The Bitcoin price has shown an increasing tendency to correlate itself with the stock markets in recent weeks and months. While a few years ago Bitcoin prices were still moving very freely from the international financial markets, the dependency on the classic financial world has increased. Let’s tackle the reasons that contribute to why the Bitcoin price is increasingly correlated with the stock market.

What Happened to Bitcoin in the recent years?

The development of the Bitcoin price was always viewed very critically by outsiders. The mainstream mostly hears about Bitcoin when it becomes highly bullish or even hits a new all-time high price. Most of the time, this is followed by heavy losses, which leads to negative news about cryptocurrencies in general.

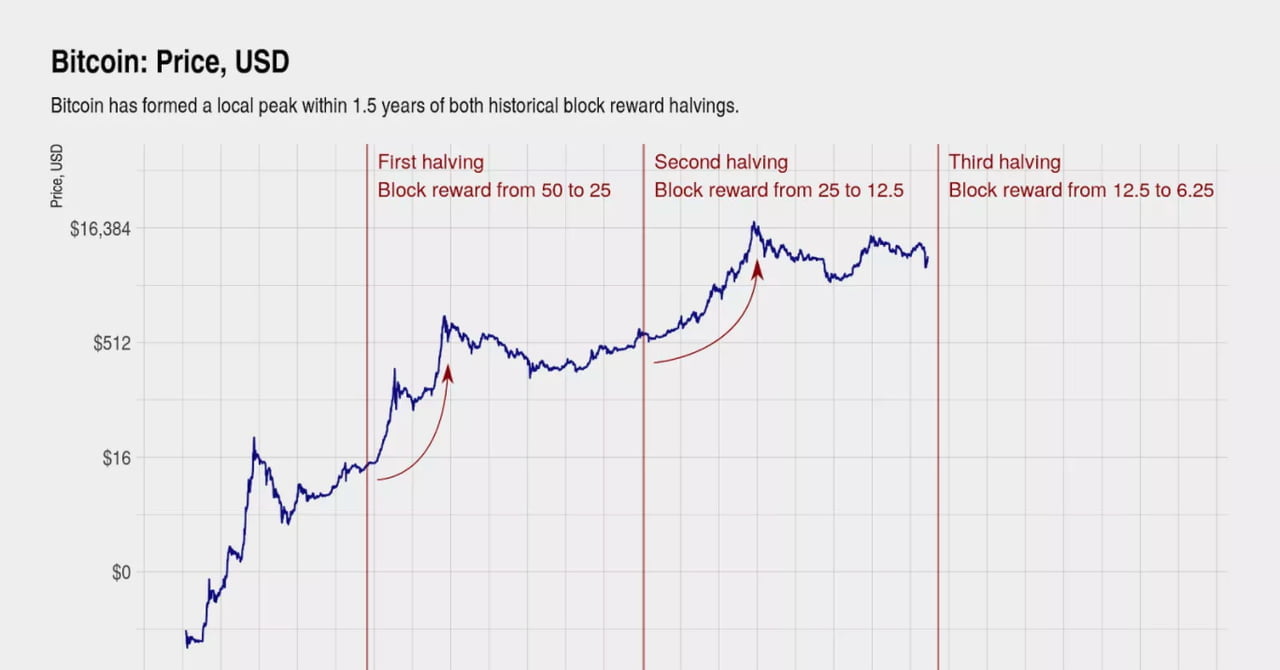

According to “Normies“, Bitcoin prices are extremely unpredictable and risky. There is a risk of a massive price loss at any time. The development of the price in recent years has been easy to predict, at least in the medium to long term. We saw a 4-year cycle that featured a bear market and a bull market. The cycle ended with a massive parabolic advance in Bitcoin prices. This was the case at the end of 2013 and 2017 respectively.

Furthermore, we saw the price development of Altcoins with a slight lag compared to Bitcoin prices. Bitcoin peaked in December 2017, altcoins a month later in January 2018. The bull markets were followed by a sharp drop (about 80%) and a transition to a bear market.

-----Cryptonews AD----->>>Sign up for a Bybit account and claim exclusive rewards from the Bybit referral program! Plus, claim up to 6,045 USDT bonus at . https://www.bybit.com/invite?ref=PAR8BE

<<<-----Cryptonews AD-----

The Bitcoin cycles are based on the Bitcoin Halving Events. In a halving, the mining rewards are halved. After 1.5 years after the halving, Bitcoin prices rose massively.

Did the Bitcoin Price Behavior CHANGE recently?

