven for projects in the crypto sector, including NFTs, DeFi, Metaverse, Web3, and others. One of its core responsibilities is to help push Web3 forward through its early stages to full adoption across the sector. The native token of Oasis Network, ROSE, is presently trading around $0.217, seeing a decline of 9.70% in the last seven days. The token’s trading volume in the previous 24 hours is around $55,380,185, while its market cap in the same duration is approximately $759,519,126. ROSE presently has about 3,493,014,306 in circulation.

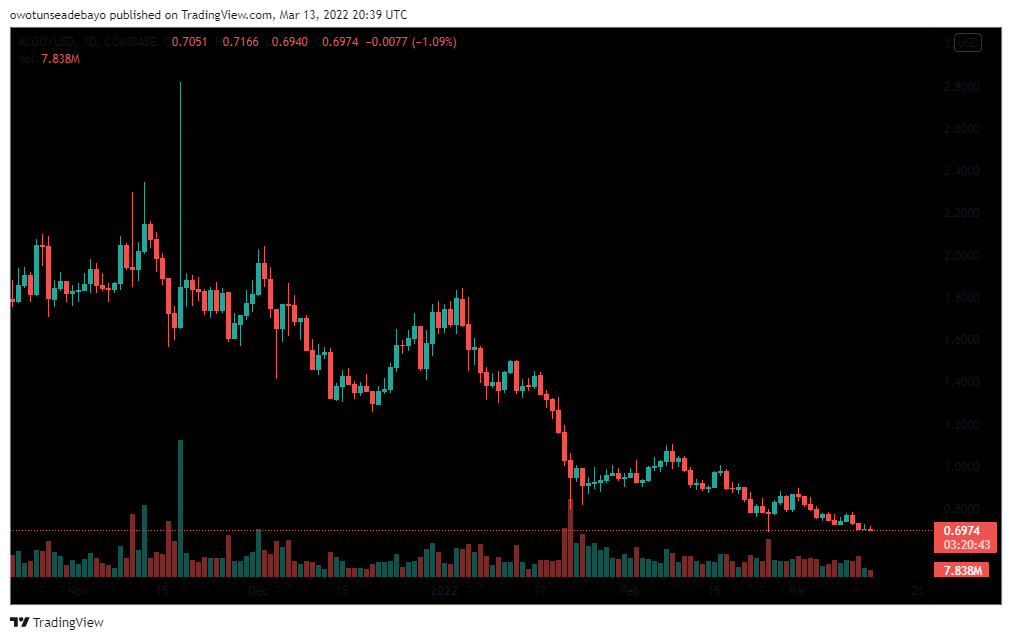

#5 Algorand (ALGO)

Algorand was designed to be a blockchain that would sustain itself and provide support to the majority of the applications in the decentralized finance sector. The network provides security, sustainability, and efficiency, mirroring the most stable apps outside the crypto sector. The network also supports computation that gives a basis for a new form of trust. Since December 2020, Algorand has handled nothing less than 1 million daily transactions. Presently, ALGO trades at $0.702, seeing a decline of 9.43% in the last seven days. It boasts a market cap of $4,654,253,991 and a trading volume of $70,860,306 over the last 24 hours. It currently has about 6,627,013,432 tokens in circulation.

Conclusion

With the bears roaming across the market in the last few days, it is paramount to note that the entire market is facing a general decline. However, traders can still make most of the bear market by purchasing promising tokens. It is also advisable to ensure that you are tactical with buying the dip during this period. This ensures that you do not continue to lose when the general market starts witnessing a bull run. Besides that, traders should look carefully into the tokens they wish to commit with and diversify their portfolios in case of a prolonged general market drop in price.