The war for one-upmanship has begun in the stable coin market. CurveDAO’s CRV token has apparently emerged as the mega weapon to win the APY war. So, every protocol wants CRV tokens since CRV token holders have been promised a steady return during this bear market.

Those who are holding CRV tokens have been duly getting so much leverage and every protocol wants CRV investors to lock CRV tokens in their own ecosystem. To do that, these protocols are offering unrealistic returns. In this race, Convex Finance has been leading the way with as high as 48% APY, which is 10 times more than what other DeFi lending and borrowing protocols are offering.

If you haven’t staked enough CRV, maybe this is the time to do so because returns as high as this would be once in a blue moon event. But before we go ahead and buy CRV tokens, it is necessary to understand the project. We will help you in this regard.

What is Curve DAO or CRV Token?

CRV Token or Curve DAO Token is a governance token built on top of the Ethereum chain that powers Curve Finance, a DEX, and AMM protocol. Using the Curve DAO DEX, anyone can quickly swap between ERC-20 tokens and avoid impermanent loss. Due to its ability to outdo the impermanent loss that most liquidity providers face while depositing their tokens in specific liquidity pools, Curve DEX is one of the most popular places for swapping and locking crypto assets.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

What is Impermanent Loss?

Impermanent loss is the change in the value of the asset from the time of depositing to the time of cashing out or withdrawing. To understand this, let’s take the example of Alice, she deposits 1 ETH and 100 DAI to ETH/DAI liquidity pool. As per this equation, the dollar value of Alice is 200. This means for every ETH, there has to be 200 DAI. Apart from Alice’s contribution, there are 10 ETH and 1000 DAI. The pool total liquidity is 10000.

If the price of ETH increases to 400 DAI for every ETH. Now, Alice wants to withdraw her ETH, but since she holds 10% of the pool. She can just withdraw 0.5 ETH. But that would still be profitable since that would amount to $400. However, had she stuck with the pool, she would have made $500; which is $400 for 1 ETH and the remaining 100 DAI she had. That’s how impermanent loss happens.

Where To Buy CRV Token?

There are many exchanges that offer Curve DAO tokens. However, it is very important to pick a reputable exchange that has strong security measures, good liquidity, and low fees. Here’s a list of recommended exchanges:

How To Buy CRV Token?