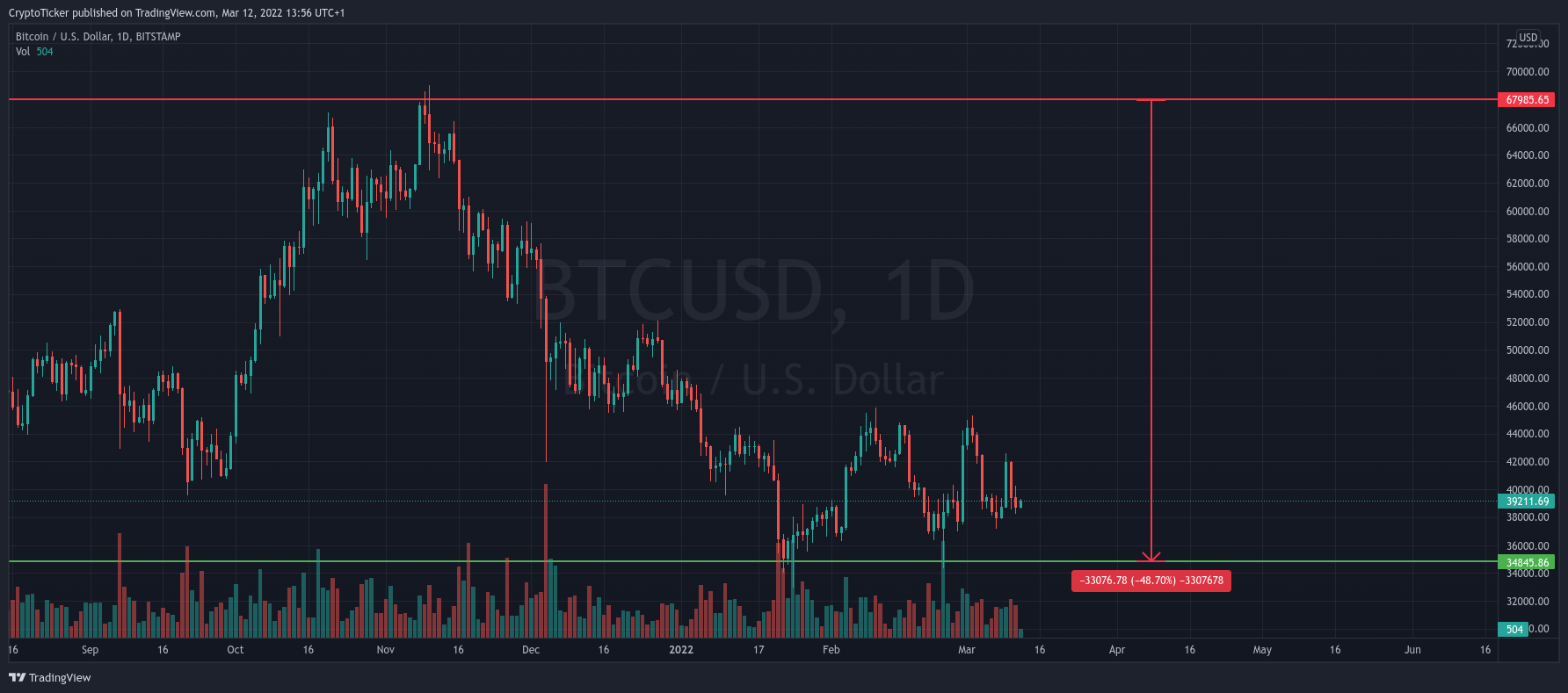

Based on the cycles presented, many analysts also expected that the Bitcoin price would rise again massively at the turn of the year 2021/2022. Many forecasts spoke for a six-digit price. So far, however, this has not happened in 2022. Instead, we saw a sharp correction of over 45% over the last 3 months.

This raises the theory that the Bitcoin cycle has now lengthened significantly. We already saw a slightly longer cycle in 2017 compared to 2013. But another observation could also be made. The Bitcoin price follows the developments on the international stock markets more and more.

Buy the Bitcoin in 2022 easily on Binance and Bitfinex !

Why is Bitcoin Correlating more with the Stock Market?

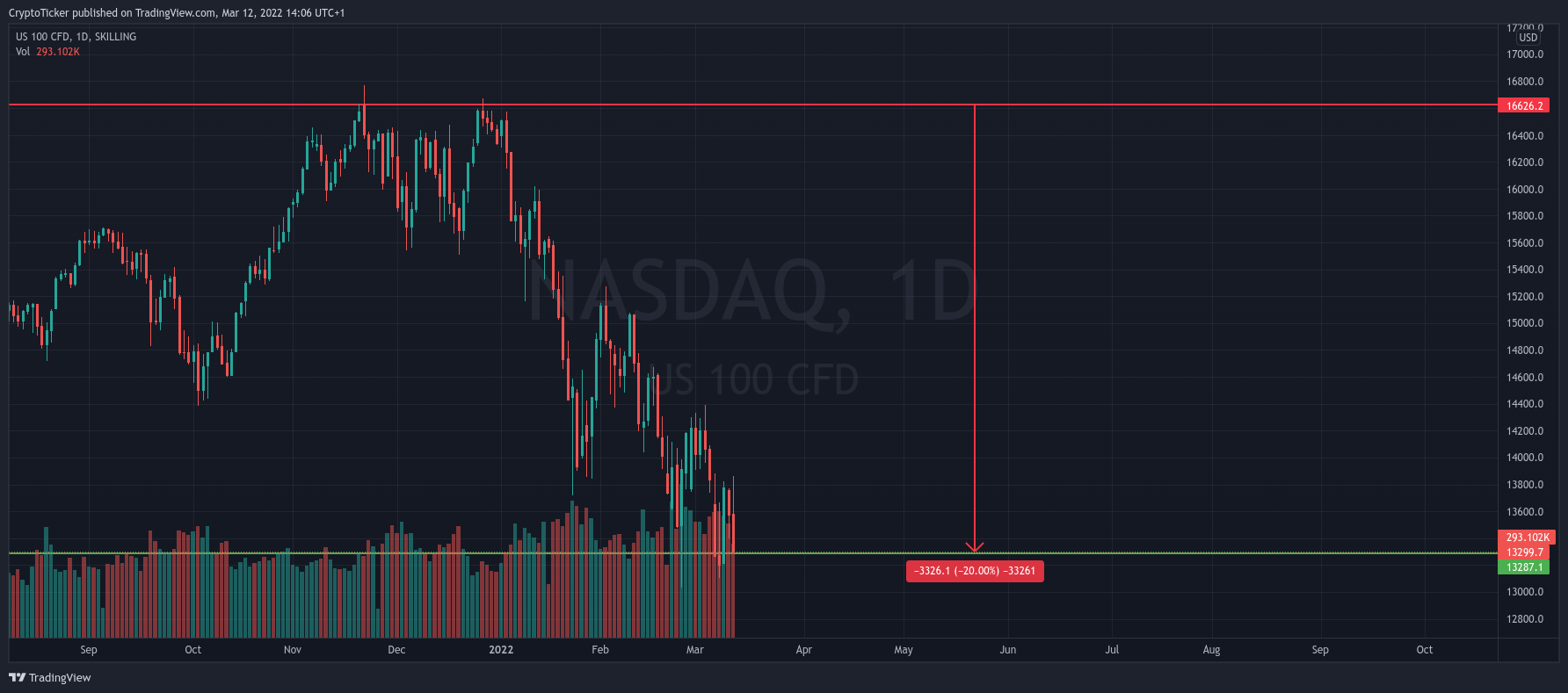

The trends have been confirmed in recent weeks and months: the Bitcoin price is heavily dependent on developments on the stock market. In particular, the development of tech stocks in the USA, represented by the Nasdaq Composite Index, has recently been almost parallel to the development of the Bitcoin price.

Furthermore, we see a similar reactivity of bitcoin to external, especially negative influences as with stocks. Recently, the rumors about rapid interest rate increases by the central banks and the conflict in Ukraine have rather damaged the Bitcoin price.

There are several reasons for the increasing dependency:

- Institutional investors have taken over the crypto market, most notably Bitcoin, in recent years. Your willingness to invest depends heavily on financial developments.

- Bitcoin has been getting more and more representation on the stock market in recent months . The first Bitcoin ETFs were approved in the fourth quarter of 2021.

- Increasing regulations in various countries are making Bitcoin more and more a classic financial product.

Will the Bitcoin Stock Market Correlation continue in the Future?

We currently need to ask ourselves whether Bitcoin is now becoming a common asset on the financial market or not yet. So does the dependency on the movements on the stock markets remain or can the Bitcoin price decouple itself from these developments?

The times of the wild west seem to be over in the crypto market. New regulations in particular are increasingly bringing Bitcoin and other cryptocurrencies to a point where they resemble normal financial products. However, growth markets such as DeFi and NFTs as well as the mass adoption of bitcoin could again ensure that cryptocurrencies will achieve significantly higher returns than other financial products in future bull markets.

You can buy Bitcoin in 2022 on crypto exchanges like Coinbase and Kraken .