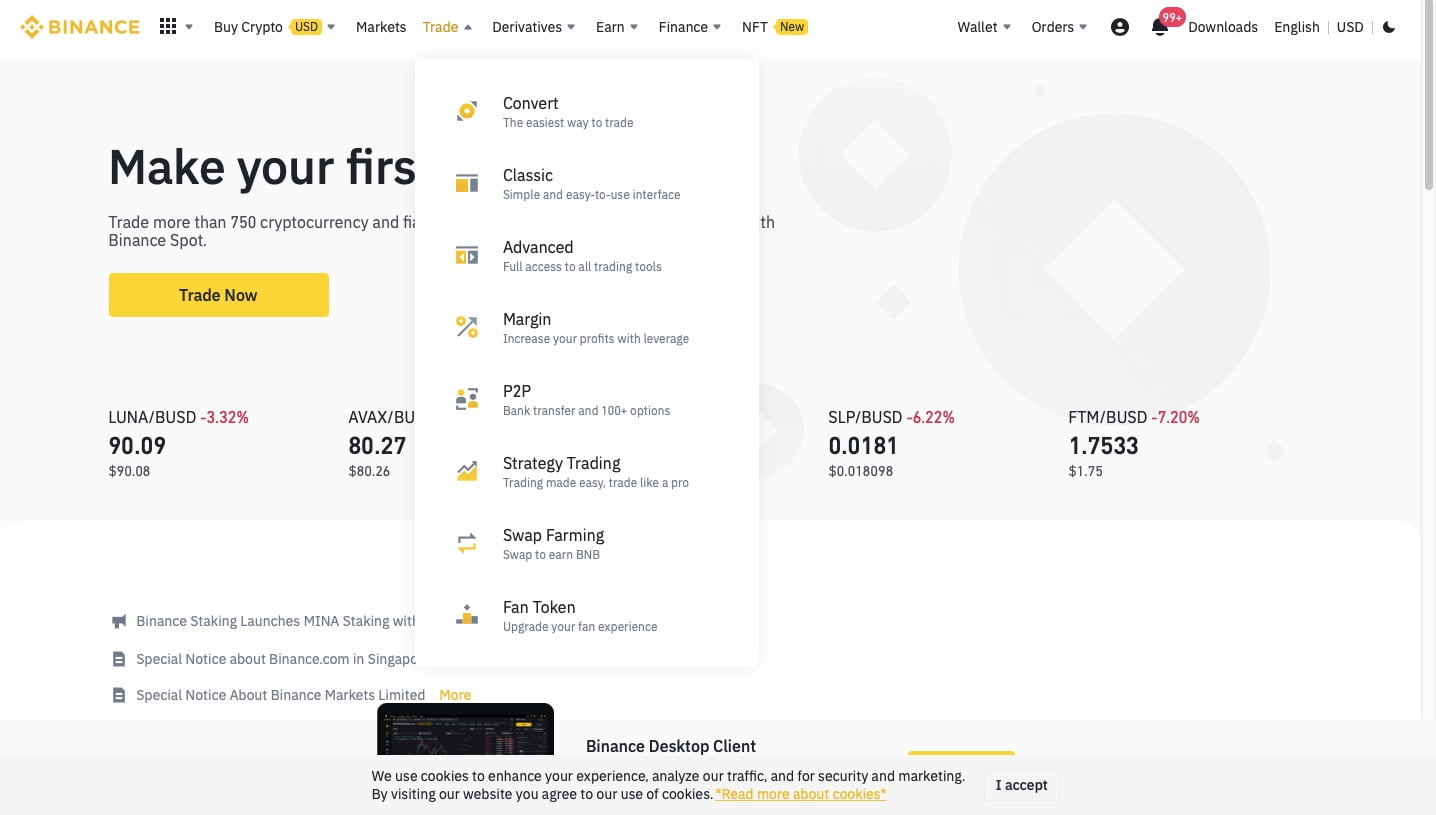

There are multiple exchanges where you can buy CRV, but we are showing how to buy it on the Binance exchange. Assuming you already have USDT, we will show you how to swap USDT for CRV.

Step 1

After you have logged into Binance.com, go to trade.

Step 2

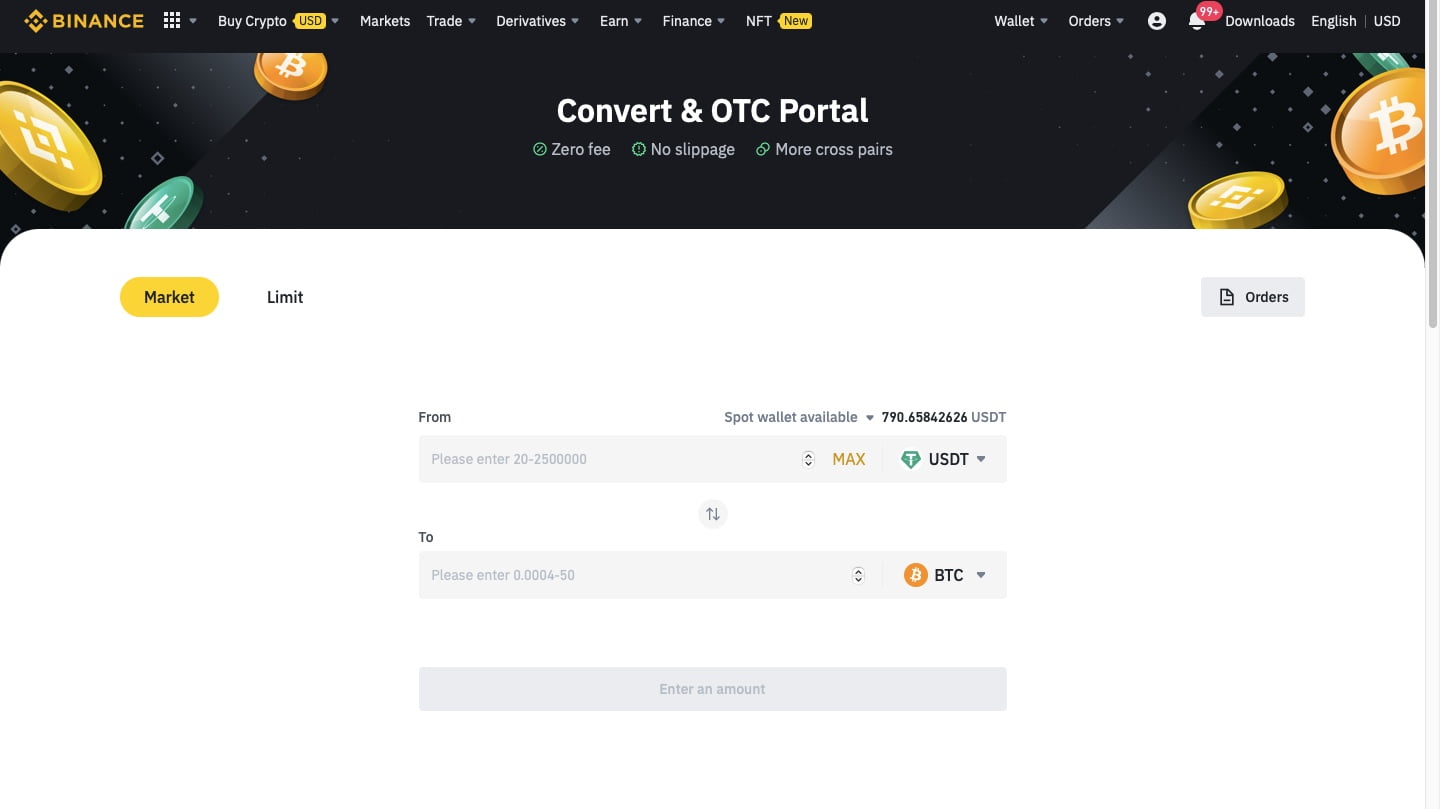

Click on convert, once you do, a screen like the one given below will appear.

Step 3

You need to switch BTC to CRV. Once you do that, it will show the amount of CRV you will receive. Click on submit to complete the transaction. In this way, you can easily buy CRV tokens from Binance.com.

You can store your CRV in a hardware wallet or the exchange wallet as per your preference.